Is MoneyLion a Scam?

Laura Martisiute

Reading time: 7 minutes

Table of Contents

If you’re thinking of using MoneyLion, you need to know: Is MoneyLion a scam?

Below, we explain whether Moneylion is a scam and discuss some steps you can take to improve your safety when using this financial marketplace.

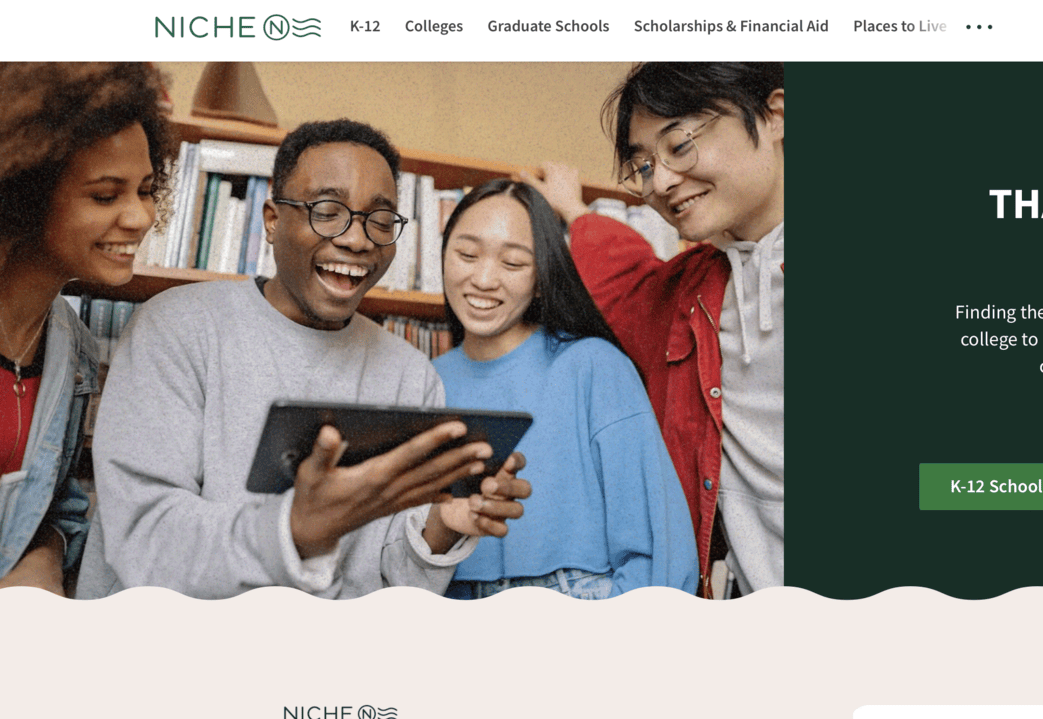

What Is MoneyLion?

MoneyLion is a financial marketplace that connects you to lenders, banks, credit card issuers, and other financial institutions (“Marketplace Partners”).

MoneyLion was launched in 2013 and is based in the US.

Is MoneyLion a Scam?

No, MoneyLion is not a scam. It’s a legitimate online lending tool. However, for many people, it may not be the best option.

MoneyLion has been reviewed by third-party publications, such as US News, which gave it a rating of 4.1 out of 5.0 stars, and Business Insider, which rated it as 3.8 out of 5.0 stars. The College Investor rated MoneyLion as 3.5 out of 5.0 stars.

As for MoneyLion’s specific products, LendingTree scored MoneyLion’s Credit Builder loans as 3.6 out of 5.0, with the following conclusion:

“MoneyLion’s Credit Builder Plus loans can help you build your credit, but monthly membership fees and interest charges make these loans expensive.”

LendEDU scored MoneyLion’s Credit Builder loans similarly, at 3.8 out of 5.0 stars.

NerdWallet gave MoneyLion’s Instacash a rating of 3.5 out of 5.0 stars. It also said the following:

“MoneyLion can deliver a large cash advance with no fees, but funding time may be slow for some users.”

MoneyLion gets mixed reviews from users:

- 4.4 out of 5.0 stars (from 2,670 reviews) on WalletHub.

- 3.8 out of 5.0 stars (from 27,809 reviews) on Trustpilot.

- 4.05 out of 5.0 stars (from 864 reviews) on Better Business Bureau.

- 4.8 out of 5.0 stars (from 248,026 reviews) on the App Store.

- 4.7 out of 5.0 stars (from 182,913 reviews) on Google Play.

On internet forums like Reddit, people report very mixed experiences with MoneyLion.

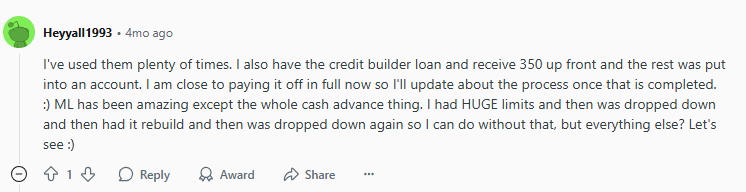

For example, one person said they got $350 upfront from a MoneyLion Credit Builder Loan with the rest locked until payoff, and while they like the service overall, they’re frustrated that their Instacash (cash advance) limits keep going up and down unpredictably.

On the other hand, another person warned that cancelling MoneyLion is difficult, noting that the service got worse with higher fees and poor customer support (no more live chat, only tickets and phone) by the time they finished their Credit Builder Loan.

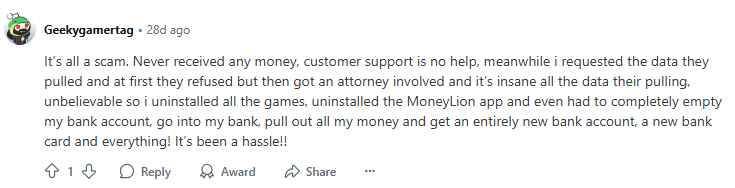

Regarding using MoneyLion for earning money through games, while some people reported positive experiences, others said they never received the money, and customer support was unhelpful.

MoneyLion is not Better Business Bureau (BBB) accredited. It has received 1,198 complaints in the last three years, 320 of which have been resolved in the past 12 months. (Read our review “Is BBB a Scam?”)

The company has two alerts on the BBB website.

The BBB reports a long‑standing pattern of complaints against MoneyLion for frozen accounts, payment errors, delayed fund access, and poor customer service.

Separately, the CFPB has sued MoneyLion (case pending), alleging it violated the Military Lending Act by charging servicemembers more than the 36% APR cap and trapping them in costly, non‑cancelable membership programs.

In 2025, New York Attorney General Letitia James sued MoneyLion and DailyPay for allegedly predatory payday‑style lending.

Security

We couldn’t find much information on MoneyLion’s security measures.

In its privacy policy, MoneyLion says it maintains “commercially reasonable administrative, technical and physical safeguards (which vary depending on the sensitivity of the Personal Information).”

It also has a bug bounty program which is a good sign.

Privacy

MoneyLion explains the kind of data it collects, for what purposes, and with whom it shares it in its privacy policy.

It collects the following information:

- Contact and demographic information, such as your name, address, phone number, date of birth, Social Security number, sex, marital status, age, citizenship, driver’s license number, passport number, and veteran or military status.

- Professional or employment information, such as education levels and degrees, graduation dates, institutions attended, income, employment status, and pay frequency.

- Financial information, such as credit score, credit data status, credit, payment and bankruptcy histories, and the type and amount of outstanding loans.

- Residence and homeownership information, such as whether you rent or own a home, and the amount of your mortgage payments.

- Auto loan information, such as estimated mileage, vehicle identification number, and monthly payment information.

- Commercial information, such as purchase information.

- Health-related information on a self-reported basis.

- Criminal history information on a self-reported basis.

- Support information, such as electronic information collected when you email or call customer service.

- Survey information if you complete surveys.

- Sensitive personal information, including that of a co-applicant, if you apply for a loan or a financial product/service with one.

- Device and usage data, such as IP address, device IDs, location data, browsing history, and interactions with the site.

- Inferences from other sources of information or data about you.

MoneyLion uses this information to provide services as well as for advertising, personalization, analytics, improvement, compliance, security, and marketing.

It may share your data with related companies, marketplace partners, channel partners, service providers, consumer reporting agencies, law enforcement agencies, regulators, and in corporate transactions.

The company keeps your data for as long as necessary for business, legal, and compliance purposes. When it is no longer required to keep your data, it will destroy, erase, or de-identify it.

According to MoneyLion’s terms of service, by providing a phone number, you consent to calls and texts (including marketing and automated messages) from MoneyLion and affiliates.

You can opt out, but they warn you may miss “important information regarding your account” if you do.

By using the service, you agree that MoneyLion can:

- Share your personal information (including data for credit checks) with financial providers.

- Retain your data indefinitely, even if you stop using the service.

It can also use your feedback and “User Content” for marketing without compensation.

Note that the company can also suspend or terminate your access at any time, without notice, even if you’ve done nothing wrong.

Depending on where you live, you may be able to exercise privacy rights like the right to delete your data, correct inaccurate information, and withdraw consent for data use.

MoneyLion’s website does not honor “Do Not Track” signals.

So, Should You Use MoneyLion?

MoneyLion’s products can be costly and hard to cancel, with major privacy trade-offs. Their ongoing lawsuits and BBB complaint patterns suggest systemic issues.

How to Use MoneyLion Safely and Privately

- Start small. If using a Credit Builder loan, borrow the minimum amount so you limit fees.

- Budget for payments. Make sure you can afford the monthly membership fee and loan payments to avoid overdrafts.

- Avoid relying on Instacash. Treat cash advances as an emergency-only tool. Taking frequent advances can lead to a debt cycle.

- Don’t expect full loan amounts. Many users only get a portion of the loan upfront. The rest is locked in a “credit reserve” until payoff.

- Set up payment alerts. Link the account to a bank with real-time transaction alerts so you’ll know if MoneyLion charges unexpectedly.

- Limit what you share. Only provide the required information. Avoid giving optional data.

- Use a dedicated email. Create a separate email for MoneyLion to filter marketing spam and reduce exposure if they share your information.

- Opt out of marketing texts and calls. Reply STOP to texts and email MoneyLion to limit promotional contact.

- Review app permissions. On your phone, turn off unnecessary permissions (location tracking, contacts, etc.) in settings.

- Don’t connect your main bank account. If possible, use a secondary checking account with just enough balance for payments, not your primary account.

- Document everything. Take screenshots of loan terms, repayment schedules, and support communications.

- Check your credit report. Verify that MoneyLion is reporting your payments correctly.

- Be ready to escalate support. If you encounter an issue, skip automated chatbots and request a supervisor immediately. If ignored, file a BBB complaint.

- Pay off loans early if possible. This reduces fees and gets your “credit reserve” money released faster.

- Cancel as soon as the loan is done. Membership fees can pile up, so cancel promptly after payoff (document your cancellation).

- Unlink bank information. After cancellation, remove your banking information from the app (and confirm via email) to prevent future charges.

- Monitor your account for months afterward. Some users report being charged even after cancellation.

Our privacy advisors:

- Continuously find and remove your sensitive data online

- Stop companies from selling your data – all year long

- Have removed 35M+ records

of personal data from the web

Save 10% on any individual and

family privacy plan

with code: BLOG10

news?

Don’t have the time?

DeleteMe is our premium privacy service that removes you from more than 750 data brokers like Whitepages, Spokeo, BeenVerified, plus many more.

Save 10% on DeleteMe when you use the code BLOG10.