Is Robinhood a Scam?

Laura Martisiute

Reading time: 6 minutes

Table of Contents

If you’re thinking of using Robinhood, you need to know: Is Robinhood a scam?

Below, we explain whether Robinhood is a scam and discuss some steps you can take to improve your safety when shopping on this day.

What Is Robinhood?

Robinhood is a platform for commission-free trading.

Investors can use Robinhood to trade stocks, cryptocurrencies, exchange-traded funds (ETFs), and options.

There’s no dollar minimum for opening an account on Robinhood.

Is Robinhood a Scam?

No, Robinhood is not a scam. It is a legitimate financial services company that is fully regulated by authorities.

The company is registered with the U.S. Securities and Exchange Commission (SEC). It’s also a member of the Financial Industry Regulatory Authority (FINRA) and the Securities Investor Protection Corporation (SIPC), which safeguards customer securities and cash up to $500,000 (with a limit of $250,000 for cash claims).

However, Robinhood gets mixed reviews.

Third-party financial review websites tend to rate Robinhood favorably:

- 4.5 out of 5.0 stars on Nerdwallet.

- 4.0 out of 5.0 stars on Investopedia.

- 4.0 out of 5.0 stars on Bankrate.

- 4.5 out of 5.0 stars on The Motley Fool.

On the other hand, the platform gets very mixed (mostly negative) reviews from users:

- 2.6 out of 5.0 stars (from 514k reviews and 10m+ downloads) on Google Play.

- 4.3 out of 5.0 stars (from 4,517,004 reviews) on the App Store.

- 1.2 out of 5.0 stars (from 3,990 reviews) on Trustpilot.

- 1.1 out of 5.0 stars (from 122 reviews) on Consumer Affairs.

- 1.12 out of 5.0 stars (226 reviews) on Better Business Bureau.

On internet forums like Reddit, people complain about Robinhood’s customer service (which apparently isn’t very good) and that the platform feels somewhat basic for investors who are not complete beginners.

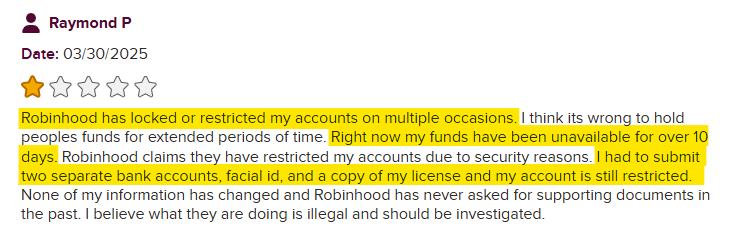

There are also complaints from people who have been locked out of their accounts.

One person said on the BBB website that their funds have been unavailable on Robinhood for more than 10 days and that their account remains restricted even though they’ve provided a facial ID, two separate bank accounts, and a copy of their license.

Robinhood has also been criticized over how it dealt with the GameStop trading frenzy in 2021.

However, other people say they’ve been using Robinhood for years without any issues.

The platform faced a class action lawsuit due to service outages and interruptions. As a result, Robinhood agreed to a $9.9 million settlement.

Security

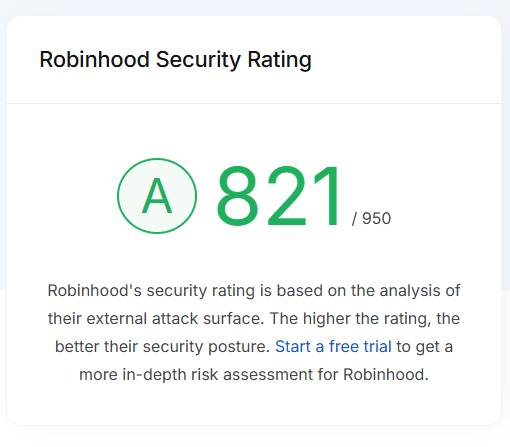

The cybersecurity company UpGuard rates Robinhood’s external attack surface as 821/950, meaning that its security posture (how well an organization can defend against cyber threats) is good.

However, Robinhood has experienced some security incidents in the past.

In 2021, the platform was hacked. More than 5 million user email addresses and 2 million names were taken. Just over 300 customers also had more specific data, like their names and ZIP codes, stolen, as well.

In 2019, Robinhood alerted some customers that it had stored their passwords in cleartext and recommended that they change their passwords. Luckily, it didn’t look like the exposed passwords were accessed by criminals.

Robinhood doesn’t have a clear policy about what happens if someone hacks into your account.

The platform offers biometric login (on mobile devices) and two-factor authentication (2FA). It also logs you out automatically if you’re not active in a session for a specific period of time.

Privacy

Robinhood’s privacy policy explains the kind of data it collects, why, and with whom it shares it.

Robinhood collects your identity and contact data, location data (for example, your mobile’s GPS location if you’ve turned this setting on), and financial data (e.g., income and credit history).

It also collects your profile data, pay & request details, stored content with your consent (e.g., photos), and other voluntary information (e.g., contest entries).

The platform collects your personal information directly from you as well as from third-party sources like public social media content and credit history from credit bureaus.

Robinhood uses this data to deliver and improve its services, communicate with you, personalize its content and ads, run promotions and contests (and process rewards), protect the platform from fraud, enforce legal rights, comply with regulations, and other lawful purposes with your consent.

It may share your data with third-party vendors and service providers (e.g., fraud protection services, advertising agencies), companies in which you hold securities, banking and credit card partners, and affiliates.

Robinhood may also share your information in the event of a corporate transaction like a merger and for legal purposes.

So, Should You Use Robinhood?

Depends on your situation and goals.

Robinhood seems like a good platform for beginner investors and people trading small amounts who are looking for a simple interface.

It may not be the best option for more serious traders who need advanced order types or who worry about outages or customer service delays.

How to Use Robinhood Safely

- Turn on two-factor authentication (2FA). This adds an extra layer of protection to your account in case your Robinhood password is ever exposed.

- Create a strong, unique password for your Robinhood account. Don’t use “12345” (or “password” and similar) or your personal information as your password, as these are easy to guess. Also, don’t reuse your Robinhood account password elsewhere on the web.

- Periodically review your account. Keep an eye on your Robinhood account for any transactions or changes you did not make.

- Be on the alert for phishing scams. Phishing emails that look like they come from Robinhood (but don’t really) may try to trick you into revealing sensitive information or clicking on a malicious link. SecureWorld has put together a guide on how to spot phishing emails from criminals pretending to be Robinhood.

- Share limited personal information online. Robinhood collects your personal data from public sources like social media profiles, so be careful about what you share on them (and set them to private).

- Keep your devices secure. With up-to-date antivirus software and the latest security updates.

- Review your Robinhood account profile information. Make sure your username doesn’t personally identify you on Robinhood, and don’t upload a profile picture (it’s not required).

- Manage your Robinhood profile visibility. Your Pay & Request profile is visible to everyone by default, but you can adjust the visibility settings.

- Turn off the app’s access to certain data. Withdraw permission for the Robinhood app to access your contact list, device’s precise location, and photo gallery.

- Opt-out of affiliate sharing. Limit data sharing between Robinhood affiliates by emailing privacy@robinhood.com and referring to the relevant Financial Privacy Notices (RHF and RHS Financial Privacy Notice, RHC Financial Privacy Notice, RHY Financial Privacy Notice, and RCT Financial Privacy Notice).

- Turn off certain data sharing. Through Robinhood’s settings, you can limit how Robinhood shares your personal information with marketing partners so that your data is not used in targeted ads.

- Adjust cookie controls. You can reject or delete cookies and similar technologies in your browser’s settings, but this might affect the functionality of Robinhood’s services.

Our privacy advisors:

- Continuously find and remove your sensitive data online

- Stop companies from selling your data – all year long

- Have removed 35M+ records

of personal data from the web

Save 10% on any individual and

family privacy plan

with code: BLOG10

news?

Don’t have the time?

DeleteMe is our premium privacy service that removes you from more than 750 data brokers like Whitepages, Spokeo, BeenVerified, plus many more.

Save 10% on DeleteMe when you use the code BLOG10.