Is National Debt Relief a Scam?

Laura Martisiute

Reading time: 5 minutes

Table of Contents

If you’re thinking of enrolling into National Debt Relief, you need to know: Is National Debt Relief a scam?

Below, we explain whether National Debt Relief is a scam and discuss some steps you can take to improve your safety with this company.

What Is National Debt Relief?

National Debt Relief is a debt settlement company that negotiates with creditors on behalf of consumers to reduce the total amount of unsecured debt they owe. It was founded in 2009.

After enrolling in the National Debt Relief program, an FDIC-insured escrow account will be established for you. Instead of paying creditors directly, you make monthly deposits into this account.

As the escrow account balance grows, National Debt Relief negotiates with each creditor to settle the debt for less than the owed amount. According to National Debt Relief, consumers can reduce their enrolled debt by 20% to 25% after fees.

The settlement fee is up to 25% of the total enrolled debt (some states cap this fee at 15%), and it’s only collected if the company settles the debt. There’s also a one-time $9 setup fee and a monthly maintenance fee of $9.85.

Once a settlement is reached, payments are made from the escrow account to the creditor, and the debt is considered settled.

Is National Debt Relief a Scam?

No, National Debt Relief is not a scam. It is a reputable debt settlement company.

However, just because it’s reputable doesn’t necessarily mean you should go with it.

While there are pros to using National Debt Relief, there are also cons.

According to NerdWallet, the pros include a free initial consultation and additional services, like recommendations for other debt-relief options (e.g., credit counseling). National Debt Relief is also accredited by the Better Business Bureau (with an A+ rating) and is a member of the American Association for Debt Resolution (AADR).

The cons are that debt settlement can damage credit scores, lead to increased debt if negotiations fail, and potentially result in creditor lawsuits. There’s no guarantee of success.

The Federal Trade Commission also says that using debt settlement companies is risky and reminds consumers that if you fail to complete the entire program, you will lose the fees already paid to the debt settlement company for any debts they managed to settle, still owe any remaining unsettled debts, and your credit report is likely to reflect late payments.

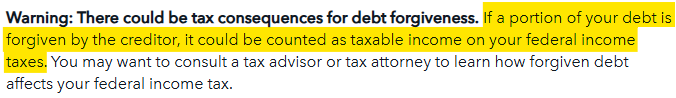

Another thing to note is that forgiven debt may come with tax consequences.

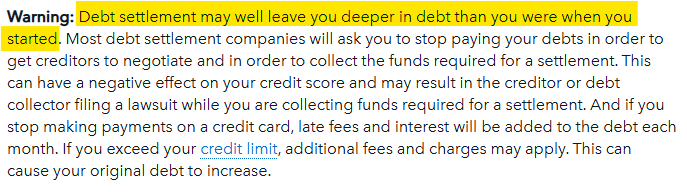

The Consumer Protection Financial Bureau advises against using debt relief companies, warning consumers, “Debt settlement may well leave you deeper in debt than you were when you started.”

In particular, the Consumer Protection Financial Bureau says not to do business with a debt relief company if it:

- Charges fees before settling debts.

- Says it can settle all your debts for a % reduction.

- Promotes a “recent government initiative” aimed at eliminating personal credit card debt.

- Assures you they can completely eliminate your debt.

- Advises you to stop communicating with your creditors.

- Promises to halt all debt collection phone calls and legal actions.

- Guarantees that your unsecured debts can be settled for just a small portion of the total amount owed.

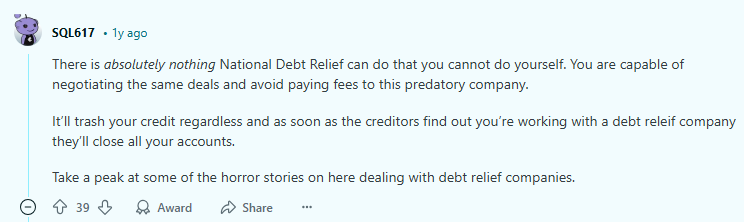

In general, people’s opinion about National Debt Relief seems to be fairly negative, at least on online forums for people working towards being debt-free.

While a small minority of users say they’ve had positive experiences with National Debt Relief, most recommend looking at alternative debt relief options, like non-profit credit counseling, direct negotiations with creditors, and structured debt repayment plans.

So, Should You Enroll to National Debt Relief?

Probably not before you explore other options, like contacting your credit directly to negotiate lower interest rates or reduced payment plans, and consult a financial advisor or a non-profit credit counselor.

How to Use National Debt Relief Safely

Here are some tips for a safer experience with National Debt Relief.

- Assess your financial situation. Before enrolling, thoroughly review your budget to confirm you can consistently make the required monthly payments without compromising your essential expenses. Look at the total amount of debt you have, plus your income, expenses, and ability to make consistent payments.

- Understand the fees. Calculate whether the potential debt reduction justifies the fees you’ll pay to the National Debt Relief. NDR typically charges up to 25% of the total enrolled debt. There’s also a one-time $9 setup fee and a monthly $9.85 maintenance fee.

- Evaluate credit impact. Consider how stopping payments and settling debts will impact your credit score.

- Talk to a financial advisor. Get professional advice about your specific financial situation.

- Read the contract carefully. Read the clauses in the contract, pay close attention to the obligations you and NDR have during the program, and understand the terms regarding cancellation.

- Stay informed. Regularly communicate with your NDR representative to stay updated on the progress of your debt settlement negotiations and request written confirmation for all agreements reached with creditors. Having everything in writing protects you in case of disputes.

- Monitor your credit report. Periodically check your credit reports to track how enrolling in National Debt Relief affects your credit score and to ensure all reported information is accurate.

- Understand the impact. Be aware that debt settlement can negatively impact your credit score because you may be advised to stop making payments on enrolled debts, leading to delinquent accounts.

Our privacy advisors:

- Continuously find and remove your sensitive data online

- Stop companies from selling your data – all year long

- Have removed 35M+ records

of personal data from the web

Save 10% on any individual and

family privacy plan

with code: BLOG10

news?

Don’t have the time?

DeleteMe is our premium privacy service that removes you from more than 750 data brokers like Whitepages, Spokeo, BeenVerified, plus many more.

Save 10% on DeleteMe when you use the code BLOG10.