Is Colonial Penn a Scam?

Laura Martisiute

Reading time: 7 minutes

Table of Contents

If you’re thinking of using Colonial Penn, you need to know: Is Colonial Penn a scam?

Below, we explain whether Colonial Penn is a scam and discuss some steps you can take to improve your safety when using this insurance provider.

What Is Colonial Penn?

Colonial Penn is a life insurance provider.

It’s best known for its “guaranteed acceptance” policies aimed at seniors.

Since Colonial Penn’s flagship product requires no health questionnaire or medical exam, it’s often chosen by individuals with health issues that make standard underwriting difficult.

The company is part of the CNO Financial Group family of brands.

Is Colonial Penn a Scam?

No, Colonial Penn is not a scam. However, it has a lot of bad reviews.

Colonial Penn gets mostly negative reviews from third-party publications and review sites.

For example, NerdWallet gives Colonial Penn life insurance a rating of 2.5 out of 5.0 stars, saying: “With a high volume of complaints and relatively low coverage limits, you’ll likely find better options elsewhere.”

Bankrate rates Colonial Penn life insurance as 2.2 out of 5.0 stars, Investopedia gives Colonial Penn a rating of 2.4 out of 5.0 stars, and Forbes gives Colonial Penn a rating of 1.0 out of 5.0 stars.

All of the above publications remark on the number of complaints filed about Colonial Penn to regulators in comparison to other companies of its size.

According to I Sold My House, the $9.95-per-month plan from Colonial Penn may seem budget-friendly, but its benefits are so low (i.e., the policies can usually only pay a fraction of the actual average funeral cost) that policyholders and their families end up exposed to high end-of-life expenses.

Another drawback is the mandatory two-year waiting period before full benefits are payable, meaning that if a policyholder dies during the first two years of coverage, Colonial Penn limits the payout to a refund of premiums plus interest rather than the full face amount.

Customer reviews are likewise negative:

- 1.5 out of 5.0 stars (from 40 reviews) on Trustpilot.

- 1.1 out of 5.0 stars (from 47 reviews) on Yelp.

- 1.2 out of 5.0 stars (from 17 reviews) on Pissed Consumer.

People complain about claim denials or delays, bad customer service, billing and refund issues, and deceptive advertising.

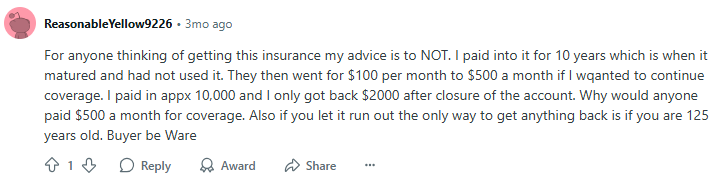

On online forums like Reddit, users report mostly bad experiences with Colonial Penn.

One person said: “For anyone thinking of getting this insurance my advice is to NOT. I paid into it for 10 years which is when it matured and had not used it. They then went for $100 per month to $500 a month if I wqanted to continue coverage. I paid in appx 10,000 and I only got back $2000 after closure of the account. Why would anyone paid $500 a month for coverage. Also if you let it run out the only way to get anything back is if you are 125 years old.”

Another noted that canceling the policy was difficult: “I called to cancel on 3/3/25. They said I had to fill out a form to make it official. I called 3 more times as each time they said the form had been mailed to me. Although I never received the for, they continued to send me letters soliciting me to add more coverage. Finally on 4/9/25 I was told that I could write a letter and fax it. And the representative also stated she hoped that I would receive the cash value payout since I never received the cancellation forms.”

Someone summed up Colonial Penn as “a real company, but a bad product. You are far better off just saving money for final expenses.”

Security

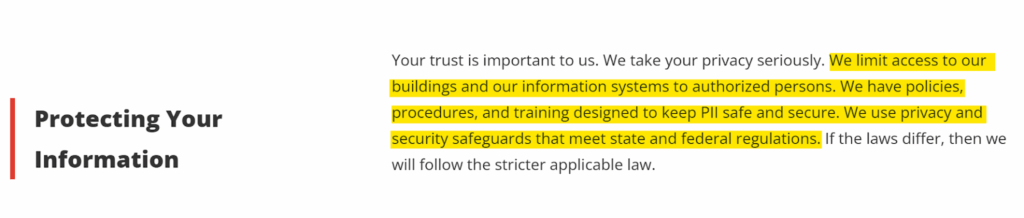

In its privacy policy, Colonial Penn describes its security controls.

It says it limits access to its buildings and information systems to authorized persons only.

Additionally, it states that it has policies, procedures, and training in place to safeguard your personal information. Its safeguards meet state and federal regulations.

Privacy

Colonial Penn describes what data it collects, why, and with whom it shares it in its privacy policies.

It has several policies. We looked at the Colonial Penn Life Insurance company privacy policy (versus, for example, its website privacy policy).

Colonial Penn collects the following information from the individuals who choose to get insured with the company:

- Information collected from you: Name, contact information, birth date, Social Security number. Additionally, depending on the coverage you apply for, they may request information about your health status (past and present), financial assets, and other identifying details.

- Data from third parties: Personally identifiable information needed to determine your eligibility for coverage or to process a claim.

Colonial Penn states that it primarily uses this information to underwrite policies, service your coverage (including claims, quality reviews, and customer service), and for risk management and business planning purposes.

If permitted by law, it may also use your personal information to offer you other insurance-related products and services.

Health plan personal information isn’t used for marketing unless legally permitted.

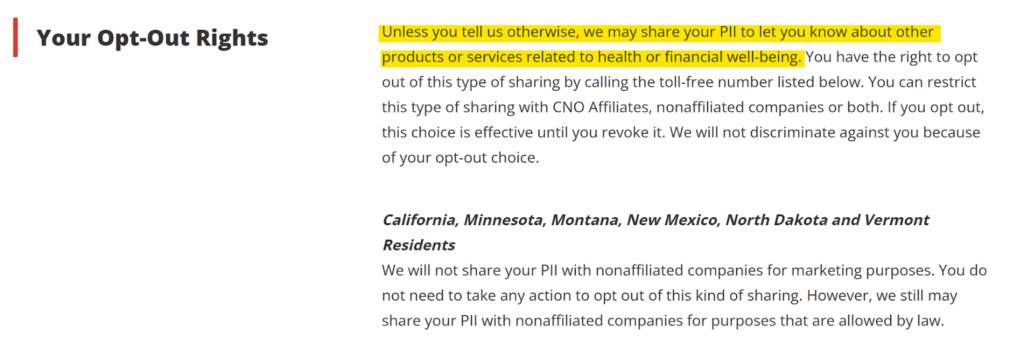

Colonial Penn says it may disclose your personal information to non-affiliated service providers to perform services on its behalf or jointly market financial products and services with another insurance company or financial institution.

By default, the company will use or share your personal information to pitch you related products until you call or write to opt-out, unless you live in California, Minnesota, Montana, New Mexico, North Dakota, or Vermont, in which case, Colonial Penn will not share your personal information with non-affiliated companies for marketing purposes.

You can ask Colonial Penn to see or receive a copy of the personal information they have about you, correct it, get a list of disclosures of your personal information, request information on adverse underwriting decisions, file a complaint, request alternative communications, and request the restriction of communication.

However, even though you can ask the company not to share certain data, it isn’t required to agree if it feels it would impede its business or your care.

Colonial Penn can also update the privacy policy at any time with no direct notice to you (you’d have to proactively check their website or request a paper copy).

So, Should You Use Colonial Penn?

Probably not, unless you can’t qualify for any other life insurance policy due to serious health issues and need coverage immediately.

For most people, Colonial Penn’s flagship “guaranteed acceptance” final-expense plan is likely to turn out to be poor value.

How to Use Colonial Penn Safely and Privately

- Shop around first. Get quotes on standard final-expense or term life from at least three other insurers. Compare coverage amounts, premiums, and waiting periods side by side to find the best option for you.

- Understand the waiting period. For the first two years, if you die, your beneficiaries will not get full death benefits.

- Opt out of unwanted marketing immediately. Call 1-800-523-9100 (have your policy number ready) or write to Privacy Opt Out, Policyholder Service, P.O. Box 1918, Carmel, IN 46082. Inform Colonial Penn that you do not wish for your personal information to be shared for marketing purposes with either affiliates or non-affiliated companies.

- Document your interactions with Colonial Penn. Reviews note poor customer service. To be on the safe side, keep copies of every form, letter, fax cover sheet, and email you send or receive. When you cancel or request changes, send your instructions by certified mail or fax and save your proof of delivery. Note names, dates, and reference numbers of any phone calls.

- Audit your policy regularly. If something appears to be incorrect, contact the company in writing immediately to request a correction.

- Exercise your privacy rights. You can ask Colonial Penn to see the personal information they have on you, correct it, request a list of disclosures, and request information on adverse underwriting decisions.

Our privacy advisors:

- Continuously find and remove your sensitive data online

- Stop companies from selling your data – all year long

- Have removed 35M+ records

of personal data from the web

Save 10% on any individual and

family privacy plan

with code: BLOG10

news?

Don’t have the time?

DeleteMe is our premium privacy service that removes you from more than 750 data brokers like Whitepages, Spokeo, BeenVerified, plus many more.

Save 10% on DeleteMe when you use the code BLOG10.