Is Lending Tree a Scam?

Laura Martisiute

Reading time: 8 minutes

Table of Contents

If you’re thinking of using Lending Tree, you need to know if it’s safe. Is Lending Tree a scam?

Below, we explain whether Lending Tree is a scam and discuss some steps you can take to improve your safety when using this platform.

What Is Lending Tree?

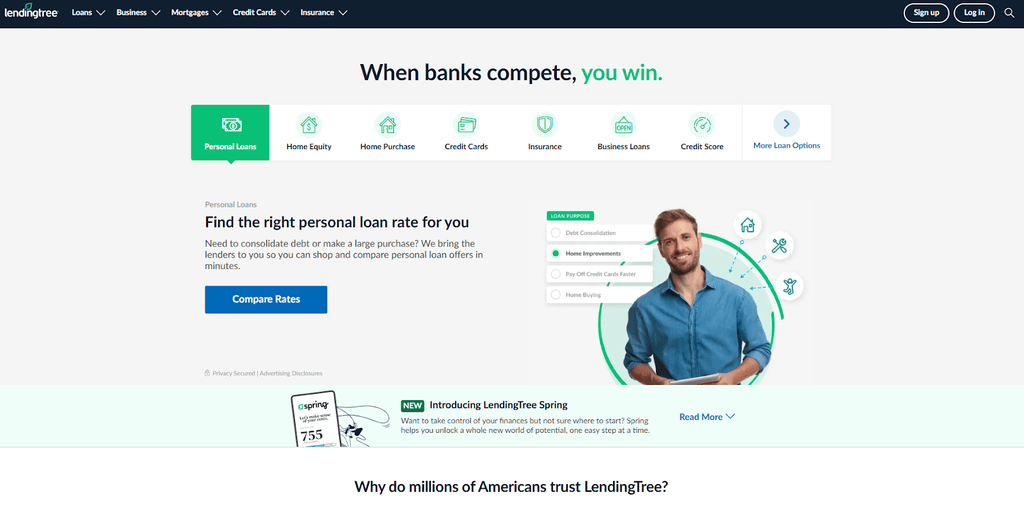

LendingTree is an online marketplace that connects consumers with lenders, financial institutions, and other service providers.

The marketplace doesn’t lend money directly. Rather, it’s an intermediary that lets people compare offers for different financial products and services. It operates on a lead generation model, where lenders and other companies pay for customer leads.

Is Lending Tree a Scam?

No, Lending Tree is not a scam. It’s a legitimate online loan marketplace.

Several third-party publications and review sites have reviewed Lending Tree.

These include Business Insider, which gave Lending Tree a rating of 3.75 out of 5.0 stars, and LendEDU, which scored Lending Tree as 4.5 out of 5.0 stars. U.S. News rated Lending Tree as 4.0 out of 5.0 stars.

Money.com does not give Lending Tree a rating, but it does list the platform’s pros (ability to compare multiple quotes at the same time, 1,500+ partnered lenders in the network, and credit monitoring tools) and cons (limited contact options, customer support not addressing issues with the lender of your choice, and not actually servicing loans).

Users’ reviews of Lending Tree are mostly negative:

- 1.0 out of 5.0 stars (from 1,900 reviews) on WalletHub.

- 1.0 out of 5.0 stars (from 104 reviews) on Better Business Bureau.

- 1.6 out of 5.0 stars (from 1,570 reviews) on ConsumerAffairs.

- 4.2 out of 5.0 stars (from 9,427 reviews) on Google Play.

- 1.1 out of 5.0 stars (from 32 reviews) on Yelp.

Many reviews are from people who were surprised to learn LendingTree doesn’t actually provide loans but instead shares user information with multiple lenders.

A significant number of reviewers mention being bombarded with phone calls, texts, and emails almost immediately after submitting their information to Lending Tree. Some described dozens of calls per day, even weeks later.

Attempts to unsubscribe or stop the calls reportedly often fail, with users reporting that “STOP” texts don’t work or that removal requests are ignored.

On online forums like Reddit, people report similar experiences (i.e., a barrage of calls).

However, as one person noted, using Lending Tree is like applying at many banks at once, so it’s expected that all those lenders will follow up with you.

Lending Tree is Better Business Bureau accredited and has an “A+” rating. The company has received 189 total complaints in the last three years, 53 of which have been closed in the past 12 months.

Lending Tree terms of use

Before using any service, it’s a good idea to read the terms of use in full.

Here are some noteworthy points from Lending Tree’s terms of use:

- Submitting a “Qualification Form” = request to be matched with Providers.

- Filling out the form doesn’t guarantee that you’ll receive any loan offers or be approved for credit.

- Providers, not LendingTree, decide approval terms, fees, and rates.

- Submitting the form may result in a soft credit inquiry (which will not affect your credit score).

- If you ask LendingTree about one type of financial product (like a personal loan), they can also share your information and connect you with companies offering similar or alternative products (like a home equity loan or debt relief) if they think those might fit your needs.

- Lending Tree is paid marketing fees by Providers, and this may affect how offers are displayed on the Lending Tree website.

- Lending Tree doesn’t include all lenders or insurers in the marketplace, so comparisons aren’t comprehensive.

- Lending Tree chatbot is AI-powered and may give inaccurate or unreliable responses.

Lending Tree security

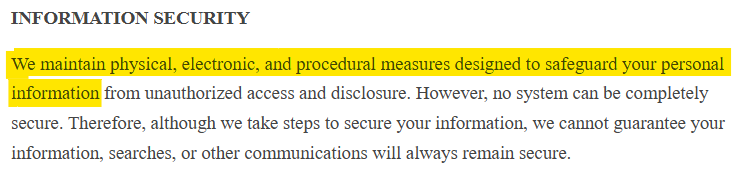

In its privacy policy, Lending Tree briefly mentions its security controls. It says it maintains “physical, electronic, and procedural measures.”

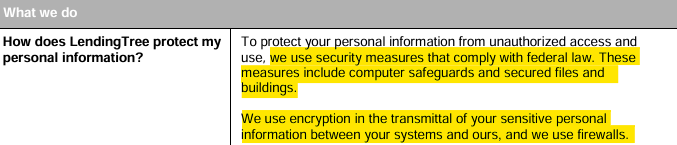

It goes into more detail in its Financial Privacy Disclosure, where it says that it uses “computer safeguards and secured files and buildings,” as well as “encryption in the transmittal of your sensitive personal information between your systems and ours, and we use firewalls.”

And even in more detail on its security policy page. For example, Lending Tree has a vulnerability form that security researchers can use to share the details of any vulnerabilities they find in any Lending Tree asset.

Over the years, Lending Tree has had several data breaches.

In 2022, LendingTree experienced a data security incident where a code vulnerability led to the potential unauthorized disclosure of personal information to an unauthorized third party. This also led to a class-action settlement.

Two years later, in 2024, LendingTree’s subsidiary, QuoteWizard, was impacted by a widespread cybersecurity incident involving the cloud data analytics company Snowflake.

Hackers reportedly gained unauthorized access to the personal information of millions of consumers that was stored on Snowflake’s cloud servers. The compromised data included names, addresses, phone numbers, dates of birth, driver’s license numbers, Social Security numbers, and financial information.

This led to a proposed class-action lawsuit against LendingTree and QuoteWizard, alleging negligence in their data security practices.

Lending Tree privacy

Lending Tree explains the kind of data it collects, for what purposes, and with whom it shares it in its privacy policy.

It collects the following information:

- Directly from you: Contact info, SSN, DOB, account details, communications, preferences, and chatbot interactions.

- Automatically: Device data, IP address, location, browsing behavior, site recordings, cookies, pixels, and analytics.

- From third parties: Credit bureaus, service providers, social media, and partners.

Lending Tree may combine information from all of the above sources.

It uses this information to provide and operate services, communicate with you (administrative, transactional, and marketing communications), and personalize services and ads (interest-based advertising).

The company also uses your data for analytics, research, and service improvement as well as for fraud prevention, security, and legal compliance. Plus, for business operations, sales, or transactions.

Lending Tree may share your details with affiliates/subsidiaries (within LendingTree’s family), network Partners (i.e., lenders and financial institutions who may keep and use your info under their own privacy policies), financial companies/business partners (for joint marketing and services), service providers, analytics/marketing partners (including Google, Meta, TikTok, etc.), government/public authorities (as required by law), in business transactions (i.e., mergers, acquisitions, bankruptcy, etc.), and with other Parties (for legal compliance, fraud prevention, or protection).

In other words, when you submit a loan request, Lending Tree may share your personal information with multiple lenders/partners. Once shared, those lenders may keep and use your data under their own privacy policies, not LendingTree’s. You lose control once the data leaves LendingTree.

To stop a Provider from contacting you, you must contact them directly.

De-identified data may also be shared.

The company retains personal information as long as needed for services, legal requirements, or business purposes.

You can opt out of marketing communications from Lending Tree via your Lending Tree profile.

Depending on where you live and how you’ve engaged with Lending Tree, you may also be able to request access to or correction of personal information. However, Lending Tree says that it may keep information even after requests for deletion (due to compliance/retention laws).

The company notes that it serves you interest-based ads across the internet.

So, Should You Use Lending Tree?

Depends.

If you want convenience and don’t mind lots of follow-up calls/emails, LendingTree can be useful for comparing offers quickly.

On the other hand, if you value privacy or don’t want your information widely shared, you may be better off comparing rates directly with trusted lenders.

How to Use Lending Tree Safely and Privately

- Compare rates directly. Before you use Lending Tree, consider comparing rates directly through lender websites.

- Create a separate email and phone number. Use a dedicated email just for loan shopping and a free VoIP number for lender calls/texts. This way, your personal inbox/phone won’t get spammed.

- Know what you’re signing up for. LendingTree isn’t a lender. It’s an intermediary that shares your information with multiple lenders. Expect follow-ups. Dozens of calls/texts/emails are common.

- Be selective on forms. Don’t share more information than necessary until you’re serious about an offer.

- Watch for “upsells”. LendingTree can share your information with companies offering other (similar) products (debt relief, home equity, insurance, etc.). Stick to what you’re actually shopping for.

- Take screenshots/notes. Save loan offers in writing so you can compare terms later.

- Opt-out where possible. Adjust marketing preferences in your LendingTree profile. Contact lenders directly and request removal from their lists.

- Monitor your credit and identity. Place a fraud alert or credit freeze if you’re concerned about breaches.

Our privacy advisors:

- Continuously find and remove your sensitive data online

- Stop companies from selling your data – all year long

- Have removed 35M+ records

of personal data from the web

Save 10% on any individual and

family privacy plan

with code: BLOG10

news?

Don’t have the time?

DeleteMe is our premium privacy service that removes you from more than 750 data brokers like Whitepages, Spokeo, BeenVerified, plus many more.

Save 10% on DeleteMe when you use the code BLOG10.