Is Dave a Scam?

Laura Martisiute

Reading time: 8 minutes

Table of Contents

If you’re thinking of using Dave, you need to know if Dave is safe. Is Dave a scam?

Below, we explain whether Dave is a scam and discuss some steps you can take to improve your safety when using this banking app.

What Is Dave?

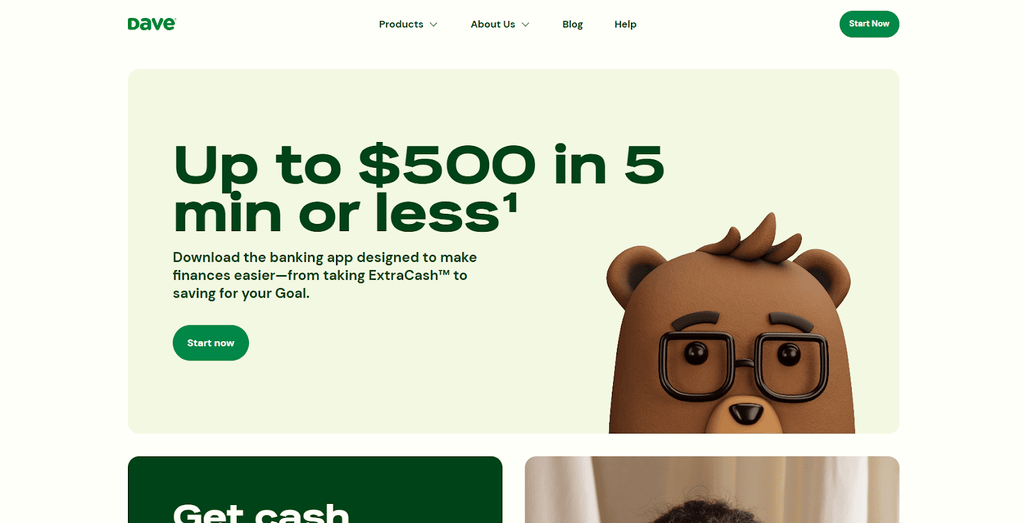

Dave describes itself as a banking app that is on a mission to “level the financial playing field.”

Its products include the following:

- “ExtraCash”, i.e., cash advances up to $500.

- Checking accounts with early direct-deposit access (up to 2 days early), no minimum balances, and no overdraft fees.

- “Goals Account,” i.e., savings account meant for a particular goal, such as a new car.

- “Side Hustle” board for gig and survey opportunities to earn extra income.

As per its website, Dave accounts are FDIC insured up to $250,000.

Is Dave a Scam?

No, Dave is not a scam. It’s a legitimate financial services app.

Dave gets good reviews from third-party publications.

For example, Bankrate gives Dave Pay Advance App a rating of 4.7 out of 5.0 stars.

GOBankingRates also gives the Dave app a 4.7 out of 5.0 stars score.

Business Insider says that Dave may be “a good choice if you’re looking for an account that’s easy to open. […] It also offers a 2-day early direct deposit and a high interest rate of 4.00% APY.”

However, Business Insider also warns of “potential fees and limitations to the account. M[…] here’s a $1 monthly subscription fee to use the Dave app and limited ways to deposit cash.”

The Budget Diet recommends Dave for those looking for an affordable app with a high advancement limit. That said, it notes that its express fees are pricey.

MoneyRates gives Dave a rating of 3.5 out of 5.0 stars.

User reviews are more mixed:

- 1.1 out of 5.0 stars (from 69 reviews) on Consumer Affairs.

- 4.8 out of 5.0 stars (from 730.9k reviews) on the App Store.

- 4.4 out of 5.0 stars (from 554,683 reviews and 10M+ downloads) on Google Play.

- 1.9 out of 5.0 stars (from 14 reviews) on Trustpilot.

- 1.8 out of 5.0 stars (from 1,517 reviews) on PissedConsumer.

Common complaints include payments not showing up on their Dave account, leaving them unsure if Dave has received the funds. Others say Dave took payments twice or continued to withdraw money even after the debts were paid off.

Most negative reviews say that Dave’s customer service is unresponsive, only offering automated messages. Disputes can apparently drag on for a long time.

On online forums like Reddit, Dave is generally positively reviewed, with several people saying they use it all the time and have had no issues.

Some people say they no longer use Dave because “once you get stuck in that cycle it was hard to get out.”

As one user put it: “You’re basically just getting an advance on your payday, so it’s easy to spend the money you don’t technically have yet. You could easily find yourself in a constant state of borrowing and reborrowing, giving Dave there small % everytime.”

Dave is a Better Business Bureau (BBB) accredited business and has an “A+” rating. (Read our review “Is BBB a Scam?”)

Regulatory actions

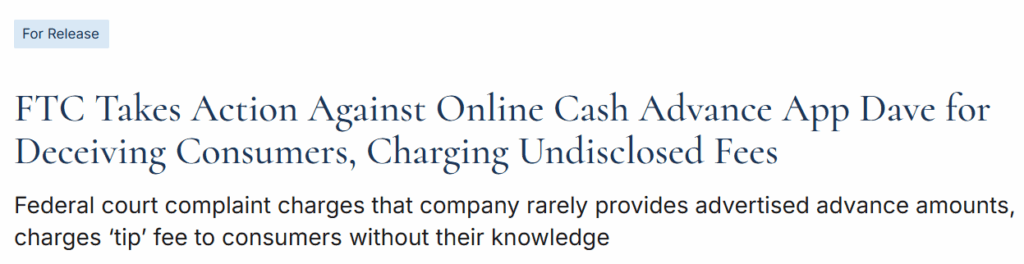

In 2024, the Federal Trade Commission (FTC) published a press release saying it was taking action against Dave.

According to the FTC, Dave used misleading marketing tactics about its cash advances and charged undisclosed fees and “tips” without consumer consent.

The FTC claimed that Dave advertised cash advances of “up to $500” when only a small number of users qualified for such amounts (one consumer reportedly said, “I only was able to get 25.00. Not very helpful.”)

Also, despite advertising “instant” access to advances, Dave requires users to pay an “Express Fee” (which can range from $3 to $25) to get the money instantly, something that users only find out after sharing their bank details. Otherwise, consumers have to wait two to three business days for the advance.

Users also complained about being tricked into paying a “tip” of 15% of the advance and said they were unaware of the $1 monthly “membership fee.”

Security

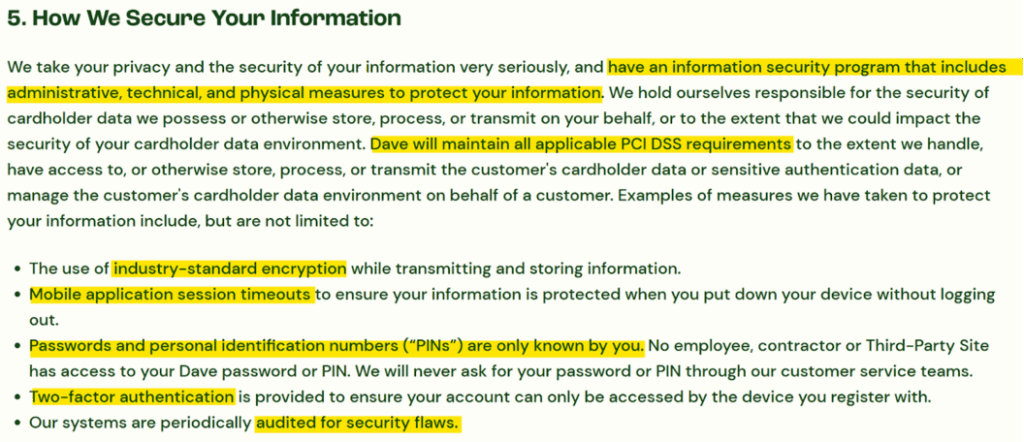

In its privacy policy, Dave explains its security measures.

It says it has “an information security program that includes administrative, technical, and physical measures to protect your information.”

These measures include maintaining all applicable PCI DSS requirements, using industry-standard encryption, mobile app session timeouts, two-factor authentication, and periodic audits for security flaws.

In 2020, Dave experienced a data breach in which 7.5 million Dave users’ data was exposed.

The incident happened as a result of Dave’s former third-party service provider being breached.

Exposed information included names, birth dates, phone numbers, physical addresses, and emails. The information was reportedly auctioned off on a hacking forum.

Following the breach, some Dave users filed a class action lawsuit against the company, saying that it failed to take adequate measures to protect sensitive customer data and promptly notify users.

The incident caused some users to close their Dave accounts.

In 2024, Dave reported another security incident involving its financial technology partner, Evolve Bank & Trust. An unauthorized third party gained access to Evolve’s information environment, potentially impacting Dave users.

Privacy

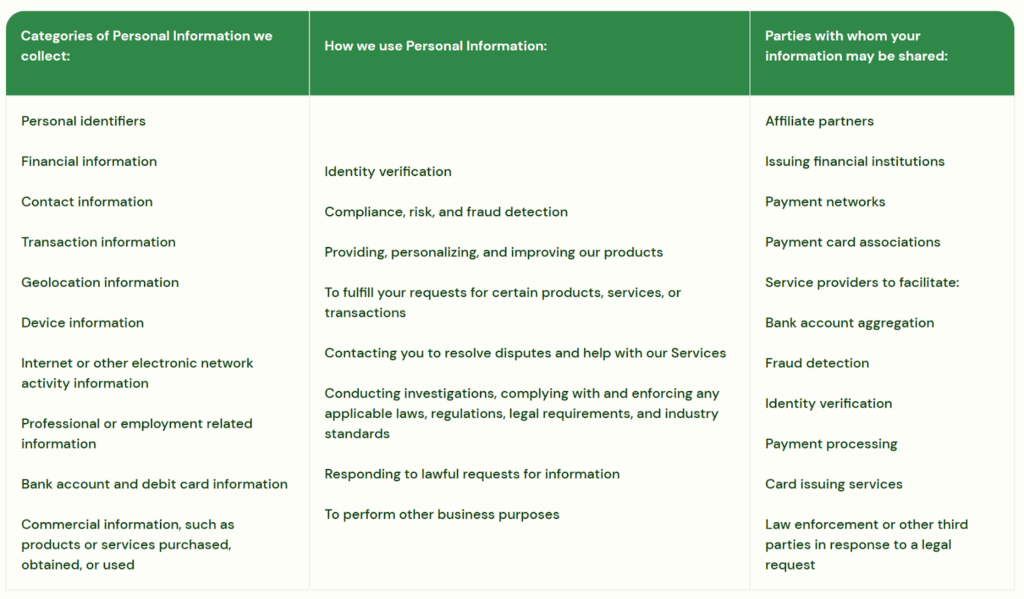

Dave explains the kind of data it collects, why, and with whom it shares it in its privacy policy.

It collects the following personal information:

- Contact information (e.g., name, phone number, email address, and address).

- Sensitive information (e.g., date of birth, Social Security number, and driver’s license number).

- Demographic information (e.g., marital status, citizenship status, and race and gender).

- Biometric information.

- Location information.

- Internet or other network activity information.

- Professional/employment-related information.

- Financial information.

- Commercial information.

- Bank account and debit card information.

It may also collect information about you from third-party services (e.g., usernames, passwords, account numbers, and other account information for internet banking services) and information from cookies and web beacons.

Plus, it may collect technical and navigation information (e.g., computer browser type, pages visited, internet protocol address, and how long you spent on the Dave site) and device data information (such as regional settings and preferences and motion and orientation data).

Dave uses this data to process and verify the transactions you request, prevent fraud, and manage your Dave Card. They also use your data to improve and personalize your experience, communicate important updates (like security alerts or policy changes), respond to your support inquiries, and suggest other Dave products or services they think might benefit you.

It may share your information with service vendors (including merchants and fraud-prevention providers), legal or regulatory authorities as required by law, its bank partners, and other third parties with your consent.

You can access and/or correct the personal information you shared with Dave through the Dave website or by emailing them at support@dave.com.

You can also email Dave if you want to deactivate their services. However, Dave notes that even if you deactivate Dave, it may keep archived copies of your information for a “period of time that is consistent with applicable law.”

So, Should You Use Dave?

Depends on your situation.

If you only need a small, short-term advance now and then, and you’re disciplined about repaying it on your next payday, Dave can be a good option.

However, Dave’s “express” fees, optional (but aggressively solicited) tips, and automatic sweep of every deposit if you can’t cover the full amount on time can trap you in a costly borrowing cycle.

How to Use Dave Safely and Privately

- Only borrow what you need. Treat each advance as short-term, only borrowing an amount you’re sure you can repay on your next payday.

- Repay on time. If your account is short when Dave sweeps, it will take every deposit until your balance is restored.

- Skip the “tip.” When prompted, decline or ignore the optional tip, as this adds directly to your cost.

- Take express fees into consideration. If you really need the money immediately, factor in the “express fee” so you’re not caught off-guard.

- Use a strong, unique password. And don’t reuse it elsewhere.

- Turn on two-factor authentication (2FA). Dave offers 2FA, so make sure you turn it on to make your account more secure.

- Keep an eye on your balance. Set low-balance alerts in your main bank so you know well in advance if Dave’s upcoming sweep might bounce.

- Check transactions regularly. A quick review can help spot any unauthorized charges or misapplied payments right away.

- Give Dave only the necessary permissions. Don’t link any extra third-party apps or data sources beyond what Dave needs to function.

- Revoke connections that are no longer needed. If you stop using a bank or card, unlink it immediately in the app.

- Read Dave’s latest privacy policy. Read Dave’s privacy policy to understand what you’re agreeing to.

- Manage your communications preferences. Opt out of marketing emails or push notifications you don’t need.

- Consider alternative options. For example, local credit unions may offer low-cost short-term loans.

Our privacy advisors:

- Continuously find and remove your sensitive data online

- Stop companies from selling your data – all year long

- Have removed 35M+ records

of personal data from the web

Save 10% on any individual and

family privacy plan

with code: BLOG10

news?

Don’t have the time?

DeleteMe is our premium privacy service that removes you from more than 750 data brokers like Whitepages, Spokeo, BeenVerified, plus many more.

Save 10% on DeleteMe when you use the code BLOG10.