Is Nelnet a Scam?

Laura Martisiute

Reading time: 7 minutes

Table of Contents

If you’re thinking of using Nelnet, you need to know if it’s safe. Is Nelnet a scam?

Below, we explain whether Nelnet is a scam and discuss some steps you can take to improve your safety when using this service.

What Is Nelnet?

Nelnet stands for National Education Loan Network.

It’s a US-based financial services company primarily known for student loan servicing.

Nelnet is one of the companies contracted by the US Department of Education to manage federal student loans, although it also services private student loans.

The company also provides payment processing solutions to educational organizations and businesses.

Is Nelnet a Scam?

No, Nelnet is not a scam. It’s a legitimate, publicly traded financial services company with a mixed reputation (strong editorial reviews for private loans, but many borrower complaints about servicing).

Nelnet is reviewed favorably by third-party publications for its private student loans (not its servicing experience).

For example, Bankrate gives Nelnet a rating of 4.0 out of 5.0, saying, “It has low rates compared to other lenders on the market and has loan amounts from $1,000 to $500,000, depending on your degree and program.”

U.S. News scores Nelnet even higher (4.6 out of 5.0 stars).

However, user reviews of Nelnet’s servicing experience are mostly low:

- 1.4 out of 5.0 stars (from 41 reviews) on Trustpilot.

- 1.3 out of 5.0 stars (from 340 reviews) on Yelp.

- 2.6 out of 5.0 stars (from 528 reviews) on WalletHub.

- 1.06 out of 5.0 stars (from 263 reviews) on Better Business Bureau.

On internet forums like Reddit, people report negative experiences with Nelnet.

Users complain about Nelnet’s confusing website and bad customer service. Several people reported mismatched balances, missing payments, and unexpected forbearances. Others said that Nelnet mishandled extra payments, making it difficult to target specific loans.

In 2024, a proposed class action lawsuit alleged that Nelnet repeatedly miscalculated student loan borrowers’ monthly repayment amounts and reported these inflated amounts to credit reporting agencies.

A previous class action suit alleged that Nelnet mishandled income-based student loan repayment plans by failing to process applications and adjustments properly, causing borrowers to incur additional debt.

A 2024 settlement required Nelnet to pay $1.8 million and improve its practices after the Massachusetts Attorney General found the company violated consumer protection laws by failing to properly notify borrowers about renewing Income-Driven Repayment (IDR) plans between 2013 and 2017.

Nelnet is a Better Business Bureau (BBB) accredited company and holds an “A+” rating. It has received a total of 1,169 complaints on the BBB website over the last three years, with 284 of these complaints closed within the past 12 months (as of the time of writing). (See our review of whether the BBB is a scam).

Security

In its privacy policy, Nelnet briefly describes its security measures.

It says it uses “security measures that comply with federal law,” including “computer safeguards and secured files and buildings.”

In 2022, Nelnet experienced a data breach that compromised the names, addresses, phone numbers, email addresses, and Social Security numbers of about 2.5 million borrowers connected to EdFinancial and the Oklahoma Student Loan Authority (OSLA).

Nelnet responded by offering free credit monitoring and identity theft protection for 24 months to those affected.

Multiple class action lawsuits claiming negligence on the part of Nelnet followed.

Privacy

Nelnet describes the kind of data it collects, for what purposes, and with whom it shares it in its privacy policies.

The company has a separate policy for its website and apps, as well as for borrowers who have loans owned by Nelnet’s affiliated subsidiaries.

Financial data policy

According to its financial data policy (for borrowers), Nelnet collects personal information, which may include:

- Identifiers: Social Security number and checking account information.

- Financial details: Account balances, transactions, payment history, and credit history.

- Contact and account-related data.

The company also collects data from third-party sources, including credit bureaus, affiliates, and other companies.

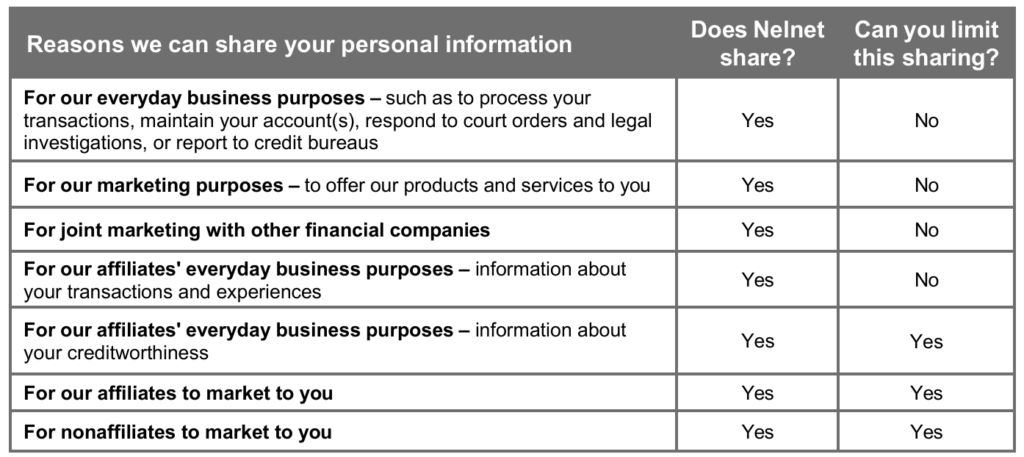

Nelnet may share your information for everyday business purposes (such as processing transactions and reporting to credit bureaus), marketing its own products and services, and running joint marketing campaigns with other financial companies.

It may also share it for affiliates’ everyday business purposes (such as transactions and creditworthiness), affiliates’ marketing to you, and non-affiliates’ marketing to you.

You can limit Nelnet from sharing your creditworthiness information with affiliates, affiliates using your information to market to you, and Nelnet sharing your information with non-affiliates for marketing purposes.

Depending on where you reside, you may have extra privacy protections. For example, if you’re a Vermont resident, Nelnet will not share the information it collects about you with non-affiliates except as permitted by law (for example, with your consent or to service your account).

Nelnet can start sharing new customers’ information 30 days after sending the notice. Even if you stop being a Nelnet customer, the company continues sharing your data unless you opt out.

Online data policy

According to Nelnet’s online data policy (web privacy policy), the company collects the following information:

- Information you directly provide, such as name, date of birth, email address, phone number, payment card information, bank information, government-issued identifiers, uploaded documents, and chat messages.

- Information Nelnet collects automatically, including IP addresses, browser details, device IDs, cookies, and clickstream data.

It uses this information to manage your account, process payments, personalize your experience on the site, and for analytics, fraud prevention, and site optimization.

Nelnet may share your data with affiliates and third-party service providers. It may also disclose it if required to do so by law. Plus, if Nelnet is sold, merged, restructured, or acquired, your information may be transferred to the new company.

The company states that your phone number and text opt-in data will not be sold or shared for marketing purposes. It will only be used to provide the messaging services you requested.

The website does not honor “Do Not Track” browser signals.

So, Should You Use Nelnet?

Well, you may not have a choice if you already have federal student loans and Nelnet is assigned as your servicer.

Otherwise, it could be a good option if you’re seeking a private student loan and Nelnet’s rates are better than those of competitors, and you’re comfortable with actively monitoring your account and protecting your data.

But if you’re uncomfortable managing income-driven repayment plans on a platform with a history of mishandling them, are concerned about data privacy, and want decent customer service, you may want to look at alternatives.

How to Use Nelnet Safely and Privately

- Opt out of data sharing. Nelnet shares borrower data with affiliates and marketing partners unless you opt out. You can opt out of affiliate marketing, sharing creditworthiness information, and non-affiliate marketing campaigns.

- Monitor your credit and payments. Set up alerts to catch errors or unauthorized changes.

- Be wary of phishing scams. Especially if you were impacted in the 2022 Nelnet data breach, you may be a potential phishing target. Always verify the sender’s email address and website URLs to avoid falling victim to scams.

- Keep detailed records. Save payment confirmations, loan balances, interest accruals, and correspondence.

- Target extra payments carefully. If you make extra payments, specify which loan you want the payment applied to. Contact Nelnet in writing to confirm this.

- Double-check IDR plans. Nelnet has been sued for mishandling Income-Driven Repayment (IDR) plans. Keep copies of IDR applications, renewal confirmations, and communications. Follow up regularly to ensure your plan is processed correctly.

- Stay updated on lawsuits and settlements. Nelnet has faced multiple class actions and state attorney general settlements. If another settlement arises, you may be eligible for compensation or debt adjustments.

- Compare alternatives. For private loans, compare rates and reviews from other lenders to find the best option.

Our privacy advisors:

- Continuously find and remove your sensitive data online

- Stop companies from selling your data – all year long

- Have removed 35M+ records

of personal data from the web

Save 10% on any individual and

family privacy plan

with code: BLOG10

news?

Don’t have the time?

DeleteMe is our premium privacy service that removes you from more than 750 data brokers like Whitepages, Spokeo, BeenVerified, plus many more.

Save 10% on DeleteMe when you use the code BLOG10.