Is NetCredit a Scam?

Laura Martisiute

Reading time: 8 minutes

Table of Contents

If you’re thinking of using NetCredit, you need to know whether it’s safe. Is NetCredit a scam?

Below, we explain whether NetCredit is a scam and discuss some steps you can take to improve your safety when using this personal loan provider.

What Is NetCredit?

NetCredit is an online lending brand that offers personal loans and lines of credit to borrowers with fair or poor credit. Loans range from about $1,000 to $10,000, with terms of six to 60 months and APRs between roughly 34% and 99%.

The brand was created in 2012 when Enova International (a publicly traded company) expanded into longer‑duration installment loans for near‑prime consumers.

NetCredit’s proprietary underwriting system uses multiple factors beyond FICO scores, including income, employment, and credit history, to approve borrowers.

Over the years, it added lines of credit and a tool that lets borrowers adjust payment schedules, but the fundamental model of high‑rate, small‑dollar loans to risky borrowers remains the same.

NetCredit does not operate in every state, and loan terms vary heavily by state laws.

Is NetCredit a Scam?

No, NetCredit is not a scam. It’s a legally operating lender, but it charges very high interest rates. APRs from about 34% up to nearly 100% mean many borrowers struggle to repay. That said, the company is not a fraudulent operation and reports repayments to at least two major credit bureaus.

Several third-party publications and review sites have evaluated NetCredit. Most do not recommend this personal loan provider.

For example, NerdWallet’s 2025 review rates NetCredit as 2.0 out of 5.0 stars and labels it as “a last resort” because its APRs (about 34.99%‑99.99%) exceed the 36% cap many advocates consider affordable.

Credible highlights NetCredit’s flexible repayment terms and same‑ or next‑day funding. It praises the ability to prequalify without affecting credit, but warns of high APRs and a low maximum loan ($10,000). The platform notes that NetCredit isn’t available in every state and that a hard credit check occurs when an application is completed.

Business Insider criticizes NetCredit’s “exorbitant” APRs and notes a low minimum loan ($500) and fast funding as minor positives.

Reviews from U.S. News Money and Bankrate echo these themes, generally emphasizing high interest costs despite some borrower-friendly features.

User reviews of NetCredit are mixed at the time of writing:

- 2.9 out of 5.0 stars (from 498 reviews) on WalletHub.

- 4.9 out of 5.0 stars (from 1,947 reviews) on Consumer Affairs.

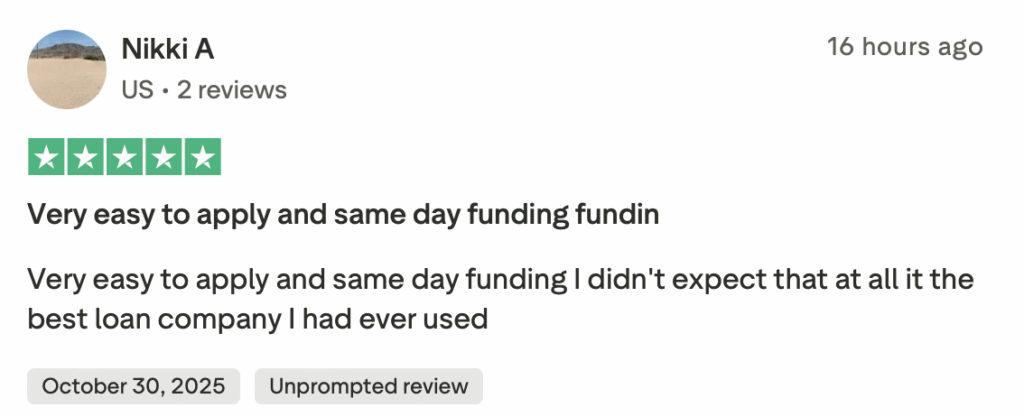

- 4.8 out of 5.0 stars (from 31,180 reviews) on Trustpilot.

- 1.05 out of 5.0 stars (from 80 reviews) on Better Business Bureau.

Customers often praise the quick, clear application and next‑day funding. One borrower said they were approved and received funding the same day.

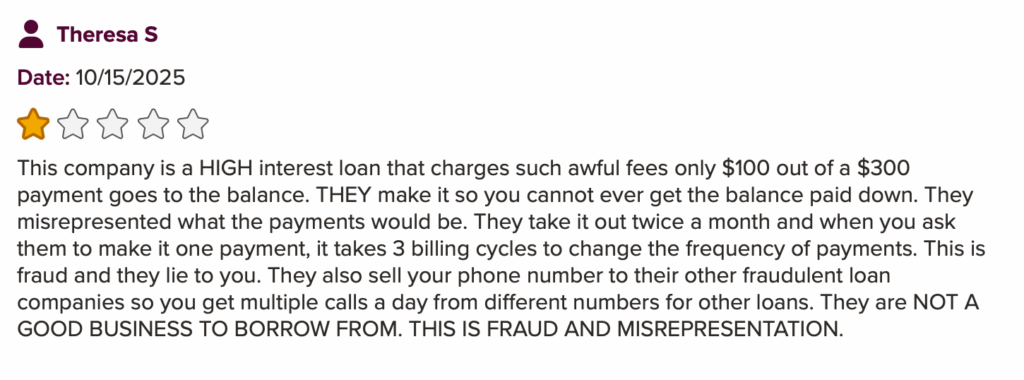

On the other hand, people complain about extremely high interest rates, predatory terms and practices that make it hard to pay off the loan, and credit report issues.

A number of reviewers call out polite, professional staff, though several report long hold times, missed callbacks, and email responses that don’t arrive, which make simple tasks (like making a payment or fixing an error) frustrating.

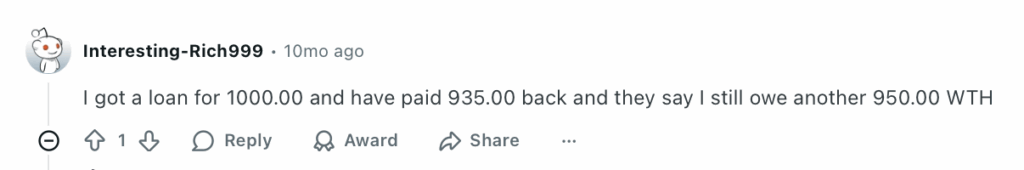

On online forums like Reddit, people report overwhelmingly negative experiences. Most users say NetCredit is a predatory lender with extremely high fees that make it very hard to pay down the balance.

For example, one person said they paid $935 toward a $1,000 loan and still owed $950.

NetCredit is not Better Business Bureau (BBB) accredited.

The company received a total of 386 complaints over the last three years, with 162 of these complaints closed within the past 12 months. Most complaints involve billing, collections, or misunderstandings of loan terms and are often resolved through refunds or clarifications.

NetCredit regulatory actions

In 2023, the Consumer Financial Protection Bureau (CFPB) fined Enova International, NetCredit’s parent, $15 million for unauthorized withdrawals from consumers’ accounts and deceptive loan practices.

The order banned certain short‑term loans and required the company to compensate more than 111,000 affected customers.

Enova previously paid a $3.2 million penalty in 2019 and must tie executive pay to regulatory compliance.

In Virginia, the attorney general’s Predatory Lending Unit sued NetCredit for charging interest rates far above the state’s 12% cap and for collecting from borrowers who had filed for bankruptcy.

The company settled for about $1.2 million.

NetCredit security

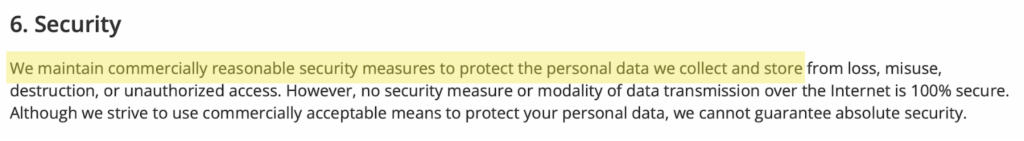

We were unable to find much information about NetCredit’s security.

In its privacy policy, the company says it maintains “commercially reasonable security measures” to protect customers’ personal data, but does not go into detail as to what these measures are.

It uses 128‑bit encryption to safeguard your data.

A 2018 breach at NetCredit allowed unauthorized access to a small percentage of NetCredit accounts, exposing names, phone numbers, addresses, basic employment and income information, NetCredit account numbers, and the last four digits of Social Security Numbers and bank account numbers.

NetCredit privacy

NetCredit explains in its privacy policy the type of data it collects, why it collects it, and with whom it shares it.

It may collect the following personal information:

- Information you provide directly, such as name, address, phone, email, Social Security number, bank account details, government-issued IDs, and login credentials (username/password).

- Information collected automatically, such as IP address, browser type, device details, pages you visit, and actions taken on the site, approximate location, and whether you’re using mobile or desktop.

- Information from other sources, such as credit bureaus, marketing and advertising partners, data brokers, and government and service platforms.

The company may use this data to process loan applications, verify your identity, disburse funds, process payments, and service and maintain your account.

It may also use your information to communicate with you about your account or promotions, prevent fraud, meet regulatory requirements, improve website functionality and user experience, and comply with legal or law enforcement requests.

NetCredit may share your data with service providers (including identity, fraud, hosting, analytics, and customer service), banks and financial partners, marketing and advertising partners, law enforcement or regulators (when required), buyers in the event of a business sale or merger, and others (with your consent).

The company notes that text message opt-in data is not shared for marketing.

It uses cookies to analyze usage, personalize site experience, and deliver targeted ads. You can manage cookie preferences or use opt-out tools, though features may break if you turn off all cookies.

NetCredit honors the Global Privacy Control (GPC) browser signal. It does not currently support “Do Not Track” signals.

The company keeps your data for as long as needed for legal, business, or account servicing purposes.

Depending on where you live, you may be able to exercise certain privacy rights, like request access, deletion, correction, or opt-out of certain data uses, especially advertising.

So, Should You Use NetCredit?

Depends.

NetCredit may be an option for borrowers with poor credit who need emergency funds and have exhausted cheaper alternatives. The ability to pre-qualify without hurting your credit, quick funding, and reporting to credit bureaus can help rebuild your credit.

Those who qualify for bank or credit union loans, credit card cash advances, peer-to-peer lending, or family loans will likely find far lower rates. NetCredit’s high APRs, low maximum loan amounts, and potential fees mean many consumers could end up paying double the principal or more.

How to Use NetCredit Safely and Privately

- Treat NetCredit as a last-resort lender. Its APRs range from about 34% to nearly 100%, which is extremely expensive. Only use NetCredit if you have no cheaper borrowing options, and the loan is truly for an emergency, not regular expenses.

- Verify the official site and representatives. Always visit NetCredit’s official website (netcredit.com) and contact customer service using the numbers listed there. Ignore unsolicited calls or emails claiming to be from NetCredit and never share personal details until you confirm the source.

- Read fees, APR, and penalties. Complaints often arise from misunderstandings about the cost, so be sure to read the APR, repayment schedule, and total cost before accepting. Consider the total repayment amount, not just the monthly payment, and ensure there are no additional fees associated with the repayment timing.

- Protect your bank account. NetCredit has been fined for unauthorized withdrawals. To protect yourself, use a separate bank account for repayment if you can. This prevents NetCredit from having unrestricted access to your primary funds. If you cannot use a separate account, monitor your transactions closely.

- Avoid missing or delaying payments. Because of the high APR, the balance can be hard to reduce if you fall behind. To limit damage, make payments on time, and pay more than the minimum when possible to reduce interest over time. Even small extra payments toward the principal can help prevent the loan from spiraling.

- Limit marketing and tracking where possible. Since NetCredit uses cookies and shares data with marketing partners, adjust cookie preferences on their site, use a browser that supports Global Privacy Control (NetCredit honors it), and opt out of promotional emails and texts.

- Keep records of every interaction. Save emails and chat transcripts, record call dates and who you spoke with, and download statements and payoff confirmation notices. This helps if there’s a billing error or dispute later.

Our privacy advisors:

- Continuously find and remove your sensitive data online

- Stop companies from selling your data – all year long

- Have removed 35M+ records

of personal data from the web

Save 10% on any individual and

family privacy plan

with code: BLOG10

news?

Don’t have the time?

DeleteMe is our premium privacy service that removes you from more than 750 data brokers like Whitepages, Spokeo, BeenVerified, plus many more.

Save 10% on DeleteMe when you use the code BLOG10.