Is SoFi a Scam?

Laura Martisiute

Reading time: 7 minutes

Table of Contents

If you’re thinking of using SoFi, you need to know: Is SoFi a scam?

Below, we explain whether SoFi is a scam and discuss some steps you can take to improve your safety when using this financial services company.

What Is SoFi?

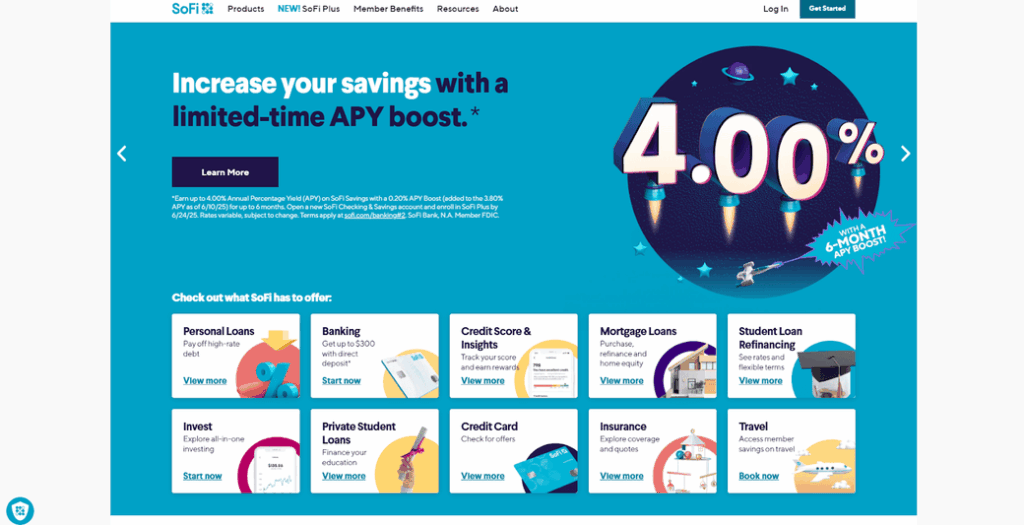

SoFi is a financial technology company that offers a range of digital financial products and services.

Its products include loans (e.g., private student loans, home equity loans, mortgage loans, and auto loan refinances), investing (e.g., stock trading, retirement accounts), credit cards, bank accounts, insurance, financial insights, and business solutions.

SoFi was founded in 2011 and became a publicly traded company in 2021.

It’s headquartered in San Francisco, California.

Is SoFi a Scam?

No, SoFi is not a scam. It’s a legitimate financial services company.

SoFi gets good reviews from third-party publications and review sites.

For example, US News gives SoFi a rating of 5.0 out of 5.0 stars.

Some of the pros it lists include no account fees or service charges, competitive interest rates, and robust online tools. Among the cons are limited bank account options and a lack of physical branches.

Similarly, NerdWallet rates SoFi as 4.9 out of 5.0 stars.

It said: “Financial services company SoFi gained its bank charter in 2022 and launched a combination checking and savings account, which is not a common offering. It has some of the best rates available, no monthly fees and a solid free overdraft coverage program for customers who qualify.”

Bankrate, which specifically examined SoFi Mortgage, gave it a 4.8 out of 5.0-star rating.

The Motley Fool, which reviewed the SoFi Checking and Savings account, gave it a 4.5 out of 5.0 stars rating. Their conclusion: “The SoFi Checking and Savings combo (Member FDIC) is so good, it landed on both our Best High-Yield Savings and Best Checking Accounts lists this year.”

User reviews of SoFi are more mixed but mostly good:

- 4.3 out of 5.0 stars (from 9,620 reviews) on Trustpilot.

- 4.5 out of 5.0 stars (from 452 reviews) on Credit Karma.

- 4.5 out of 5.0 stars (from 45,096 reviews) on Google Play.

- 4.8 out of 5.0 stars (from 379,069 reviews) on the App Store.

- 2.3 out of 5.0 stars (from 667 reviews) on WalletHub.

- 1.5 out of 5.0 stars (from 167 reviews) on Consumer Affairs.

On online forums like Reddit, people generally report positive experiences.

One person said: “Absolutely love it, as someone who has used many banks in the past, this is so much better than all banking options for almost everything.”

However, most people note that they don’t use SoFi as their only bank.

For instance, one user said: “Not my only bank, but with a year of experience with SoFi — no problems, no issues at all.”

Common complaints include no cash deposits/physical branches, poor customer service compared to traditional banks, and lack of certain features (e.g., Zelle),

A few users also reported bad experiences with fraud disputes.

One said: “I used to LOVE sofi, but im definitely moving my checking after my past experience with them. If your debit card gets used fraudulently even if its out of state they will NOT give you your money back no matter your evidence. Im so disappointed ☹️”

Overall, it appears that many SoFi users create a hybrid banking system, utilizing SoFi in conjunction with traditional banks or credit unions (for cash handling, in-person service, and backup) and other apps for more advanced investing or international use.

SoFi is not Better Business Bureau (BBB) accredited. At the time of writing, SoFi has received 2,319 complaints on the BBB website over the last three years, with 788 of these complaints closed within the last 12 months. (See also: Is the BBB a Scam?)

Security

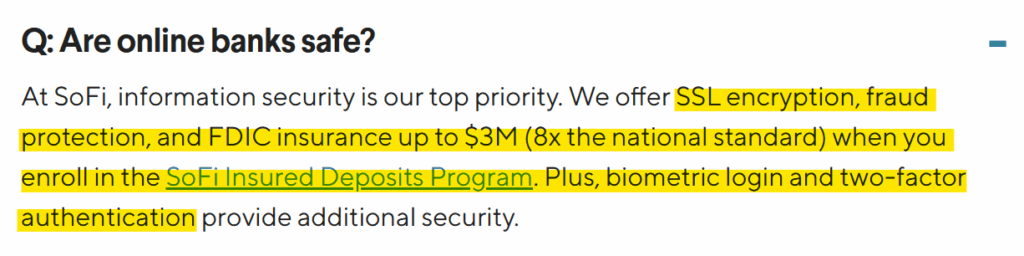

SoFi describes its security measures on its website.

It offers SSL encryption, fraud protection, biometric login, two-factor authentication, and instant alerts for real-time transactions and daily activities.

It also allows you to designate up to five primary and five secondary beneficiaries for your checking and savings accounts, ensuring that your funds are passed on according to your wishes.

All SoFi Checking and Savings accounts are FDIC insured up to $250,000 per member (up to $500,000 for joint accounts). You can get additional insurance of up to $3 million if you enroll in the SoFi Insured Deposits Program.

In its privacy policy, SoFi details how it secures your personal information.

It says it uses “secure measures that comply with federal law” and that include “computer safeguards and secured files and buildings.”

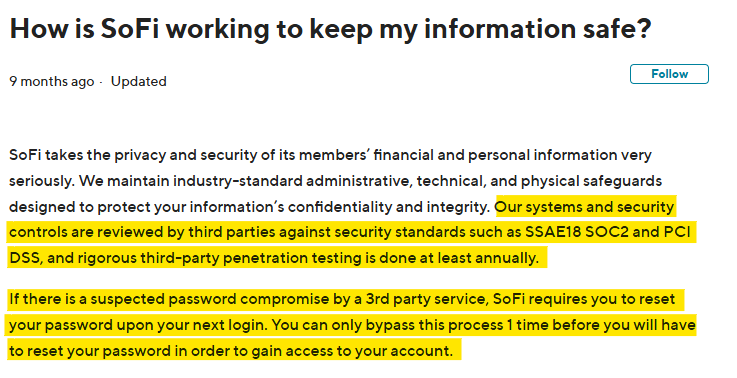

It provides more detail on its FAQs page, stating that its systems and security controls are reviewed by third parties against security standards and tested at least annually.

If SoFi believes that a third-party service compromised users’ passwords, it will ask you to reset your password the next time you log in.

Privacy

SoFi explains its data collection and sharing in its privacy policy.

It says that the types of personal information it collects and shares depend on the products and services you have with SoFi.

However, data collected may include:

- Social Security number.

- Employment information.

- Income.

- Credit scores.

- Payment history.

- Credit history.

- Transaction history.

- Assets.

- Account balances.

When you’re no longer a SoFi customer, it continues to share your information as described in its privacy policy.

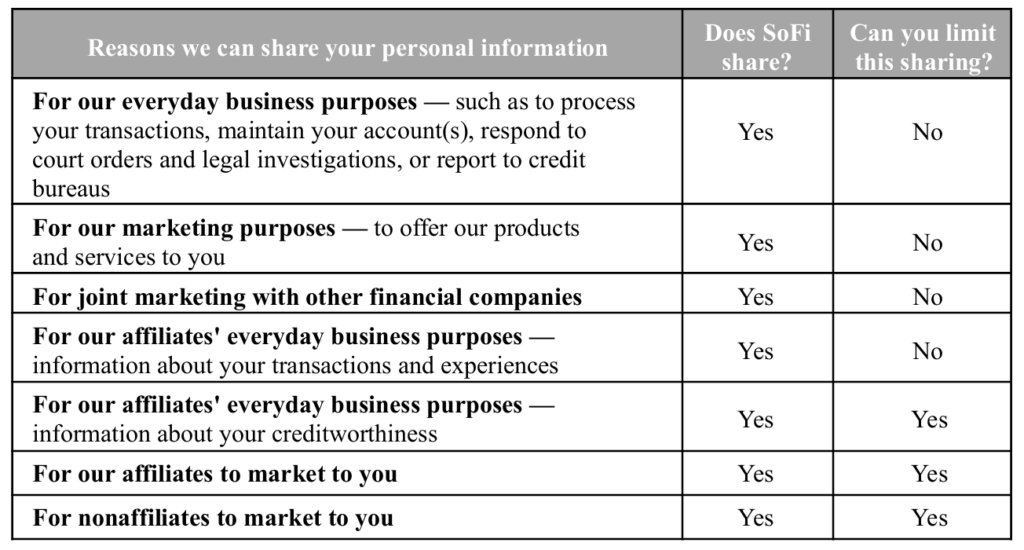

SoFi shares your personal information for its everyday business purposes (e.g., processing transactions and responding to legal investigations), marketing purposes (including its own, its affiliates’, and nonaffiliates’), and affiliates’ everyday business purposes.

You can opt out of some of this personal information sharing (affiliates’ everyday business purposes, affiliates’ marketing purposes, and nonaffiliates’ marketing purposes) through your Account Settings or by calling 1-855-456-SOFI.

The Common Sense Privacy Program, which rates internet services’ privacy policies, gives SoFi’s privacy policy a “Warning” rating. This means SoFi’s privacy policy “Does not meet our recommendations for privacy and security practices.”

Among the issues flagged are the following:

- SoFi sells or rents personal information to third parties.

- Personal information is shared for third-party marketing.

- Personalized advertising is displayed.

- Third parties collect data for their own purposes.

- User information is used to track and target advertisements on other third-party websites or services.

- Data profiles are created and used for personalized advertisements.

So, Should You Use SoFi?

Probably.

SoFi is a legitimate financial services company that is a great choice for digital-savvy users and people who don’t rely on cash deposits or in-person service.

Those looking to earn interest and manage their finances via an app will also appreciate SoFi.

Something to note is that many people don’t use SoFi as their only bank but instead combine it with a credit union or traditional bank.

How to Use SoFi Safely and Privately

- Create a strong password. And don’t reuse it elsewhere. Consider using a password manager to help you create stronger passwords and store them securely.

- Turn on two-factor authentication. You will see a screen at login prompting you to set up 2FA.

- Set up real-time alerts. Turn on transaction notifications and daily summaries in the SoFi app to know immediately if anything unusual happens.

- Freeze your card. If your SoFi card is stolen or lost, you can freeze it through your account to prevent transactions from being made until you find it.

- Keep a backup bank. Many SoFi customers recommend not relying solely on SoFi for their financial needs. Consider maintaining a secondary account (e.g., at a credit union) in case SoFi locks your account during a fraud investigation or technical issue.

- Limit how much personal information you share. Don’t overshare sensitive information like SSN or financial details in support chats or external sites.

- Opt out of data sharing. You can opt out through your SoFi account settings or by calling 1-855-456-SOFI.

- Review the privacy policy. This helps you understand what SoFi collects and how it uses your information.

- Access SoFi only from secure devices and networks. Avoid logging into your SoFi account from public Wi-Fi or shared computers.

- Monitor your SoFi account regularly. Don’t just rely on alerts. To be extra cautious, review your transaction history weekly to identify any suspicious activity.

Our privacy advisors:

- Continuously find and remove your sensitive data online

- Stop companies from selling your data – all year long

- Have removed 35M+ records

of personal data from the web

Save 10% on any individual and

family privacy plan

with code: BLOG10

news?

Don’t have the time?

DeleteMe is our premium privacy service that removes you from more than 750 data brokers like Whitepages, Spokeo, BeenVerified, plus many more.

Save 10% on DeleteMe when you use the code BLOG10.