Is Albert a Scam?

Laura Martisiute

Reading time: 8 minutes

Table of Contents

If you’re thinking of using Albert, you need to know: Is Albert a scam?

Below, we explain whether Albert is a scam and discuss some steps you can take to improve your safety when using this app.

What Is Albert?

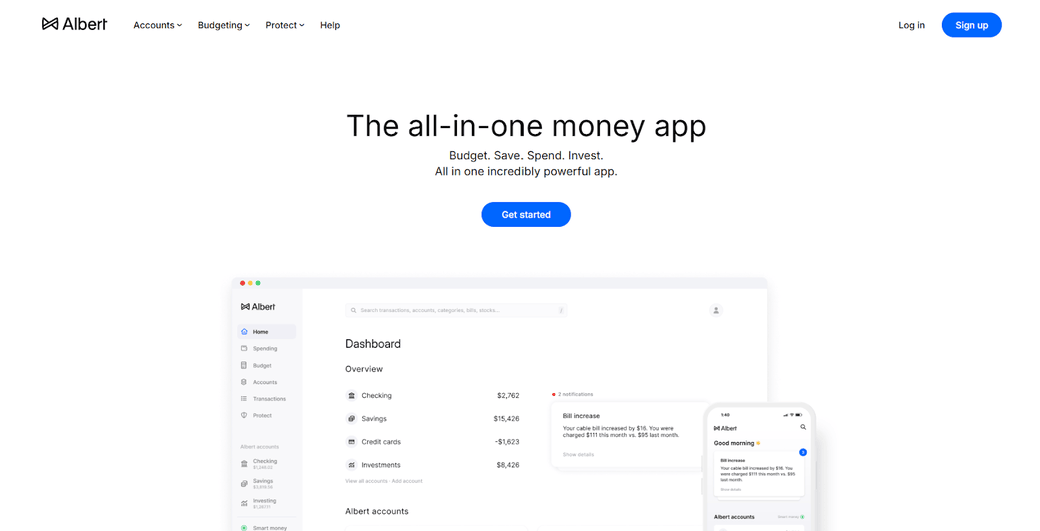

Albert describes itself as “the all-in-one money app.”

In other words, it’s a personal finance app that lets you budget, save, spend, invest, and protect your financial accounts all from one platform.

Albert is not a bank, but it partners with licensed FDIC-insured banks to provide cash and savings accounts.

It operates on a subscription model.

Is Albert a Scam?

No, Albert is not a scam. It’s a legitimate fintech app. However, it doesn’t get good user reviews.

Several third-party publications and review sites have reviewed the app.

For example, Moneywise gave Albert a score of 3.8 out of 5.0 stars, Business Insider rated it as 3.0 out of 5.0 stars, and The Penny Hoarder graded it as 4.5 out of 5.0 stars.

The Budget Diet, which also reviewed the app, said the following about Albert:

“Albert could be worth it if you want an all-in-one solution to budget, save, spend, and invest your money. However, we don’t think it holds up well against its competitors due to its expensive monthly fees. The lack of an interest-bearing savings account is also a downside.”

On LinkedIn, Genevieve Harrison said that despite canceling her account twice, the app continued charging her $14.99 per month until she threatened to escalate the issue to the CFPB. She also noted that Albert’s cancellation process requires government ID and biometric selfies.

User reviews of Alber are very mixed:

- 4.5 out of 5.0 stars (from 5,499 reviews) on Trustpilot.

- 1.2 out of 5.0 stars (from 85 reviews) on Consumer Affairs.

- 4.6 out of 5.0 stars (from 251,799 reviews) on the App Store.

- 4.5 out of 5.0 stars (from 129,028 reviews) on Google Play.

- 3.96 out of 5.0 stars (from 1,198 reviews) on Better Business Bureau.

On online forums like Reddit, people report mostly negative experiences with Albert.

One person warned that Albert trapped them into a yearly subscription by delaying withdrawals and preventing cancellation until funds “settle,” leading to surprise charges and weeks‑long waits to access their own money.

Someone else noted that they had a very similar experience.

Several users also reported difficulty canceling their Albert subscription.

One user wrote: “i’ve been trying to cancel since september of 2024…. they keep charging me although i’ve emailed countless times for them to cancel and refund me. i’m fed up atp.”

Albert is not Better Business Bureau (BBB) accredited. It has received 1,423 complaints on the BBB website in the last three years, 255 of which have been closed in the past 12 months. (Read our review “Is BBB a Scam?”)

Terms of service

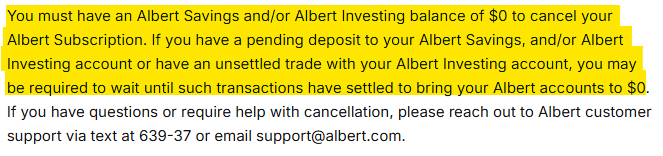

In its terms of service, Albert says that you cannot cancel your subscription until your Albert Savings and Investing balances are exactly $0.

Pending transfers or investments can take days or weeks to “settle,” effectively delaying cancellation and potentially causing unwanted charges.

Albert also notes that subscriptions auto-renew unless actively cancelled and that it may debit linked bank accounts (or other Albert accounts) for unpaid subscription fees.

Fees can change at Albert’s discretion with notice. You agree to pay the new rate if you continue to use the app.

Regarding Instant Advance, though marketed as “no interest / no late fees,” instant transfer fees can make advances expensive. If you fail to repay on time, Albert can suspend your account and set off balances from your other Albert accounts.

You must enable Smart Money (automatic withdrawals) to use advances, giving Albert priority access to your funds.

Security

Albert describes its security measures on a dedicated security help page.

Funds in Albert Cash and Albert Savings are FDIC-insured up to $250,000 through its partner banks. Funds in Albert Investments are protected by the Securities Investor Protection Corporation (SIPC). Coverage up to $500,000 total, including a $250,000 cap for cash.

All personal and financial information is encrypted and transmitted using SSL (Secure Sockets Layer), the same protocol major banks use.

Albert does not store your bank login credentials; they are only used when connecting through Plaid.

Account connections are handled by Plaid, which encrypts all data while in transit.

In its privacy policy, Albert states that it protects your National Provider Identifier (NPI) from unauthorized access and use.

It says it uses “reasonable security measures” that include “computer safeguards and secured files and buildings.”

Privacy

Albert explains the kind of data it collects, for what purposes, and with whom it shares it in its privacy policy.

It says it collects the following personal information:

- Account information: Name, email, phone, postal address, SSN, DOB, and income.

- Bank details: Login credentials (via Plaid), balances, transactions, routing/account numbers.

- Verification data: Government-issued ID, utility bills, employment, and citizenship details.

- Protect Users: Credit history, medical ID numbers, insurance info; may require a limited power of attorney for identity restoration.

- Albert Genius: AI chatbot records interactions; collects financial details, documents in the “Vault,” credit scores, debts, and income.

- Biometric data: Facial geometry for ID verification (processed by a third-party vendor).

- Cookies and tracking: Web beacons, log data, analytics (Google, Meta).

- Location data: Based on IP or GPS (if turned on).

- Other sources: Consumer reporting agencies, social networks, app stores, and event sign-ups.

It uses this data to provide services, improve AI chatbot and services (but not for training providers’ AI models), and create de-identified or aggregated data for analysis, as well as for marketing, advertising, security, legal compliance, and administrative purposes.

The company may share your information with service providers, bank partners, marketing partners, LLM providers, and law enforcement. It may also share it in business transactions.

Albert shares uses your NPI for:

- Everyday business (processing transactions, credit reporting).

- Marketing their own services.

- Joint marketing with other financial companies.

- Affiliates’ business purposes (transactions, experiences).

Users can limit affiliate marketing, but cannot limit everyday business or joint marketing sharing.

Information may be stored outside your state/U.S.

Albert keeps data for as long as needed for services, legal, or business purposes. It does not store any biometric information entered through its services (except a record of your consent).

You can opt out of promotion communications from Albert.

Depending on where you live, you may be able to exercise privacy rights like the right to request deletion of your personal data and the right to request restriction of or object to Albert’s processing of your personal information.

So, Should You Use Albert?

Depends.

Albert can be a convenient all-in-one tool for budgeting, saving, investing, and cash advances.

But only if you’re comfortable with paying ongoing subscription fees, sharing extensive personal data, and actively monitoring your account to ensure charges stop when you cancel.

Otherwise, there are likely better alternatives out there.

How to Use Albert Safely and Privately

- Use a separate bank account for Albert. Link Albert only to a secondary checking account (not your primary one) with limited funds to reduce risk in case Albert continues charging even after you cancel.

- Set up strong 2FA on your linked bank. Even though Albert uses Plaid, adding two-factor authentication to your bank adds another protection layer.

- Use a strong password for your Albert account. And never reuse it elsewhere.

- Monitor transactions daily. Set up bank alerts for any withdrawals over $1.

- Download and save all account statements and communications with Albert. Keep PDFs of your Albert transactions and chat logs with support. This provides evidence if you need to file a complaint or dispute charges.

- Cancel well before billing dates. If you’re on a free Albert trial, cancel at least 2 weeks before it ends due to “settlement” delays. Keep screenshots of the cancellation request.

- Use a virtual card or low-balance debit card. Cancel or pause the card when you want to stop charges.

- If you want to cancel Albert, zero out your balances first. Withdraw all funds from Albert Cash and Investments before requesting cancellation, since unsettled transfers can trap you. Double-check balances show exactly $0.

- Limit the amount of personal data you provide. Only provide information that is absolutely required to use the features you want.

- Opt out of data sharing and marketing. This reduces tracking.

- Turn off location sharing. In your phone settings, deny Albert access to your location unless you need a location-based feature. Also, block unnecessary push notifications.

- Be aware of potential biometric requests. Albert users have noted that the app may ask for biometric verification when you cancel your account.

- Contact Albert support in writing. Always use email or in-app chat so you have proof. If ignored, escalate with the Consumer Financial Protection Bureau (CFPB) or Better Business Bureau (BBB).

- Dispute charges quickly with your bank. If Albert continues billing after cancellation, request a chargeback. Provide copies of your cancellation proof.

- Stay updated on policy changes. Albert can change its terms and fees. Check for updates monthly.

Our privacy advisors:

- Continuously find and remove your sensitive data online

- Stop companies from selling your data – all year long

- Have removed 35M+ records

of personal data from the web

Save 10% on any individual and

family privacy plan

with code: BLOG10

news?

Don’t have the time?

DeleteMe is our premium privacy service that removes you from more than 750 data brokers like Whitepages, Spokeo, BeenVerified, plus many more.

Save 10% on DeleteMe when you use the code BLOG10.