Is Otto Insurance a Scam?

Laura Martisiute

Reading time: 7 minutes

Table of Contents

If you’re thinking of using Otto Insurance, you need to know: Is Otto Insurance a scam?

Below, we explain whether Otto Insurance is a scam and discuss some steps you can take to improve your safety when using this platform.

What Is Otto Insurance?

Otto Insurance is a platform where you can find insurance quotes and compare policies. It is not an insurance carrier.

To use Otto Insurance, you need to provide some basic personal information, including contact information, which it then uses to match you with multiple licensed insurers. You’ll receive rate offers directly from those carriers or their agents.

It’s free to use Otto Insurance. Insurers pay Otto Insurance for the leads it generates.

According to the Otto Insurance website, the company is headquartered in Miami, FL.

Is Otto Insurance a Scam?

No, Otto Insurance is not a scam.

It’s a legitimate business that connects you with insurance providers. In other words, it’s the middleman between you and these providers.

However, it may not be suitable for everyone.

The personal finance website Credit Karma says the following about Otto Insurance: “Otto could be a good tool to compare quotes for those looking to shop for car insurance. Be aware that by submitting your information to the platform, you may be signing up for promotional communication from companies and individual agents. Other companies offer similar without unwanted phone calls.”

One of the cons noted by Credit Karma is that there is limited information available about Otto Insurance.

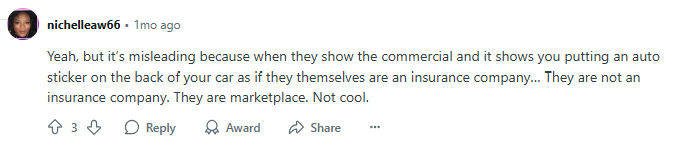

On internet forums like Reddit, people complain about confusing branding and a lack of transparency. In particular, many people say that they thought Otto Insurance was an insurance company.

One person said: “It’s misleading because when they show the commercial and it shows you putting an auto sticker on the back of your car as if they themselves are an insurance company… They are not an insurance company. They are marketplace. Not cool.”

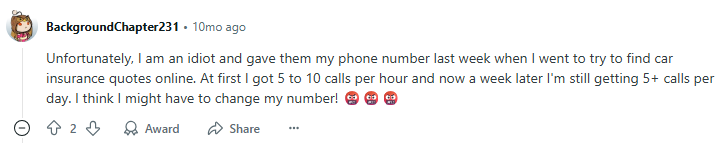

Several people complain about having shared their contact details with Otto Insurance and receiving countless spam calls.

For instance, one person said: “Unfortunately, I am an idiot and gave them my phone number last week when I went to try to find car insurance quotes online. At first I got 5 to 10 calls per hour and now a week later I’m still getting 5+ calls per day. I think I might have to change my number!”

Otto Insurance is not Better Business Bureau (BBB) accredited and has received 14 complaints in the last three years, seven of which have apparently been resolved. (See also: Is the BBB a Scam?)

People complain about misleading rate promises, data selling, and unsolicited calls and texts (despite not giving their consent).

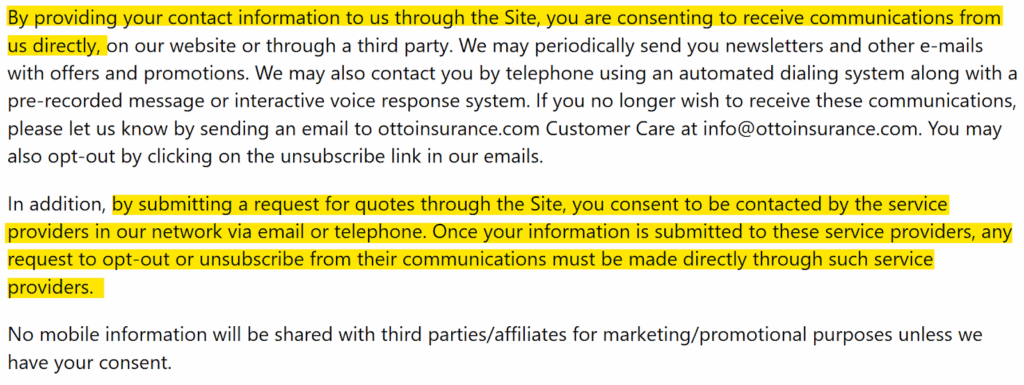

However, Otto Insurance isn’t doing anything it didn’t say it wouldn’t do in its terms of service.

Otto Insurance states in its terms of service that by simply entering your phone or email (even before completing the flow), you’ve already agreed to let Otto share your information with any of its “network” partners, who can call, text or email you (potentially with auto-dialers or prerecorded messages).

It says: “By providing your contact information to us through the Site, you are consenting to receive communications from us directly. […] In addition, by submitting a request for quotes through the Site, you consent to be contacted by the service providers in our network via email or telephone.”

If you want to opt out of these communications, you must opt out separately for each one.

Otto Insurance says: “Once your information is submitted to these service providers, any request to opt-out or unsubscribe from their communications must be made directly through such service providers.”

Security

In its privacy policy, Otto Insurance says that it takes steps to safeguard your personal information.

For example, it limits access to personal data to only employees or agents who need it to provide the products/services you request.

It also “maintain[s] physical, electronic, and procedural safeguards that comply with or exceed federal standards to protect your personal information.”

Privacy

Otto Insurance explains the type of data it collects, why it collects it, and with whom it shares it in its privacy policy.

It collects the following personal information:

- Identifiers.

- Characteristics of protected classifications under California or federal law.

- Commercial information.

- Internet or other electronic network activity information.

- Geolocation data.

- Audio, electronic, visual, thermal, olfactory, or similar information.

- Professional or employment-related information.

- Education information.

- Inferences drawn from the above.

For example, Otto Insurance says that it asks users to provide their full name, address, telephone number, email address, and other information to match them to insurance carriers and agents.

It also collects demographic information, such as gender, zip code, or any other information that is not tied to your personal information.

Otto Insurance may receive data about you from other online or offline sources and may add that information to the information they already have about you.

It uses your information to deliver its services (e.g., matching you with insurers), for site performance and security, marketing and analytics, and research and development purposes.

Otto Insurance may share your data with insurance service providers, third-party vendors (e.g., payment processors), law enforcement, or regulators if required by law or in the context of corporate transactions.

When you request quotes, the company shares your information with insurers and agents “even if you have opted into” federal or state Do-Not-Call lists. If you later don’t want a given provider to contact you, you must ask that provider directly. The provider may keep your data whether or not you use their services.

The company retains identifiers collected in conjunction with a person’s TCPA consent for six years. It retains all other data indefinitely unless you request that Otto Insurance delete your information.

Depending on where you reside, you may be able to submit a privacy request.

You can also request to see a summary of the personal information that Otto Insurance retains about you.

To delete your information from Otto Insurance, you need to send a deletion request to requesttodelete@ottoinsurance.com.

Otto Insurance can change its privacy policy at any time without notifying you.

So, Should You Use Otto Insurance?

Probably not unless you love unsolicited outreach.

You can more than likely find a more privacy-focused aggregator.

How to Use Otto Insurance Safely and Privately

- Compare directly when possible. For carriers you like, go directly to their website or call them yourself. That way, you know exactly who’s calling, and you avoid re-sharing data through a lead generation platform like Otto Insurance.

- Use a secondary email and phone. Use a masked email address and phone number when signing up for Otto Insurance. That way, you can contain marketing blasts and abandon the alias/number when it becomes too overwhelming.

- Read Otto Insurance’s terms of service and privacy policy. To know exactly what you’re consenting to share. If you’re uncomfortable with the company’s data collecting and data sharing practices, don’t use it. Instead, try another quote service.

- Opt out. As soon as you start receiving calls or texts, ask the carrier or agent to stop. Consider keeping a log to note the date, time, and the person you contacted for easier follow-up.

- Exercise your privacy rights. Depending on where you reside, you may be able to submit formal “access” or “deletion” requests via the emails listed in their policy.

- Use browser privacy tools. Turn on “block third-party cookies” or deploy an ad-blocker to limit tracking as you browse their site.

- Request Otto Insurance to delete your information. Once you’ve collected quotes, email Otto and ask them to delete your personal information. Otherwise, they will retain a lot of your information indefinitely.

Our privacy advisors:

- Continuously find and remove your sensitive data online

- Stop companies from selling your data – all year long

- Have removed 35M+ records

of personal data from the web

Save 10% on any individual and

family privacy plan

with code: BLOG10

news?

Don’t have the time?

DeleteMe is our premium privacy service that removes you from more than 750 data brokers like Whitepages, Spokeo, BeenVerified, plus many more.

Save 10% on DeleteMe when you use the code BLOG10.