Is Netspend a Scam?

Laura Martisiute

Reading time: 6 minutes

Table of Contents

If you’re thinking of using Netspend, you need to know: Is Netspend a scam?

Below, we explain whether Netspend is a scam and discuss some steps you can take to improve your safety when using this prepaid debit card provider.

What Is Netspend?

Netspend is a US-based provider of prepaid debit cards. It was founded in 1999.

To get a Netspend card, all you need to do is fill out an online order form on the Netspend website. Then, Netspend will send you the card.

There are no upfront fees and no credit checks.

You can add money to your Netspend by making a Direct Deposit or visiting a Netspend Network location where you can do so in person.

Netspend makes money mostly through the various fees it charges consumers for its prepaid cards.

State of Vermont residents are ineligible to open a Card Account.

Is Netspend a Scam?

No, Netspend is not a scam. It’s a legitimate financial services company that provides prepaid cards. However, Netspend cards may not be the best option for everyone.

Third-party reviews of Netspend are cautious.

For example, Bankrate gives Netspend Visa prepaid cards a rating of 3.0 out of 5.0, mainly due to the high fees and the fact that prepaid cards don’t help you build your credit.

US News’ and Nerdwallet’s reviews are similar.

Nerdwallet says: “Netspend’s prepaid debit cards are expensive alternatives to a checking account.”

US News recommends alternatives.

User reviews on Netspend are mixed:

- 4.1 out of 5.0 stars (from 35,644 reviews) on Trustpilot.

- 3.7 out of 5.0 stars (from 6,772 reviews) on Consumer Affairs.

- 2.2 out of 5.0 stars (from 1,097 reviews) on WalletHub.

- 1.4 out of 5.0 stars (from 435 reviews) on Sitejabber.

Users complain about funds being stolen, reimbursements being delayed or denied, and accounts being closed without warning. Many also report that customer service is poor, and a few have experienced inactivity fees, even before the card is activated in some cases.

On the other hand, some people report having great experiences with Netspend, including being able to promptly freeze their accounts if they are hacked.

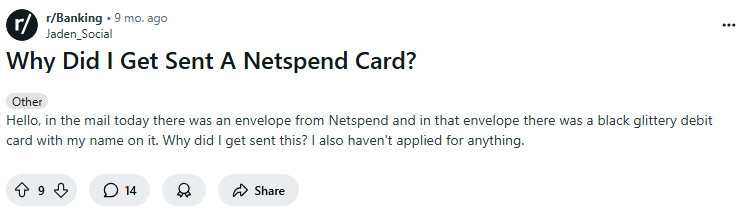

Netspend’s marketing practices appear to include mailing prepaid cards to individuals who did not request them.

On online forums like Reddit, it’s common to see people asking why they were sent a Netspend card.

Typical responses include: “I got sent it to last year, just discard it” and “Netspend will send ready to activate cards to people who didn’t ask for them. It’s clearly predatory.”

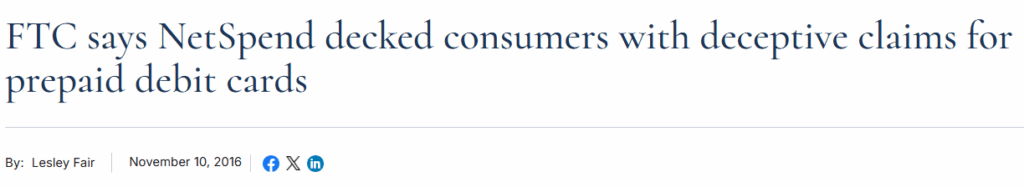

In 2016, the Federal Trade Commission (FTC) filed a complaint against Netspend, alleging the company misled consumers with false claims about “immediate access” to funds on its prepaid debit cards.

Although Netspend used phrases like “no waiting” and “use your card immediately” in its ads, many users encountered significant delays.

In 2017, the FTC reached a settlement with Netspend.

In 2025, New York Attorney General Letitia James secured over $1 million in restitution and penalties from Netspend after an investigation found the company charged illegal fees, misled customers about ATM fees, and imposed a variety of unauthorized charges.

Security

If you use Netspend, your money is FDIC-insured through Netspend’s relationship with several banks.

You can only access your card account information from the Netspend website if you’re enrolled in the Netspend Online Account Center.

According to Netspend, the Netspend Online Account Center utilizes Secure Socket Layer (SSL) technology to encrypt personal data, such as user IDs and card account information, when it’s transmitted over the internet.

Any information provided by Netspend is scrambled en route and decoded only when it reaches your browser.

Privacy

To activate your Card Account, you need to give Netspend your name, date of birth, street address, and other information that will allow them to identify you.

Netspend states that it must collect this information in accordance with the USA PATRIOT Act, a federal law that requires all financial institutions and their third-party service providers to acquire, verify, and record data that identifies every person opening a Card Account.

The privacy policy on Netspend’s website applies when you visit or interact with Netspend websites, use its mobile apps, or communicate with it electronically or via social media.

Netspend collects the following information:

- Personal identifiers, e.g., name, address, phone number, email address, and government-issued ID.

- Device information, e.g., IP address, device ID, browser type, pages visited, and browser history.

- Geolocation information, i.e., information that lets Netspend determine your location.

- Inferences, i.e., inferences drawn from any of the other types of data.

It uses this data to provide its products and services, communicate with you, prevent fraud, enhance security, and comply with legal obligations. It may also use your information for other purposes that they may disclose at the time they collect your information.

Netspend’s privacy policy does not cover how your financial account data is handled. That’s covered by GLBA rules under your bank’s privacy policy.

If you have or apply for a Netspend card, the issuing bank’s privacy policy applies (not just Netspend’s).

Netspend cards are issued by:

- The Bancorp Bank

- Pathward®, N.A.

- Republic Bank & Trust Company

You should check the back of your card or your card packaging to find out which bank’s privacy policy to review. Netspend links out to each bank’s privacy policy in its policy.

So, Should You Use Netspend?

Depends on your goals.

If you have no bank account or credit history and absolutely need a reloadable prepaid card to receive direct deposits, Netspend could be an option. Just make sure you fully understand its fees.

Otherwise, there may be better options available elsewhere.

How to Use Netspend Safely and Privately

- Verify your identity immediately. Complete the ID verification early to avoid delays in accessing your money.

- Avoid keeping a large balance. Only load the card with what you need in the short term. It’s best to use it like cash instead of a savings or long-term storage account.

- Turn on alerts. This helps you spot suspicious activity quickly.

- Use direct deposit wisely. Only use Netspend for direct deposit if you don’t have a safer account available. Withdraw funds or transfer them to another account as soon as they arrive.

- Check your balance regularly. Log in to the app or website often to monitor your balance and transaction history.

- Keep contact records. Save all emails, chat transcripts, and phone call logs in case you need to dispute a charge or escalate an issue.

- Turn off tracking. Netspend and its parent company (Ouro) track your behavior. Use ad blocker extensions and opt out of data tracking via NAI and DAA.

- Turn off location access. Turn off location tracking in the app unless absolutely needed.

Our privacy advisors:

- Continuously find and remove your sensitive data online

- Stop companies from selling your data – all year long

- Have removed 35M+ records

of personal data from the web

Save 10% on any individual and

family privacy plan

with code: BLOG10

news?

Don’t have the time?

DeleteMe is our premium privacy service that removes you from more than 750 data brokers like Whitepages, Spokeo, BeenVerified, plus many more.

Save 10% on DeleteMe when you use the code BLOG10.