Is Klarna a Scam?

Laura Martisiute

Reading time: 9 minutes

Table of Contents

If you’re thinking of using Klarna, you need to know whether it’s safe. Is Klarna a scam?

Below, we explain whether Klarna is a scam and discuss some steps you can take to improve your safety when using this BNPL service.

What Is Klarna?

Klarna is a fintech company from Sweden that offers a “buy-now, pay-later” (BNPL) service.

When consumers shop with businesses that have Klarna enabled, they can make purchases in installments or defer payment. The business gets payment immediately from Klarna.

Klarna makes money from merchant fees, interest, late charges on financing, and interchange fees.

Is Klarna a Scam?

No, Klarna is not a scam. It’s a legitimate buy-now, pay-later service provider.

It’s been reviewed favorably by several third-party publications.

For example, both NerdWallet and Business Insider rate Klarna 4.5 out of 5.0 stars, noting that the app experience is great but cautioning about fees and highlighting that it may notify the credit bureaus if you miss a payment.

Klarna gets mixed user reviews at the time of writing:

- 4.4 out of 5.0 stars (from 435,656 reviews) on Trustpilot.

- 4.8 out of 5.0 stars (from 1,346,263 reviews) on Google Play.

- 1.05 out of 5.0 stars (from 452 reviews) on Better Business Bureau.

- 1.3 out of 5.0 stars (from 294 reviews) on ProductReview.

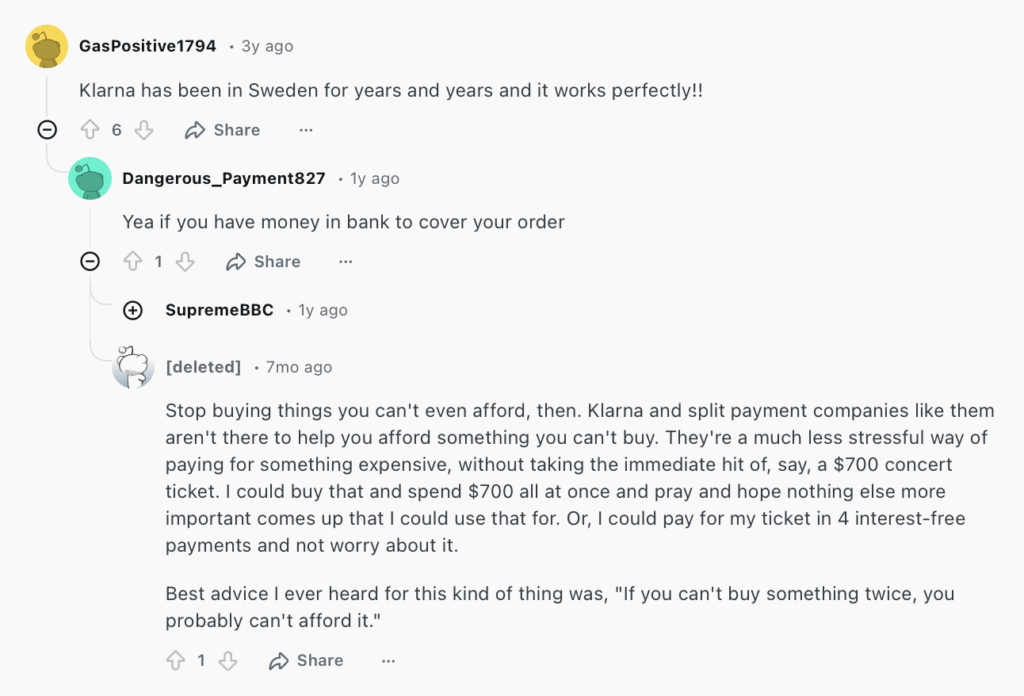

On online forums like Reddit, people generally report positive experiences with Klarna (though there is a general warning against BNPL services, particularly on personal finance subreddits).

People also note that there is a soft credit check with Klarna, which means that although there’s no impact on your credit score, you are effectively consenting to the company receiving your credit report.

Klarna is not Better Business Bureau (BBB) accredited, but holds an “A+” rating. BBB ratings consider user complaints, transparency, and responsiveness to customers.

The company has received 2,652 total complaints on the BBB website in the last three years, 959 of which it closed in the past 12 months.

Common complaints include refunds not being credited properly, dispute handling problems (for example, disputes closed before they’re resolved), and unhelpful customer service.

According to a 2024 media report, one customer’s inability to reach a human representative allegedly led to minor debts being transferred to collections agencies, which subsequently affected the customer’s credit score.

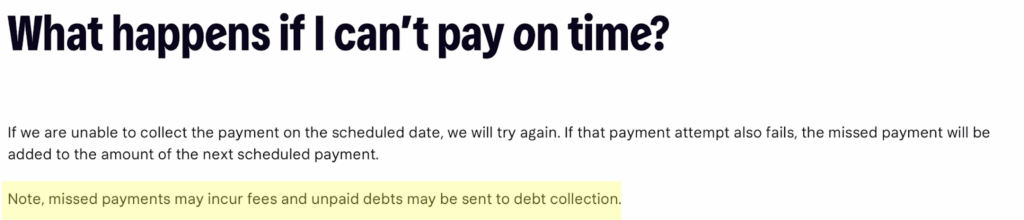

Klarna notes on its website that missed payments may incur fees and that any unpaid debts may be sent off to debt collectors.

Klarna scams

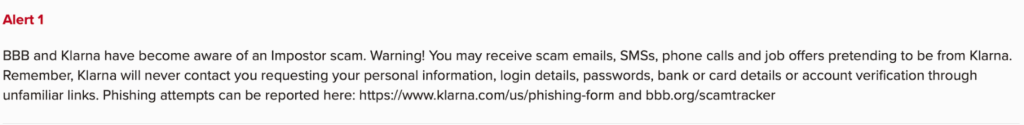

Though Klarna itself is not a scam, it is often impersonated by scammers.

Currently, Klarna has an alert on its Better Business Bureau profile, warning consumers that they may receive scam emails, phone calls, text messages, and job offers that look like they come from Klarna.

Klarna security

Klarna briefly describes its security measures in its privacy policy.

It says it uses “reasonable security measures” to protect your personal data, which include “computer safeguards and encrypted, secured files and buildings.”

It also says it maintains “other physical, technical, administrative, and procedural safeguards.”

The company provides more details about its security on dedicated security and privacy pages.

In 2020, Klarna experienced a security incident during which users could access the personal information (such as address, date of birth, and phone number) of other customers by simply entering an email and postcode on Klarna’s website.

In 2021, the company experienced an incident that reportedly exposed the account information of up to 9,500 Klarna users.

And in 2025, a technical issue where recycled phone numbers weren’t immediately recognized ended up potentially exposing limited personal information (but not card data) for fewer than a few thousand users.

Klarna privacy policy

Klarna explains in its privacy policy the kind of data it collects, why, and with whom it shares it.

It collects the following personal information:

- Personally Identifiable Information (PII): Data that can identify you, such as name, email, phone, address, device IDs, IP address, geolocation, financial information (card numbers and bank account information), and information from third parties (data vendors, consumer reporting agencies, etc.)

- Non-Personally Identifiable Information: Data that doesn’t directly identify you, such as demographic information, general location, usage data, browsing behavior, etc.

If non-PII is linked to PII (e.g., transaction history + name), it’s treated as PII.

Klarna collects this information directly from you, from your use of services, from third parties (e.g., data vendors, consumer reporting agencies, your bank, merchants, payment providers, and marketing and advertising partners), and from support interactions.

The company uses third-party analytics and session recording tools (including mouse movements, clicks, and keystrokes) to understand how you use its services.

It uses your information to provide and run its services and customer support, process transactions and send confirmations, verify identities, prevent fraud, collect payments, resolve disputes, and communicate with you about your account and changes.

Plus, to personalize content and recommendations, publish your reviews, market and advertise Klarna and partner products, and analyze and improve products, services, and marketing. Also, to conduct other legitimate business purposes and analytics.

Klarna may share your information with:

- Service providers.

- Affiliates.

- Consumer reporting agencies.

- Fraud detection companies.

- Collections agencies (as allowed by law).

- Merchants (from which you buy through Klarna).

- Marketing and advertising partners.

- Membership partners.

- Companies involved in mergers/asset sales with Klarna.

- Government and law enforcement.

- Other third parties with your consent or for other legitimate business purposes not prohibited by law.

It won’t share text messaging opt-in data except as needed to run the Klarna marketing text program.

Klarna and third-party vendors also collect and process biometric data (face scans/faceprints), selfies, and government IDs (including barcode data) to verify identity and prevent fraud. Vendors cannot use this data for their own purposes, but may share it with their service providers and as required by law.

There’s also a “Product Specific Information” section that includes relevant information about specific products Klarna offers.

For example, the Auto-Track feature in the Klarna app reads order and delivery information from your email to show delivery details and a purchase overview in the app, and to find promo codes. Klarna shares this data only with a specific service provider to provide or improve the feature, and it is not used for ads.

You have certain privacy choices. For example, you can unsubscribe from marketing emails, opt out of certain analytics, and limit cookies and tracking via browser settings, ad network opt-outs, and mobile OS settings.

Additionally, you can request to know, access, correct, or delete your personal information (subject to legal and policy limits).

Klarna keeps your data as long as needed for business or to meet legal requirements. When no longer needed and no legal retention requirement exists, it says it securely deletes it.

It may keep aggregated/de-identified data indefinitely.

As a financial company, Klarna collects information such as your SSN, payment/transaction history, credit history, credit scores, and account balances.

It says it will continue sharing this data even if you are no longer a customer.

The company shares this data for everyday business purposes, such as transactions, credit reporting, legal, etc. (you cannot limit this sharing), their own marketing (you cannot limit this sharing), and with non-affiliates to market to you (you can limit this through privacy settings in the app or web portal).

It does not share this data for joint marketing, affiliates’ marketing, or affiliates’ credit-worthiness purposes.

Klarna privacy policy evaluations

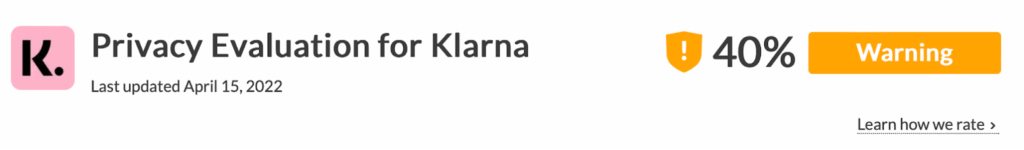

Klarna’s policies, including its privacy policy, were evaluated by The Common Sense Privacy Program, which gave it a “Warning” rating.

This means Klarna’s privacy policy “Does not meet our recommendations for privacy and security practices.”

The Common Sense Privacy Program flags the following:

- The display of personalized ads.

- Third parties collecting data for their own purposes.

- Users’ information used for tracking and targeted ads on other third-party websites or services.

- The creation and use of data profiles for personalized ads.

On the plus side, the program says that Klarna does not share consumers’ personal information for third-party marketing.

Klarna privacy fines

In 2024, Klarna was fined over £570,000 (around $750,000) for violating the EU’s General Data Protection Regulation (GDPR), specifically for not giving users clear information on how it would store, use, and share their personal data.

So, Should You Use Klarna?

Depends.

For consumers who are organised with their finances and know they’ll pay instalments on time, Klarna can be a good option.

Consumers who are prone to forgetting bills, care a lot about privacy, and dislike bot-based customer service may find the risks outweigh the benefits.

How to Use Klarna Safely and Privately

- Protect your account. Make sure your password for your Klarna account is strong and unique. Don’t reuse it on any other accounts.

- Access Klarna through official channels. Always visit Klarna through the official app or website. Don’t click links in emails or texts, as scammers are known to impersonate the service.

- Don’t turn on Auto-Track in the Klarna app. If you turn on Auto-Track, Klarna (and a service provider) scans your emails for your order and delivery data. If you’re not comfortable with this, make sure the feature is turned off. If you do use it, consider creating a separate email address just for shopping.

- Only enable the Klarna extension when you need it. With the Klarna extension enabled, Klarna gets the domains of websites you visit.

- Limit sharing and turn off personalized ads. Klarna shares data with marketing and advertising partners and says some of this counts as “selling” or “sharing” personal information under California law.

- Unsubscribe from promotional emails using the link in the footer. If you get marketing texts, look for a STOP/UNSUBSCRIBE option (or opt out wherever you enrolled).

- Minimize tracking. On your browser, block third-party cookies or use “strict” tracking protection. Clear cookies regularly if you don’t want long-term tracking. On iOS, enable “Limit Ad Tracking” or “Ask Apps Not to Track.” On Android, enable “Opt out of Interest-Based Ads” and periodically reset the advertising ID. You may still see ads, but they should be less targeted.

- Be cautious with biometrics. Only complete ID verification inside the official Klarna app or website, never via links in unexpected emails or texts.

- Be picky about where you use Klarna. Klarna shares data with merchants and payment providers you transact with. To reduce risk, only shop with reputable merchants with clear security and privacy practices.

- Exercise your privacy rights. Depending on where you live, you can request to know, access, correct, or delete your data (subject to legal limits).

Our privacy advisors:

- Continuously find and remove your sensitive data online

- Stop companies from selling your data – all year long

- Have removed 35M+ records

of personal data from the web

Save 10% on any individual and

family privacy plan

with code: BLOG10

news?

Don’t have the time?

DeleteMe is our premium privacy service that removes you from more than 750 data brokers like Whitepages, Spokeo, BeenVerified, plus many more.

Save 10% on DeleteMe when you use the code BLOG10.