Is Northwestern Mutual a Scam?

Laura Martisiute

Reading time: 7 minutes

Table of Contents

If you’re thinking of using Northwestern Mutual, you need to know if it’s safe. Is Northwestern Mutual a scam?

Below, we explain whether Northwestern Mutual is a scam and discuss some steps you can take to improve your safety when using this platform.

What Is Northwestern Mutual?

Northwestern Mutual is a financial planning and life insurance mutual company. It is one of the largest life insurance providers in the US.

Its products and planning services include life insurance, disability income insurance, long-term care insurance, annuities, retirement planning, investment advisory services, and wealth management and trust services.

Northwestern Mutual was founded in 1857 and is headquartered in Milwaukee, Wisconsin.

Is Northwestern Mutual a Scam?

No, Northwestern Mutual is not a scam. It’s a legitimate financial services company.

Northwestern Mutual is reviewed positively by third-party publications and review sites.

For example, NerdWallet scored Northwestern Mutual as 5.0 out of 5.0 stars. The review’s conclusion was the following: “Northwestern Mutual offers term and permanent life policies, and has the lowest complaint ratio out of all the life insurers we review.”

Forbes reviewed Northwestern Mutual life insurance specifically, and gave it a rating of 4.5 out of 5.0 stars, whereas U.S. News rated the company’s life insurance as 4.2 out of 5.0 stars.

However, Bankrate, which also reviewed Northwestern Mutual’s life insurance, gave it a lower rating of 3.9 out of 5 stars. The drawbacks cited include the lack of online quotes, the potential need for medical exams, and the absence of a guaranteed life insurance policy.

User reviews of Northwestern Mutual are more mixed:

- 4.2 out of 5.0 stars (from 862 reviews) on WalletHub.

- 1.8 out of 5.0 stars (from 32 reviews) on Yelp.

- 1.27 out of 5.0 stars (from 30 reviews) on Better Business Bureau.

Reviews of Northwestern Mutual life insurance on ConsumerAffairs are quite low, with an average rating of 1.5 out of 5.0 stars (based on 59 reviews as of the time of writing). Some people report positive experiences with advisors, while others say they’ve had negative experiences with accessing funds or surrendering policies.

On online forums like Reddit, people report mostly negative experiences.

Users claim that Northwestern Mutual products are expensive and have high fees, and that the company’s financial advisors are essentially insurance sales representatives.

Many commenters report that first meetings are friendly and educational, but later conversations tend to focus on buying whole life insurance, moving investments into high-fee Northwestern Mutual-managed accounts, and sharing contacts of friends and family for additional leads.

Northwestern Mutual is not a Better Business Bureau (BBB) accredited company. It has received a total of 49 complaints on the BBB website over the last three years, with 16 of these closed within the past 12 months. (See our review of whether the BBB is a scam).

Over the years, Northwestern Mutual has been subject to some controversies and scandals, including a 20-year scheme by a Northwestern Mutual adviser that defrauded clients of $8.6 million through fake investments and falsified account statements. The adviser was terminated in 2023, and the company fully reimbursed affected clients.

In 2023, Northwestern Mutual settled two regulatory cases in New Hampshire around improper email marketing practices by the company’s agents and affiliated broker-dealer, Northwestern Mutual Investment Services.

From 2019 to 2021, the company’s insurance agents and broker-dealer trainees allegedly sent tens of thousands of marketing emails to prospective clients (including people outside New Hampshire) that misrepresented the agents’ experience, client base, and licensing status.

Regulators found that some emails were sent into states where the agents were not licensed and that many bypassed the company’s required compliance review process.

Security

In its privacy policy, Northwestern Mutual (very) briefly describes its security measures. It says it uses “technical, administrative, and physical controls that comply with federal and state law” to protect your data.

It goes into (much) greater detail about its security controls on a separate page on its website dedicated to security, where it lists the controls it has in place under each category.

For example, under technical controls, Northwestern Mutual states that it utilizes endpoint protection, email security, encryption, next-generation firewalls, 24/7 continuous monitoring and incident response, regular penetration testing, and product security (i.e., identifying and correcting vulnerabilities throughout a product’s lifecycle).

Under administrative controls, it lists authentication, authorization, change control, corporate governance, cybersecurity exercises and business continuity planning, privacy notice, internal and external IT auditors, records and information management and sanitization, risks assessments, security assessments, security awareness, separation of duties, secure storage locations, threat monitoring and hunting, training and user behavior, and user access reviews.

Finally, under physical controls, the company restricts access to buildings and data centers, maintains and tests business continuity and disaster recovery plans, and utilizes redundant infrastructure to ensure the availability of company systems and client data.

Even with all these controls in place, in 2023, Northwestern Mutual’s customer data was exposed through a breach (discovered in 2024) involving Infosys McCamish Systems, a third-party service provider.

Sensitive personal information of tens of thousands of clients, including names, Social Security numbers, dates of birth, and financial information, was exposed.

As a result, Northwestern Mutual provided complimentary credit monitoring and identity theft protection services to its customers.

Privacy

Northwestern Mutual has several different privacy policies and notices depending on your relationship with them, your location, and how you interact with their services:

- Online Privacy Statement.

- Northwestern Mutual Life Insurance Company.

- Northwestern Long Term Care Insurance Company.

- Northwestern Mutual Investment Services, LLC (NMIS) & Northwestern Mutual Wealth Management Company (NMWMC).

Since the company is best known for its life insurance, let’s take a look at its life insurance privacy policy. In it, Northwestern Mutual explains how it collects, shares, and protects your personal information.

Northwestern Mutual may collect the following information:

- Personal details and identifiers: Name, date of birth, and Social Security number.

- Demographics: Age, gender, citizenship, and disability status.

- Financial information: Bank accounts, investments, debts, and account balances.

- Employment & education information: Income, employment history, degrees, academic achievements, and school records.

- Medical information: Medical history and questionnaires.

- Biometrics (for fraud prevention & authentication).

- Internet or network activity: Browser activity, search history, and IP addresses.

- Profile information: Interests, hobbies, behaviors, and attitudes.

- Product information: Policy/account number and values.

- Audiovisual records: Video and audio recordings.

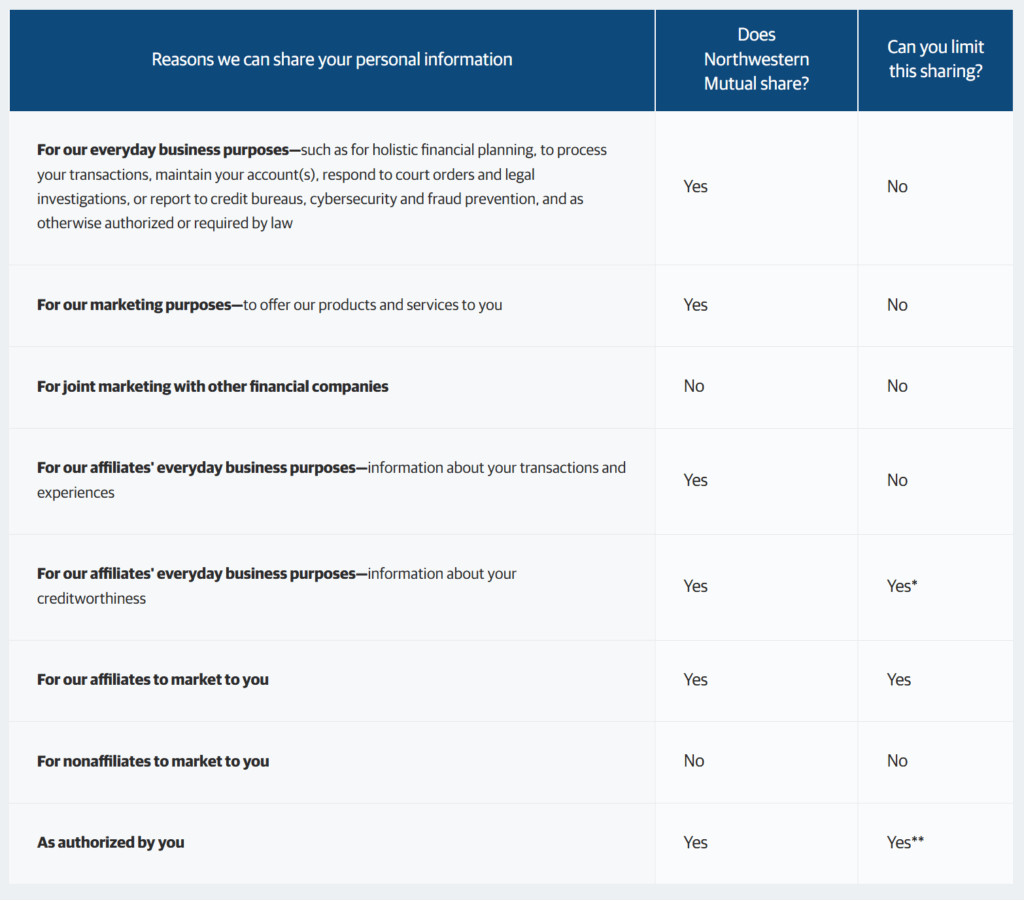

It can share your information for everyday business purposes (such as holistic financial planning and to process your transactions), marketing (including joint marketing with other financial companies), their affiliates’ everyday business purposes (information about your transactions and experiences and information about your creditworthiness), affiliates marketing, nonaffiliates marketing, and as authorized by you.

You can limit some sharing, such as sharing with their affiliates about your creditworthiness and sharing with their affiliates for marketing purposes.

If you’re a new customer, Northwestern Mutual can start sharing your data 30 days after the date it sends you its privacy notice. It continues sharing your information even when you are no longer their customer, unless you contact them to limit sharing.

So, Should You Use Northwestern Mutual?

Depends on what you are looking for in a financial services company and your tolerance for certain business practices.

Although Northwestern Mutual is a legitimate company with highly rated products, its business model and recent history of security and regulatory issues are likely to be significant drawbacks for many consumers.

How to Use Northwestern Mutual Safely and Privately

- Be clear on your financial goals first. If you’re not clear on your goals, you could end up with expensive policies or accounts you don’t need.

- Understand advisor incentives. And compare their recommendations with an independent, fee-only CFP before committing.

- Opt out of data sharing. Limit affiliate marketing and creditworthiness sharing. Contact NM’s privacy team if needed.

- Be selective with what you share. Only provide documents Northwestern Mutual absolutely requires.

- Use a dedicated email. That way, you can keep your primary inbox free of spam and compartmentalize data exposure.

- Have an exit strategy. Read cancellation terms carefully and avoid bundling too many products at once.

- Document everything. Keep copies of all signed documents, emails, and disclosures. Having your own record helps if there’s ever a dispute.

Our privacy advisors:

- Continuously find and remove your sensitive data online

- Stop companies from selling your data – all year long

- Have removed 35M+ records

of personal data from the web

Save 10% on any individual and

family privacy plan

with code: BLOG10

news?

Don’t have the time?

DeleteMe is our premium privacy service that removes you from more than 750 data brokers like Whitepages, Spokeo, BeenVerified, plus many more.

Save 10% on DeleteMe when you use the code BLOG10.