Is Cash App a Scam?

Laura Martisiute

Reading time: 7 minutes

Table of Contents

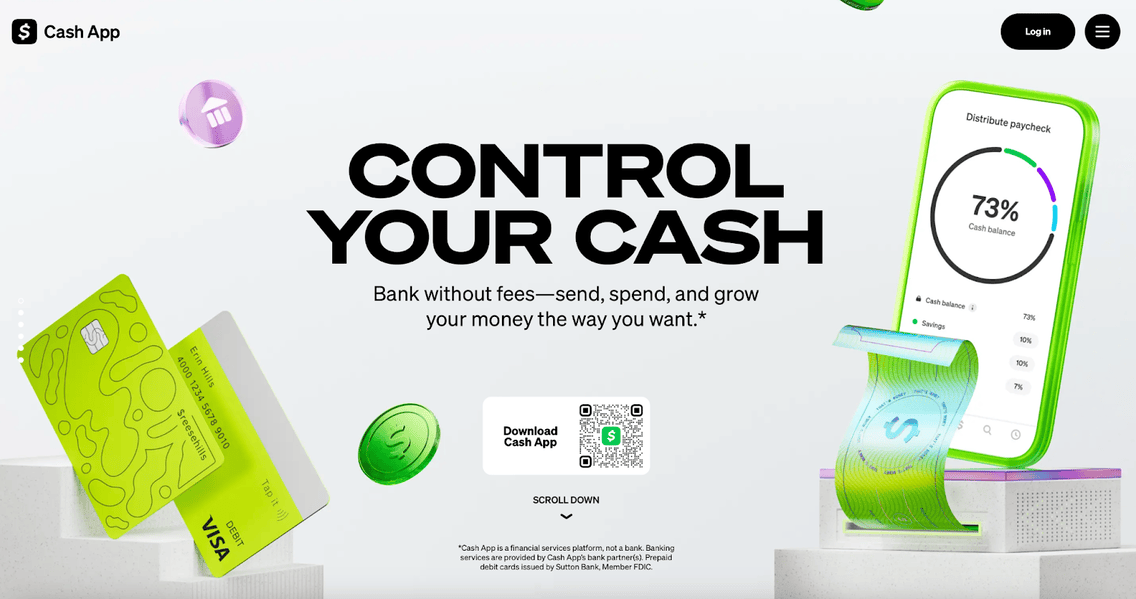

If you’re thinking of using Cash App, you need to know: Is Cash App a scam?

Below, we explain whether Cash App is a scam and discuss some steps you can take to improve your safety when using this online service.

What Is Cash App?

Cash App is a mobile payment platform and digital wallet.

The app lets you:

- Send, receive, and store money,

- Invest in stocks and Bitcoin.

- Access a customizable debit card.

- File taxes.

It was initially launched as Square Cash in 2013 by Jack Dorsey and Brian Grassadonia.

Cash App is free to download. It makes revenue through fees on various transactions.

The app operates under a fractional-reserve banking model, holding a portion of user liquidity.

Is Cash App a Scam?

No, Cash App is not a scam. It’s a legitimate digital payment service.

That said, Cash App is often impersonated by scammers. According to Cash App, scammers use tactics such as fake customer support, phishing emails, and fraudulent social media posts to trick users.

Criminals might also impersonate Cash App representatives or use copycat websites that mimic the official Cash App design.

Cash App recommends that you turn on security features, such as in-app notifications, so you’re alerted instantly to any account activity. You should also activate Security Lock, which requires a PIN or biometric authentication (like Face ID or Touch ID) before every transaction.

Another thing to keep in mind is that Cash App transactions are often instant and difficult to reverse, which means you need to be careful when sending money.

Cash App gets a 4.6 out of 5.0-star rating (from 3,474,055 ratings and 100m+ downloads) on Google Play and a 4.8 out of 5.0-star rating (from 7,249,351 ratings) on the App Store.

In 2022, PCMag gave Cash App a 4.0 out of 5.0 (“Excellent”) rating. It has also been reviewed by NerdWallet and CNBC.

Security

Cash App has several security measures in place.

On its security page, Cash App says it helps prevent fraud by requesting confirmation before sending money to contacts not saved in your list. It also provides security alerts when your PIN or security settings are changed.

Additionally, the app requires confirmation of details during international transactions or when logging in from a new device.

It performs regular identity verification to ensure the account holder is the actual user.

Cash App is certified as PCI DSS Level 1, the same security standard major credit card companies use.

According to Cash App’s Google Play page, the app encrypts your data in transit. You can also ask for your data to be deleted.

According to PCMag, you should not share your $Cashtag widely. This helps avoid scams, such as fraudulent deposits followed by reclaim attempts using stolen credit cards.

For cancellations, refunds, or disputes, Cash App encourages users to first try and resolve issues with the merchant. If that’s not possible, the app will investigate the claim, but the process is supposedly less comprehensive than, say, PayPal’s money-back warranty.

In 2025, the Consumer Financial Protection Bureau (CFPB) ordered Block, the company behind Cash App, to pay up to $120 million to consumers who suffered losses from unauthorized transactions or received inadequate support when trying to resolve these issues.

The CFPB found that Block allowed fraud to spread on Cash App because it didn’t have strong enough security measures.

Instead of properly investigating reports of unauthorized transactions, Block closed many of these cases without a thorough review. Users were told to contact their banks to reverse fraudulent transactions and used tactics (like misleading language in their Terms of Service) to discourage users from seeking help directly from them in the first place.

The company is now required to establish a 24-hour, live-person customer support system.

Federal regulators are also reviewing whistleblower complaints against Block’s Cash App over alleged insufficient identity verification measures that could allow fraud, money laundering, and even terrorism financing to occur.

Cash App has been involved in several breaches.

In one incident, a former Cash App employee accessed and downloaded customer information, which affected over 8 million users (exposing their personal details such as full names, brokerage account numbers, portfolio values, and trading activities).

In another incident, unauthorized users accessed Cash App accounts using recycled phone numbers.

Privacy

Cash App describes the kind of information it collects, what it does with it, and whom it shares it with in its privacy policy.

Cash App collects the following data:

- User-provided data. Includes personal details (name, email, phone, address, government IDs, biometrics), financial information (bank and card details), transaction details, and contacts.

- Automatically collected data. Information from devices and online interactions, such as IP addresses, device details, geolocation, browsing activity, and other usage data.

- Additional data. Information provided for enhancing the user experience (like uploaded contacts or photos) and data gathered from third-party sources for identity verification, credit checks, and fraud prevention.

It uses this information for various purposes, including providing and improving its services, communicating, detecting and preventing fraud, and developing new features.

Cash App may share your data with other users (e.g., for transaction details), internally with Cash App affiliates and group companies, rith third-party service providers, with merchants when processing payments, and in business transfers or corporate changes. It may also share this data for legal compliance and safety purposes.

Aggregated or anonymized data may be shared without identifying individual users.

Cash App can keep this information as long as you use the app and for as long as necessary to fulfill legal, security, and business requirements.

According to the privacy policy, you have certain choices and rights. For example, you can:

- Access, update, or correct your personal information through the app.

- Deactivate or close your account.

- Control location data collection and manage promotional communications.

As per Cash App’s security page, you control what personal information is shared with other users.

Payment information is encrypted, and your data is not sold to third parties.

Cash App’s privacy policy has not been rated by third-party review sites like Terms of Service; Didn’t Read (ToS;DR), a project that rates internet services’ terms of service and privacy policies.

However, ToS;DR does note some potential concerns about Cash App, including the following:

- Cash App can share your personal information with third parties.

- May use tracking pixels, web beacons, browser fingerprinting, and/or device fingerprinting on users.

- Forces users into binding arbitration in the case of disputes.

- The service uses your personal data for advertising.

- The court of law governing the terms is in a jurisdiction that is less friendly to user privacy protection.

On the plus side, ToS;DR says that Cash App will only respond to government requests for data that are reasonable.

So, Should You Use Cash App?

Probably. For many people, it’s an effective tool for everyday financial needs.

However, recent regulatory actions and whistleblower allegations suggest that Cash App users have had problems with fraud prevention and customer service practices.

Also, as with any digital payment platform, users can be exposed to scams and phishing attempts.

If you require stronger buyer protection or dispute resolution, you might also consider looking at other options.

How to Use Cash App Safely

- Turn on Security Lock & notifications. Activate the Security Lock (requiring PIN or biometric authentication) and enable push notifications to alert you immediately about any account activity.

- Don’t share sensitive data. Don’t provide your sign-in code, PIN, full bank account details, or Social Security number to anyone, even if they claim to be from Cash App support.

- Verify communications. Always confirm that any request for your information is coming from verified Cash App channels.

- Double-check recipient information. Always verify the recipient’s details (username, $Cashtag, phone, or email) before sending money to ensure you’re not accidentally sending funds to a scammer.

- Avoid unknown individuals. Only use Cash App to send money to those you know and trust.

- Review your Cash App transaction history. If you notice any suspicious transactions, dispute them immediately.

- Keep your Cash App updated. Make sure you’re using the most recent version of Cash App.

Our privacy advisors:

- Continuously find and remove your sensitive data online

- Stop companies from selling your data – all year long

- Have removed 35M+ records

of personal data from the web

Save 10% on any individual and

family privacy plan

with code: BLOG10

news?

Don’t have the time?

DeleteMe is our premium privacy service that removes you from more than 750 data brokers like Whitepages, Spokeo, BeenVerified, plus many more.

Save 10% on DeleteMe when you use the code BLOG10.