Is Lending Club a Scam?

Laura Martisiute

Reading time: 10 minutes

Table of Contents

If you’re thinking of using Lending Club, you need to know if it’s safe. Is Lending Club a scam?

Below, we explain whether Lending Club is a scam and discuss some steps you can take to improve your safety when using this platform.

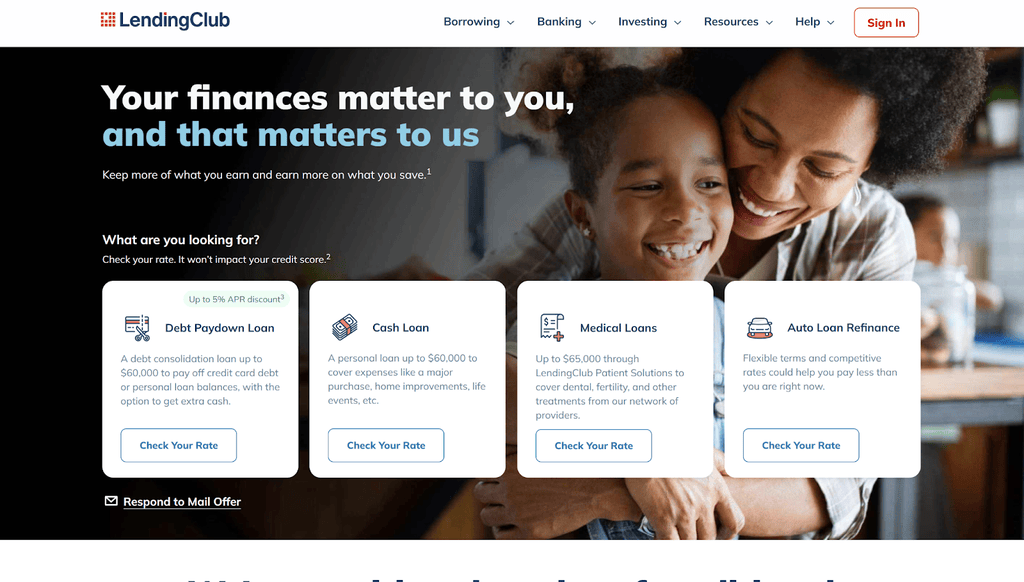

What Is Lending Club?

LendingClub is a financial services company in the US.

It began as one of the first peer-to-peer (P2P) lending platforms, where borrowers could request personal loans. Over time, Lending Club has evolved into a broader digital banking and lending platform, offering checking and savings accounts in addition to loans.

The company was founded in 2006 and went public in 2014.

Is Lending Club a Scam?

No, Lending Club is not a scam. It’s a legitimate financial services company.

Lending Club receives positive reviews from third-party publications and review sites.

For example, Bankrate gave Lending Club a rating of 4.8 out of 5.0 stars.

Looking specifically at loans, NerdWallet gives Lending Club’s personal loans a rating of 5.0 out of 5.0 stars, with the only con mentioned being the origination fee. It concluded: “Though not the lowest-cost lender, LendingClub loans stand out for flexibility, transparency and credit report insights.”

US News Money rates Lending Club personal loans as 4.2 out of 5.0 stars, and Credible Labs rates them 4.3 out of 5.0 stars. Business Insider gave it a lower score of 3.25 out of 5.0 stars, primarily due to multiple types of fees (including origination fees, late fees, and other penalties for late payments) and a high maximum APR.

User reviews of Lending Club are mixed:

- 4.7 out of 5.0 stars (from 4,369 reviews) on Credit Karma (for Lending Club’s personal loans).

- 4.6 out of 5.0 stars (from 7,306 reviews) on Trustpilot.

- 4.6 out of 5.0 stars (from 4,025 reviews) on WalletHub.

- 4.23 out of 5.0 stars (from 948 reviews) on Better Business Bureau.

- 1.9 out of 5.0 stars (from 281 reviews) on PissedConsumer.

- 1.7 out of 5.0 stars (from 412) reviews on ConsumerAffairs.

When it comes to personal loans, people praise Lending Club’s smooth process, fast loan funding, and clear communication.

On the other hand, common complaints include inefficient and frustrating customer service (including inconsistent information from different reps), problems retrieving refunds or overpayment credits, and high interest rates.

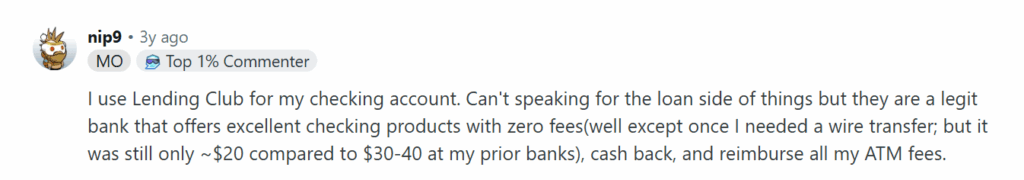

On online forums like Reddit, people report mixed experiences with Lending Club.

One person said they use Lending Club for their checking account, and are happy with the experience:

“They are a legit bank that offers excellent checking products with zero fees(well except once I needed a wire transfer; but it was still only ~$20 compared to $30-40 at my prior banks), cash back, and reimburse all my ATM fees.”

Another user stated that the terms were transparent, customer service was decent, and early repayment incurred no penalties.

Several people reported high upfront fees and interest rates.

Lending Club is Better Business Bureau (BBB) approved and has an “A+” rating on the BBB website. The company has received a total of 1,180 complaints over the last three years on the BBB website, with 400 of these complaints closed within the past 12 months. (See our review of whether the BBB is a scam).

Lending Club scams

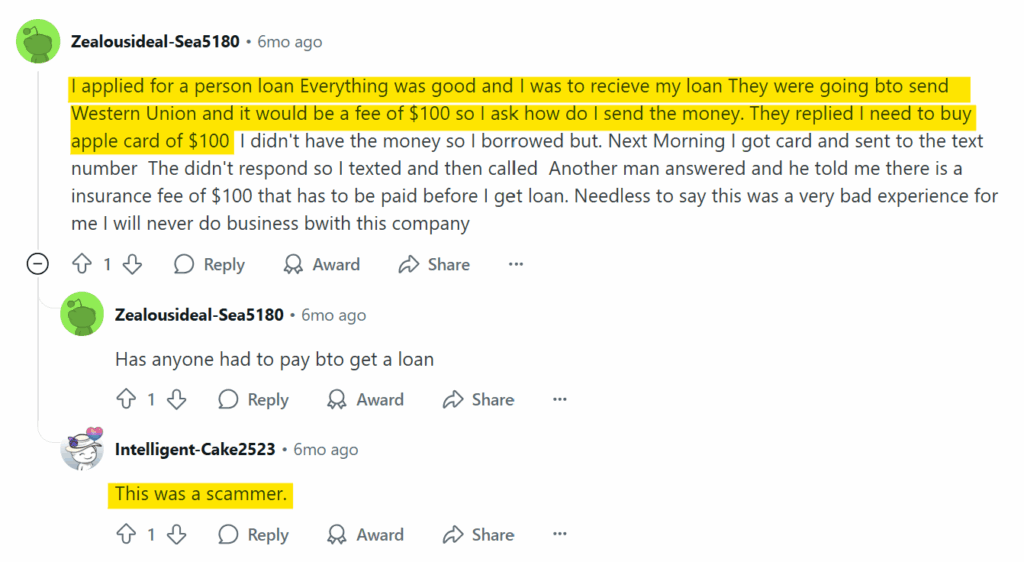

Scammers love to imitate Lending Club to trick unsuspecting users.

They contact individuals claiming to be LendingClub representatives, offering loans and instructing victims to pay “advance fees” or to purchase gift cards and then send barcodes or photos as “proof” or for “credit building.”

On internet forums such as Reddit, multiple people complain about being scammed by the company, when, in fact, they were scammed by criminals. Other commenters clarified that these are scammers impersonating Lending Club, not the actual company.

Lending Club warns about these scams (known as “advance-fee loan scams”) on its website.

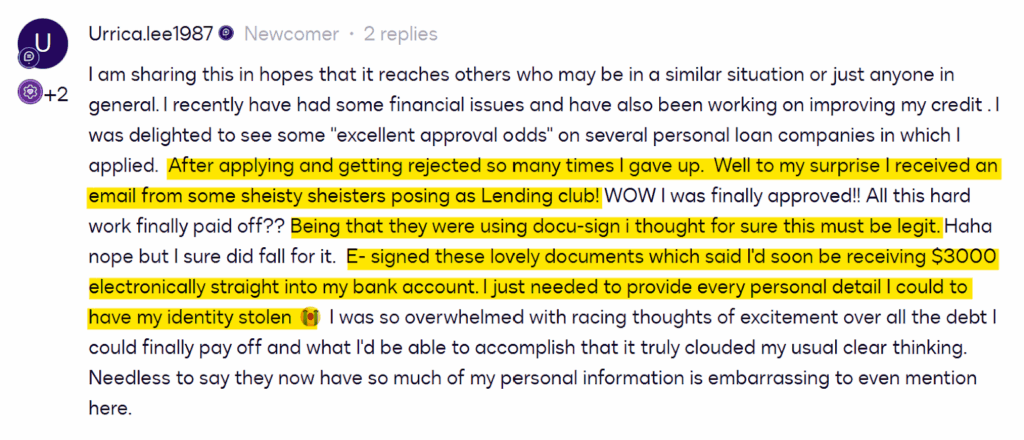

In another common Lending Club scam example, a person was scammed by fraudsters posing as Lending Club, who tricked them into e-signing fake loan documents via DocuSign and providing sensitive personal information, believing they were approved for a $3,000 loan.

Overwhelmed by financial stress and excitement, they unknowingly handed over “every personal detail I could to have my identity stolen.”

Lending Club regulatory actions and lawsuits

In 2018, the Federal Trade Commission (FTC) sued LendingClub, alleging that the company made deceptive claims about “no hidden fees” while actually charging undisclosed origination fees and misleading borrowers about loan approvals and terms.

The FTC also alleged that Lending Club misled applicants about loan approvals, improperly withdrew double payments, continued charging after cancellations or payoffs, caused overdraft fees, and failed to obtain required consent for sharing consumer information.

LendingClub agreed to pay $18 million to settle these charges. In 2025, the FTC announced it was returning over $9.7 million to affected consumers.

Lending Club SEC and DOJ investigations

In 2018, the US Securities and Exchange Commission (SEC) charged LendingClub Asset Management and former executives with fraud and breach of fiduciary duty for using client funds to benefit LendingClub’s parent company and for improperly adjusting fund returns.

LendingClub agreed to pay millions in penalties, with the company’s former CEO barred from the securities industry for three years.

The Department of Justice (DOJ) also concluded its investigations with penalties for LendingClub regarding misrepresentations to boost loan volumes.

Lending Club security

LendingClub Bank is an FDIC-insured institution that operates under federal consumer lending laws, including the Truth in Lending Act, the Equal Credit Opportunity Act, and the Fair Credit Reporting Act.

In its privacy policy, Lending Club mentions its security practices.

It says it takes “a defensive, in-depth approach to implementing physical, administrative, and technical safeguards” to protect your information.

These safeguards include physical safeguards (such as video monitoring systems and access badges), administrative safeguards (such as employee security training programs and employment background checks), and technical safeguards (such as encryption and perimeter security).

The company also utilizes encryption, website certificates, and session timeouts, and has an identity theft prevention and response program.

It periodically reviews and adjusts its security safeguards.

In case of a breach, Lending Club will “take reasonable steps to investigate the situation and, where appropriate, communicate with affected individuals.”

In 2023, LendingClub reported a security incident involving Darling Consulting Group, a data analysis services provider. Criminals exploited a vulnerability in the vendor’s file transfer system and accessed documents containing personal information of Lending Club customers, including names, addresses, Social Security numbers, and loan numbers.

Lending Club privacy

Lending Club describes what data it collects, for what purposes, and with whom it shares it in its privacy policy.

It collects the following information:

- Identifiers: Name, alias, postal address, phone number, SSN, IDs, IP, and device IDs.

- Financial data: Payment and bank information, credit card number, credit reports/scores, income, and transactions.

- Commercial data: Purchases, property used as collateral, and utilities/rewards information.

- Business information: For business accounts/practices (licenses, EIN, and banking).

- Network/location: Browsing, app usage, geolocation, and device data.

- Audio/visual/electronic data: ID images, signatures, and call/chat/session recordings.

- Employment/education: Employer, job details, and work contact information.

- Other sensitive information: Insurance and medical/education-related transaction details.

- Inferences: Preferences, habits, and characteristics.

The company can use this data to run and improve services, verify identities, and process applications, payments, and transfers. It also uses it to determine creditworthiness, manage service accounts, prevent fraud/security breaches, comply with laws, and market/advertise (including cross-device). Additionally, for analytics and research, as well as securitizations and loan sales.

Lending Club may share this information with originating banks/credit unions, providers of financial services, Lending Club companies, third-party service providers, other third parties (at your request or as part of a transaction you initiated), purchasers, prospective purchasers, credit bureaus, parties to a company transaction (e.g., merger), and legally interested parties (as required by law or subpoena).

It may also share your information with others in an aggregated/de-identified/anonymized form.

You can limit the sharing of your personal information for joint marketing with other financial companies, Lending Club’s affiliates’ everyday business purposes (information about your creditworthiness), and Lending Club’s affiliates to market to you.

Lending Club does not share your personal information with nonaffiliates to market to you.

The company can begin sharing new customers’ information 30 days after it sends you its privacy policy. It continues to share your information even after you are no longer a customer, although you can contact them and request that they limit this sharing.

Lending Club retains data as required by law (typically for at least 7 years for financial/transactional records) and for business purposes. Data may be stored/processed in the U.S. (and elsewhere).

It uses cookies, pixels, session replay, analytics, cross-device linking, and social media widgets for personalization, measurement, and ads.

You can edit your account information, opt out of third-party sharing, and unsubscribe from email communications.

Depending on where you reside, you may have additional privacy rights. For example, if you live in California, you can request to see the categories of personal information that Lending Club has disclosed to third parties for direct marketing.

So, Should You Use Lending Club?

Depends.

If you want a fast personal loan with relatively flexible terms and are okay with paying origination fees and sharing personal data, then Lending Club can be a good option.

If you’re looking for the lowest rates or maximum privacy and are uncomfortable with Lending Club’s past lawsuits, then you may want to consider alternatives.

How to Use Lending Club Safely and Privately

- Verify you’re on the actual Lending Club site/are speaking to Lending Club officials. Fraudsters love to impersonate Lending Club. Avoid links in emails, texts, or social media ads unless you’re sure they come from LendingClub.

- Avoid “advance-fee loan” scams. Anyone claiming to be from LendingClub who asks for gift cards, wire transfers, or upfront payments is a massive red flag. LendingClub never charges fees before loan disbursement. Origination fees are deducted after approval.

- Compare rates. Compare LendingClub’s rates with alternatives to make sure you’re getting a fair APR.

- Protect your personal information. Never give your Social Security number, banking info, or ID scans over phone calls, texts, or emails.

- Turn on two-factor authentication. Lending Club offers two-factor authentication as an additional safety feature for your account, so be sure to enable it.

- Read the fine print carefully. Understand the origination fee. Review the APR range and calculate the total cost of the loan. Check for any late payment penalties or prepayment policies.

- Opt out of data sharing and marketing. LendingClub shares your data with affiliates and marketing partners by default, but you can opt out by contacting them.

- Use a privacy-friendly browser setup. Since LendingClub uses tracking pixels and cross-device linking, consider using a privacy-focused browser and blocking third-party cookies and trackers.

Our privacy advisors:

- Continuously find and remove your sensitive data online

- Stop companies from selling your data – all year long

- Have removed 35M+ records

of personal data from the web

Save 10% on any individual and

family privacy plan

with code: BLOG10

news?

Don’t have the time?

DeleteMe is our premium privacy service that removes you from more than 750 data brokers like Whitepages, Spokeo, BeenVerified, plus many more.

Save 10% on DeleteMe when you use the code BLOG10.