Is Experian a Scam?

Laura Martisiute

Reading time: 9 minutes

Table of Contents

If you’re thinking of using Experian, you need to know whether it’s safe. Is Experian a scam?

Below, we explain whether Experian is a scam and discuss some steps you can take to improve your safety when using this service.

What Is Experian?

Experian is one of the three major credit bureaus in the United States (along with Equifax and TransUnion).

It tracks people’s credit histories (including loans, credit cards, payment history, and debt), provides credit scores, and creates credit reports (which lenders use to evaluate creditworthiness and risk).

Some Experian services are free, and others cost money.

For example, consumers can get free credit reports and a free Experian account that includes an Experian credit report, Experian credit score, and basic alerts about changes to their credit files.

You can also pay for extras, such as credit monitoring across all three bureaus, identity theft protection, and advanced score tracking tools.

Experian Marketing Services

In addition to operating as a credit bureau, Experian also operates Experian Marketing Services, which is explicitly a commercial data broker business.

While it cannot sell your credit report or specific credit data for marketing purposes (this is protected by the Fair Credit Reporting Act (FCRA)), it can sell consumer purchasing behavior, demographics, online activity, household data, and other data (i.e., data not protected by FCRA).

Experian Marketing Services sells this information to advertisers, political campaigns, and businesses.

If you don’t want Experian to sell your information, you can opt out. See our step-by-step Experian opt-out guide here.

Is Experian a Scam?

No, Experian is not a scam. It’s a legitimate, regulated credit reporting company.

The company has been reviewed by third-party sites and publications.

For example, a 2025 review of Experian Identity Theft Protection by CNET concludes that Experian is worth it if you want a strong free way to monitor your credit, but its paid plans feel cluttered with ads and lack some security features compared to competitors.

Similarly, according to a 2025 review of Experian Free Credit Monitoring by All About Cookies, Experian is worth using for free credit monitoring and FICO® score insights if you don’t mind frequent prompts to upgrade or apply for loans.

Business Insider, which reviewed Experian Boost (a free way to raise your credit score by reporting on-time utility and subscription payments), said it’s a strong offering but warned that it only affects your Experian score and won’t help repair existing negative credit issues.

User reviews of Experian are mixed as of this writing:

- 4.1 out of 5.0 stars (from 89,052 reviews) on Trustpilot.

- 4.8 out of 5.0 stars (from 2,529, 127 reviews) on the App Store.

- 4.7 out of 5.0 stars (from 680,843 reviews) on Google Play.

- 1.05 out of 5.0 stars (from 406 reviews) on Better Business Bureau.

- 1.1 out of 5.0 stars (from 2,067 reviews) on ConsumerAffairs.

- 1.0 out of 5.0 stars (from 236 reviews) on Yelp.

On Trustpilot, reviews frequently mention Experian Boost (a free feature that adds eligible utility and subscription payment history to your Experian credit report to potentially raise your credit score).

Some people say Experian Boost is easy to use and can be helpful if you have a thin credit history, but many are frustrated that the score increase only applies to Experian and not the other credit bureaus.

On ConsumerAffairs, customer service is a common theme, with nearly every reviewer saying it’s nearly impossible to reach a real person.

People also report account and identity access issues, being charged for services they never knowingly signed up for, difficulty canceling subscriptions, and credit score inconsistencies.

On online forums like Reddit, people likewise report varying experiences. Many people say that the free tier is great, but the paid services are not worth it in terms of what you actually get.

One person said: “Yeah I think they have a free account and it’s by far the best CRA imo. The others were always missing something from credit reports (esp Equifax)”

Experian is not a Better Business Bureau (BBB) accredited business (see our review of whether the BBB is a scam) at the time of writing.

The company has received 14,029 complaints over the last three years, with 5,267 of these complaints closed within the past 12 months. Many people complain that Experian is showing incorrect addresses, outdated names, or personal details that are no longer accurate, or an address that the person claims they never lived at.

Experian impersonation scams

As is the case with many well-known companies, scammers sometimes impersonate Experian.

In one instance, an internet user reported receiving a call from someone claiming to be from Experian about fake credit card charges. However, the caller asked for the full card numbers, provided a suspicious callback number, and nothing appeared on Experian’s site.

Regulatory actions and lawsuits against Experian

In 2025, the Consumer Financial Protection Bureau (CFPB) sued Experian, alleging it conducts inadequate or “sham” investigations into consumer disputes about credit report errors.

The CFPB alleges Experian often accepts questionable information from lenders without properly reviewing it, fails to clearly inform consumers of investigation results, and sometimes reintroduces previously removed inaccurate data.

According to the agency, these practices can harm people’s access to credit, housing, and jobs. It is therefore seeking penalties and an order to stop the alleged misconduct.

Experian denies the accusations and says it will fight the lawsuit.

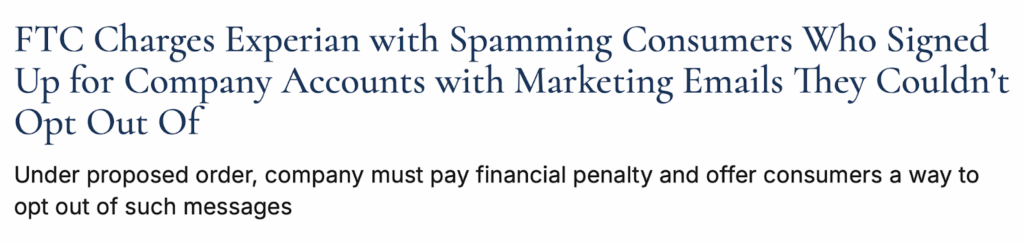

In August 2023, the U.S. Federal Trade Commission and the Department of Justice charged Experian Consumer Services with sending millions of marketing emails without providing opt-out links. Experian agreed to a permanent injunction and a civil penalty of $650,000.

In 2017, the CFPB fined Experian $3 million for misleading consumers by representing its own “educational” credit score as the same score lenders use, and also for showing ads to people before providing them with a legally required free credit report.

Experian security

According to its website, Experian’s security framework is organized into three layers:

- Prevention: Using tools and processes to stop threats from entering the system.

- Detection: Identifying any threats that do get inside.

- Mitigation: Reducing the risk of data being accessed or extracted if a threat occurs.

Experian also has a whitepaper on its security, which describes its security framework in more detail.

The company has experienced several security incidents.

Most notably, in 2015, hackers accessed an Experian server containing data mainly for T-Mobile customers. This breach affected approximately 15 million people and exposed personal data (including names, Social Security numbers, birth dates, addresses, and various identification numbers).

In 2020, another breach occurred in South Africa, exposing the data of 24 million individuals and 800,000 businesses.

Additionally, in 2021, a massive leak involving Experian’s subsidiary exposed the personal data of approximately 220 million citizens in Brazil.

In late 2022, security researcher Brian Krebs reported that a security flaw on Experian’s website allowed access to individual credit reports without full authentication, a vulnerability that was fixed only in early 2023 after lasting approximately 7 weeks.

Experian privacy

Experian explains in its privacy policy the type of personal information it collects, why it collects it, and with whom it shares it.

It may collect the following information:

- Personal and online identifiers (e.g., first and last name, address, phone number, SSN, driver’s license, email address, and unique online identifiers).

- Commercial or transaction information (e.g., records of products, services, and property purchased).

- Online activity (e.g., browsing history, search history, etc.)

- Biometric information (e.g., facial recognition, call recordings, retina/fingerprint scans).

- Geolocation information.

- Sensory information (e.g., audio, electronic, visual, etc.)

- Professional or employment-related information.

- Education information.

- Inferences drawn from the above.

The company uses personal data for marketing and targeted advertising, helping businesses find and evaluate customers, detect fraud, verify identities, conduct analytics and product development, make credit-related decisions and reports, and maintain accurate consumer contact information.

As outlined in its privacy policy, it sells and shares personal information with many types of companies, including financial institutions, marketing and research companies, retailers, insurance companies, government agencies, data compilers, and technology companies.

Experian does not collect or sell information about minors under 16.

Depending on your state, you may have rights to know/access your data, correct inaccurate data, delete your data, and opt out of data selling, targeted ads, and certain profiling.

Sometimes, Experian acts only as a service provider for another company; in that case, you must contact that company to exercise your rights.

Experian keeps your data as long as necessary for business, legal, and security reasons.

Experian’s privacy policy has been reviewed by third-party policy checkers, such as the Common Sense Privacy Program, which assigns Experian a “Warning” rating as of this writing. This means the policy “Does not meet our recommendations for privacy and security practices.”

Among the issues flagged are the fact that Experian sells or rents personal information to third parties, shares information for third-party marketing, and displays personalized ads. It also allows third parties to collect data for their own purposes.

The Common Sense Privacy Program states that it’s unclear whether Experian uses users’ information to track and target ads on other third-party websites or services, and whether it creates and utilizes data profiles for personalized ads.

Should You Use Experian?

Yes. Since lenders use Experian’s data, it’s useful to check your report to ensure there are no errors. For most people, the free account is probably enough.

How to Use Experian Safely and Privately

- Start with the free Experian account. Avoid entering credit card information unless you intend to pay, as some people have reported accidentally upgrading.

- Go directly to Experian.com. Avoid clicking email links to avoid falling for a phishing scam.

- Enable two-factor authentication (2FA). You can do this in your Experian account security settings.

- Use a strong, unique password. And don’t reuse it anywhere else.

- Do not link unnecessary accounts when using Experian Boost. Only connect utilities/subscriptions you’re comfortable sharing data from.

- Decline or ignore upgrade prompts. Many lead to paid trials that auto-renew.

- Freeze your credit at Experian, Equifax, and TransUnion. This helps prevent fraudulent account openings.

- Download your credit report once a year. And keep a copy in secure storage.

- Check your report for errors. If you find any, dispute inaccuracies in writing to create a strong legal paper trail.

- Don’t share personal information over the phone. Experian rarely calls consumers, and scammers impersonate the company often.

- Review and limit app permissions. Turn off location, contacts, and unnecessary data access.

- Opt out of data sale and marketing sharing. See our detailed Experian opt-out guide for step-by-step instructions.

- Opt out of prescreened credit/insurance offers. By calling 1-888-5-OPT-OUT (1-888-567-8688).

Our privacy advisors:

- Continuously find and remove your sensitive data online

- Stop companies from selling your data – all year long

- Have removed 35M+ records

of personal data from the web

Save 10% on any individual and

family privacy plan

with code: BLOG10

news?

Don’t have the time?

DeleteMe is our premium privacy service that removes you from more than 750 data brokers like Whitepages, Spokeo, BeenVerified, plus many more.

Save 10% on DeleteMe when you use the code BLOG10.