Is Affirm a Scam?

Laura Martisiute

Reading time: 8 minutes

Table of Contents

If you’re thinking of using Affirm, you need to know if Affirm is safe. Is Affirm a scam?

Below, we explain whether Affirm is a scam and discuss some steps you can take to improve your safety when using this BNPL financial technology company.

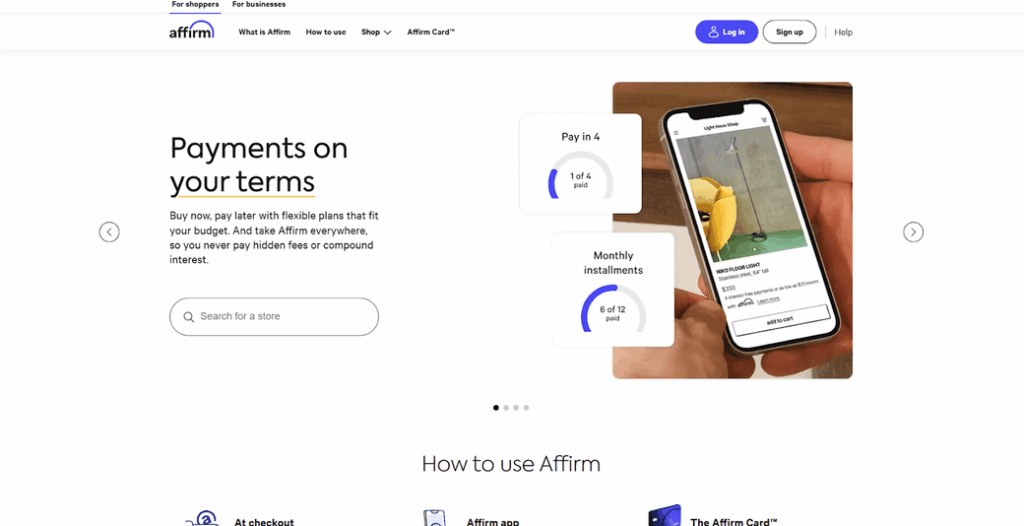

What Is Affirm?

Affirm is a “buy now, pay later” (BNPL) financial technology company.

With Affirm, users can split purchases into installments at checkout, either online or in‑store.

Upon approval, Affirm fronts the full purchase amount (minus a merchant fee) to the retailer immediately. This lets merchants ship your order without waiting for you to pay in full.

Users make installment payments directly to Affirm. There are reportedly no hidden fees, prepayment penalties, or late fees. That said, missing payments can result in interest and may be reported to credit bureaus.

The company was founded in 2012 by PayPal co‑founder Max Levchin and partners and is a publicly traded company.

Is Affirm a Scam?

No, Affirm is not a scam. It’s a legitimate BNPL financial tech company.

Affirm gets mostly positive reviews from third-party publications.

For example, NerdWallet gives Affirm a 5.0 out of 5.0 stars rating, saying it’s “a standout BNPL provider, thanks to numerous term lengths to choose from, zero fees and no-interest offers.”

Similarly, Bankrate gives Affirm a score of 4.8 out of 5.0 stars.

Business Insider reports that Affirm offers shoppers a variety of repayment plans, including interest-free options on select long-term purchases with no fees. However, its APRs vary by term and can become costly over longer financing periods.

A review of Affirm on Ramseysolutions.com is less favorable. However, the reviewer notes that they don’t like any “buy now, pay later” plans.

Clark.com has a good explanation of how Affirm works, including a list of pros and cons of using Affirm.

User reviews of Affirm are likewise mixed:

- 2.1 out of 5.0 stars (from 523 reviews) on Credit Karma.

- 1.17 out of 5.0 stars (from 1,275 reviews) on the Better Business Bureau.

- 2.7 out of 5.0 stars (from 6,906 reviews) on Trustpilot.

- 4.8 out of 5.0 stars (from 481,200 reviews) on Google Play.

- 4.9 out of 5.0 stars (from 1,591,848 reviews) on the App Store.

On online forums like Reddit, user experiences are likewise very mixed, with some people saying Affirm is great and others warning to stay away from this company.

One user said: “I financed my Peloton through Affirm and I enjoyed the entire process from start to finish.”

However, another person said: “Just beware of customer service, if you ever have an issue they will string you along for months and may even accidently ruin your credit from their mistake! I paid all my loans off on time, never missed a payment but there was an error that said i still owed 3 cents, but the system wouldn’t let me pay that 3cents because it was under a dollar. They sent that 3 cents to collections and my credit got knocked down. This was after over 50 calls to them.”

Users also warn about double-checking the sites you buy from with Affirm, as the customer service may not be helpful.

One person who used Affirm to split a $200 preorder into $50‑a‑month payments never received their item and couldn’t reach the merchant. When they canceled the charge through their bank, Affirm still demanded payment and said it would defer to the dishonest merchant’s terms.

Affirm is a Better Business Bureau (BBB)- accredited company and holds an “A+” rating on the BBB website.

According to the BBB website, Affirm has received 6,620 complaints over the last three years through the BBB, with 2,404 complaints closed in the last 12 months. (Read our review “Is BBB a Scam?”)

Security

In its privacy policy, Affirm states that it employs “physical, electronic and procedural security measures” to safeguard its systems against unauthorized access.

It also says it has safeguards such as firewalls and data encryption in place, and enforces physical access controls to its premises.

Additionally, it only grants access to users’ personal information to employees who require it for their job duties.

Affirm also offers passkeys.

In 2024, Affirm was involved in a data breach related to its third-party bank partner, Evolve Bank & Trust.

The breach happened after an Evolve employee reportedly clicked on a malicious link, granting attackers access to the bank’s systems.

The personal information of Affirm Card users was exposed, including names, Social Security Numbers (SSNs), bank account details, addresses, and contact information.

The attackers leaked the stolen data after Evolve refused to pay ransom demands, making the information publicly accessible on the dark web.

Following the breach, Affirm faced a class action lawsuit. Plaintiffs said Affirm failed to vet Evolve’s compliance with security standards sufficiently and did not promptly notify users about the breach.

Affirm responded with a detailed Q&A about the incident on its website, noting that its own systems were not accessed and detailing the steps it has taken to protect customers.

Privacy

Affirms explains the kind of data it collects, why it collects it, and with whom it shares it in its privacy policy.

It collects the following information:

- Directly from you: Identity (name, SSN, DOB), contact (email, address, phone), financial (bank login, account/card numbers, transaction history), device & usage (IP, browser/OS, cookies, app interactions), geolocation, biometric (photos), customer‑service interactions, marketing preferences.

- From third parties: Credit bureaus, identity‑verification/fraud‑prevention vendors, merchant partners, advertising & social‑media platforms.

Affirm uses this data to deliver and improve its services, support users and communicate with them, as well as to meet security and compliance requirements.

The company may share your data with affiliates and subsidiaries (e.g. Affirm Loan Services, LLC), service providers and contractors (e.g. IT, fraud monitoring and analytics), merchant partners (to complete transactions and for marketing, unless you opt out), advertising partners (for targeted ads and measurement), legal/government entities (when required by law or to protect against fraud), and in corporate transactions (e.g., mergers and acquisitions).

It states that it will only retain your information for as long as necessary for business/legal purposes, in accordance with specified criteria (purpose, legal obligations, fraud prevention, and privacy impact).

You can opt out of notifications about Affirm’s services and SMS messaging. You can also review and edit your personal data at any time through your Affirm account or by emailing customercare@affirm.com.

If you don’t have any active loans, you can request Affirm to close your account by emailing customercare@affirm.com. Affirm will mark your account in their database as “Closed,” but will keep your account information to comply with legal obligations. However, your personal information will not be used by Affirm for any further purposes or sold/shared to third parties (except as required by law).

Affirm notes that if you use a product offered through one of Affirm’s bank partners, your data will also be subject to that bank’s privacy notice (with links to these policies included at the bottom of Affirm’s own privacy policy).

So, Should You Use Affirm?

Depends on your needs and financial habits.

If you treat Affirm like a small‑loan tool rather than “free money,” read the APR and terms carefully, automate your payments, and lock down your privacy settings, it can be a good way to break up larger purchases without having to rely on traditional credit cards.

How to Use Affirm Safely and Privately

- Vet the merchant before you buy from them. Shop with retailers that have clear refund policies and positive recent reviews. According to some user reviews, Affirm may not be able to help you if you purchase from untrustworthy sites that fail to fulfill their promises.

- Use automatic payments. Link a single bank account or debit card and turn on auto‑pay to prevent missed payments and late‑interest surprises.

- Read the fine print. Always double-check the APR, down-payment requirement, and total cost before committing.

- Use strong credentials. Or better yet, a passkey.

- Turn off notifications. You can decline to receive notifications about Affirm’s services through your Affirm dashboard or by emailing customercare@affirm.com.

- Opt out of SMS messaging. If you don’t want to receive texts from Affirm, you can let them know through your Affirm dashboard or by replying “Stop” or emailing customercare@affirm.com.

- Turn off Affirm’s browser extension. If you install Affirm’s extension, turn it off or uninstall it whenever you’re not actively shopping to reduce tracking.

- Monitor your account and statements. Check your Affirm app regularly (and your bank or card statements) for any unexpected charges or lingering small balances.

- Close your Affirm account if you’re not using it. Once you’ve paid off all loans, consider closing your Affirm account.

Our privacy advisors:

- Continuously find and remove your sensitive data online

- Stop companies from selling your data – all year long

- Have removed 35M+ records

of personal data from the web

Save 10% on any individual and

family privacy plan

with code: BLOG10

news?

Don’t have the time?

DeleteMe is our premium privacy service that removes you from more than 750 data brokers like Whitepages, Spokeo, BeenVerified, plus many more.

Save 10% on DeleteMe when you use the code BLOG10.