Is Turbo Debt a Scam?

Laura Martisiute

Reading time: 8 minutes

Table of Contents

If you’re thinking of using Turbo Debt, you need to know if it’s safe. Is Turbo Debt a scam?

Below, we explain whether Turbo Debt is a scam and discuss some steps you can take to improve your safety when using this company.

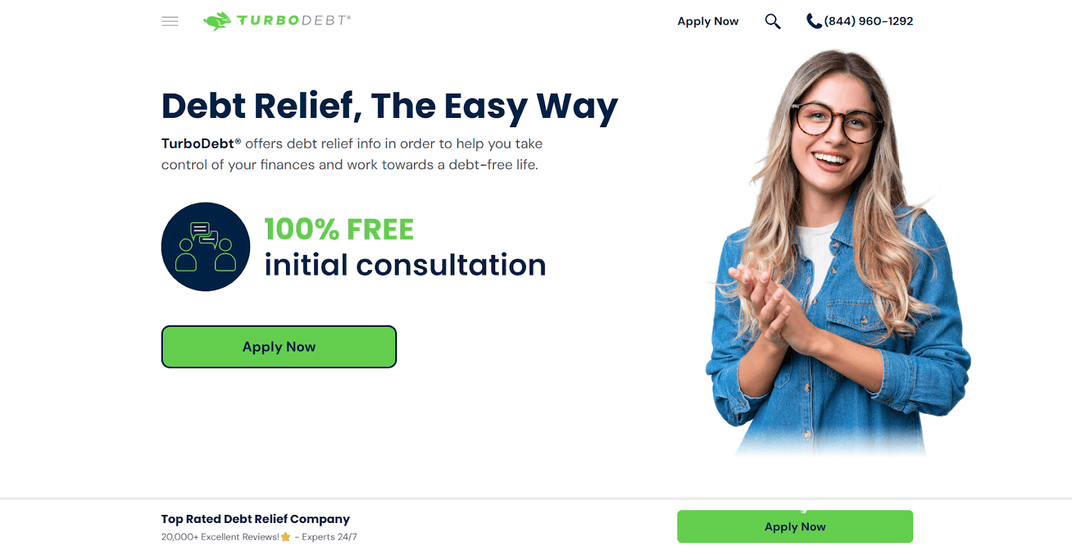

What Is Turbo Debt?

TurboDebt is a company that helps individuals (and, in some cases, businesses) resolve debts, including credit card debt, medical bills, personal loans, student loans (some types), veteran debt, divorce debt, and more.

The company’s main service is debt relief via structured repayment plans, working with creditors to lower the overall balance owed.

It partners with National Debt Relief. Read our review of whether National Debt Relief is a scam.

Turbo Debt is available in 46 states, excluding Oregon, Vermont, West Virginia, and Minnesota.

Is Turbo Debt a Scam?

No, Turbo Debt is not a scam. It’s a legitimate company that offers debt relief help.

Turbo Debt gets positive reviews from third-party publications.

For example, Bankrate gives Turbo Debt a rating of 4.2 out of 5.0 stars with the recommendation tag “Best for accessibility.”

The publication summarizes Turbo Debt in the following statement:

“TurboDebt is an accredited debt relief company specializing in debt settlement. While TurboDebt does not offer related services, such as credit repair or credit counseling, it can help customers reduce their total debt owed. With extended opening hours, wide geographic coverage and Spanish-language assistance, TurboDebt is accessible to a wide range of borrowers in need of debt relief assistance.”

Finder.com, which also reviews Turbo Debt (though it doesn’t give it a rating), notes that Turbo Debt has high fees:

“One of the biggest drawbacks to TurboDebt is that it charges up to 25% in fees to settle your debts. For example, if you have $60,000 in enrolled debts, you could pay as much as $15,000 for the service.”

Users also rate Turbo Debt favorably.

- 4.88 out of 5.0 stars (from 1,309 reviews) on Better Business Bureau.

- 4.2 out of 5.0 stars (from 23 reviews) on ConsumerAffairs.

- 4.9 out of 5.0 stars (from 13,265 reviews) on Trustpilot.

- 4.1 out of 5.0 stars (from 30 reviews) on Facebook.

- 4.9 out of 5.0 stars (from 7,568 reviews) on Google.

However, on online forums like Reddit, people report negative experiences.

One Redditor shared that TurboDebt’s rep used fear and guilt to pressure them into enrolling, only disclosing major downsides like halted payments, new account setup, high fees, and severe credit damage when pressed.

Others warn that most companies like Turbo Debt do things that “you can do on your own for free.”

Another thing to note is that, like many debt settlement firms, Turbo Debt’s process can negatively impact credit scores and may expose consumers to lawsuits from creditors if payments are stopped as part of the settlement strategy. Some customers seem unaware of these risks before enrolling.

Turbo Debt has the following disclaimer in the footer of its website:

“The use of debt settlement services will likely adversely affect your creditworthiness, may result in you being subject to collections or being sued by creditors or collectors and may increase the outstanding balances of your enrolled accounts due to the accrual of fees and interest.”

The company also states that they don’t guarantee your debts will be lowered by a particular percentage or amount or that you’ll be debt-free within a specific timeframe.

Turbo Debt is Better Business Bureau (BBB) accredited and has an “A+” rating. (See our review of whether the BBB is a scam).

The company received 80 complaints on the BBB website in the last three years, 28 of which have been closed in the past 12 months.

Turbo Debt terms of service

In its terms of service, Turbo Debt states that it provides the service without warranties and limits its liability for virtually all damages, even if caused by its own service issues. This means that if their site, advice, or service leads to financial harm, your ability to recover damages is limited.

It can also alter the terms without notice, and your continued use counts as acceptance.

All disputes must be resolved through binding arbitration on an individual basis (no jury trials or class actions), unless you opt out within 30 days in writing. This significantly limits legal options.

Turbo Debt Security

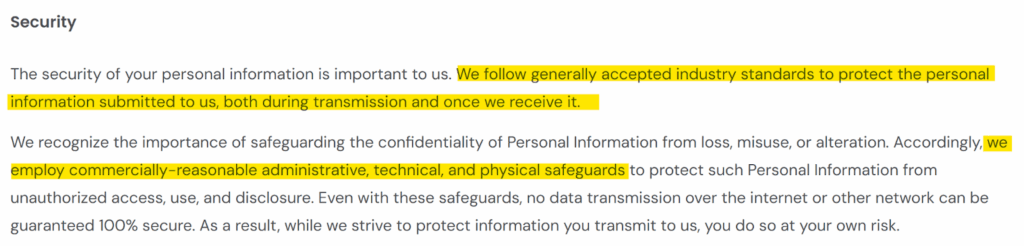

We couldn’t find much information about Turbo Debt’s security measures.

In its privacy policy, the company says it follows “generally accepted industry standards” and employs “commercially reasonable administrative, technical, and physical safeguards” to protect customers’ personal information.

Turbo Debt Privacy

Turbo Debt explains the kind of data it collects, for what purposes, and with whom it shares it in its privacy policy.

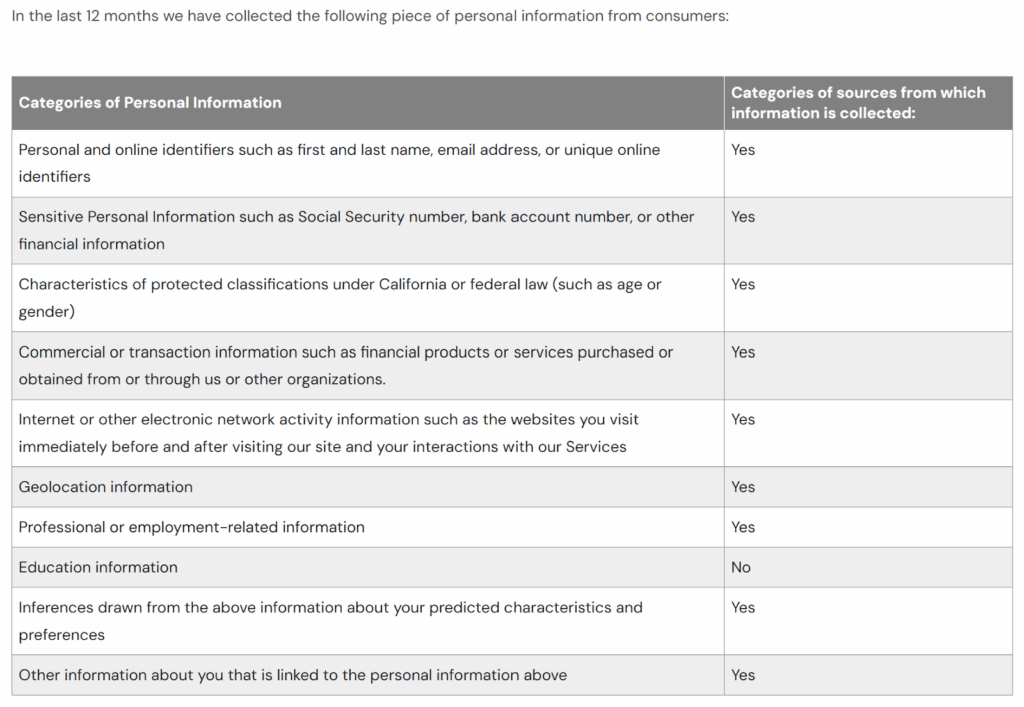

It collects the following personal information:

- Contact information, such as your name, mailing address, email address, phone number, and any other personal details you choose to share with them.

- Information you share when you subscribe to the Turbo Debt mailing list, such as name, email address, and company name.

- Financial information, such as bank accounts, credit information, credit accounts, income, employment records, and other details about your financial situation.

- Communications, such as communications with your credit or debt collections, contractual agreements, and phone conversations.

- Social media information, such as the information shared on your social media accounts or public comments.

- Log data, including your IP address, browser type and settings, and how you interacted with the Turbo Debt website.

- Usage data, including the types of content you view or engage with, time zone, country, and type of device.

- Cookie and tracking information.

- Data from other sources, such as debt settlement companies, credit reporting agencies, and advertising and marketing partners.

It uses this data to provide and improve its services, enroll you in their or partner programs, communicate offers, negotiate debts, comply with laws, market products, and protect security.

The company may purchase and combine marketing data from third parties to profile and target customers.

Turbo Debt shares your information with service providers, creditors, credit bureaus, payment processors, marketing companies, debt collectors, legal authorities, and in business transfers (e.g., mergers).

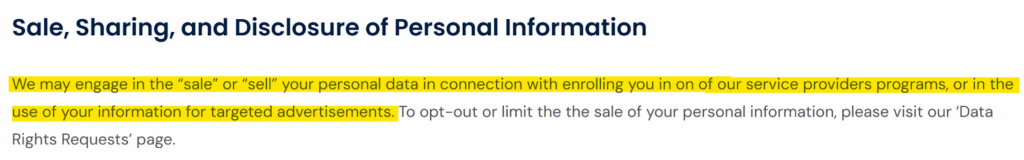

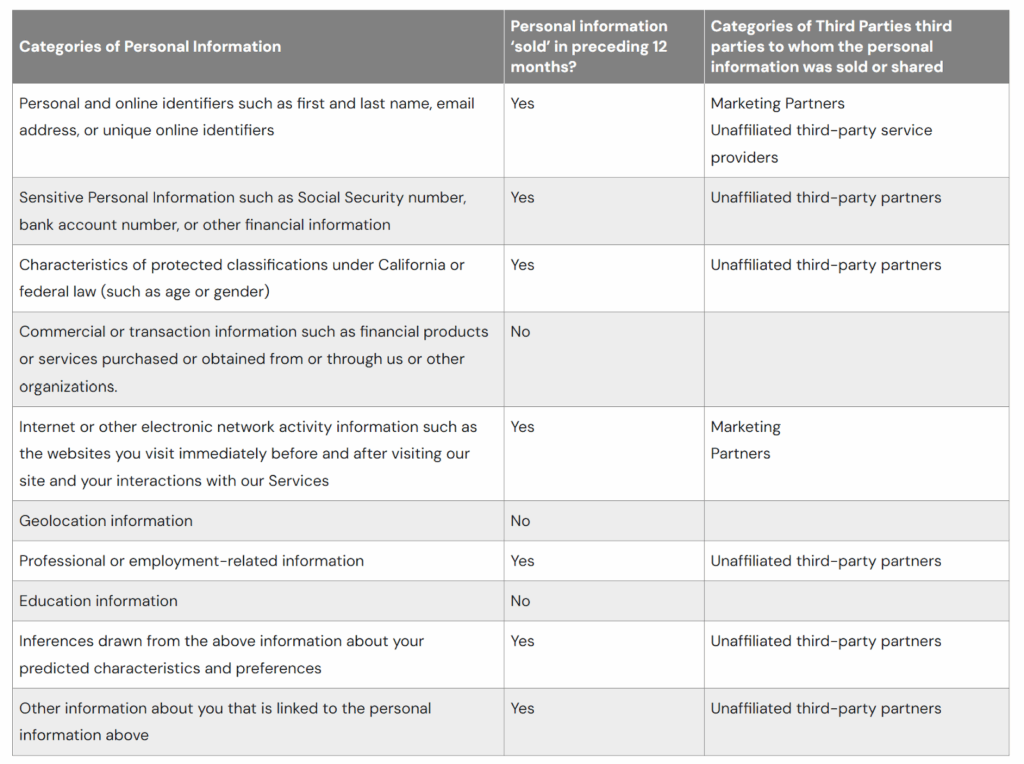

It engages in the sale/sharing of personal data for marketing and program enrollment purposes.

It sells/shares categories like personal identifiers, sensitive data, internet activity, and inferred characteristics to unaffiliated third-party partners.

The company states that it does not knowingly collect, sell, or share data from users under 16.

Turbo Debt retains your data for as long as necessary for services/legal obligations.

Depending on where you live, you may have the right to exercise certain privacy rights, such as the right to know, delete, correct, opt out of sale/sharing, and limit the use of sensitive information.

So, Should You Use Turbo Debt?

Depends on your debt situation and tolerance for financial and privacy risks.

Turbo Debt is not a scam, but it has high fees and doesn’t guarantee that debts will be reduced by a certain amount or settled at all.

It also collects, sells, and shares sensitive personal data with marketing partners.

How to Use Turbo Debt Safely and Privately

- Get everything in writing. Request a written outline that includes all fees and their charging schedules, the expected settlement timeline, the list of creditors to be contacted, and the potential impact on credit scores. Avoid agreeing to anything based on verbal promises, as they aren’t binding.

- Share only what’s necessary for your case. Don’t volunteer extra details (like multiple bank accounts) unless required.

- Use a dedicated email address for communications. This helps you avoid exposing your main inbox to spam from Turbo Debt’s marketing partners.

- Use a VOIP or secondary phone number for calls. Calls may be recorded, and contact information may be shared with third parties.

- Use Turbo Debt’s Data Rights Request page. Through it, you can opt out of the sale/sharing of your personal and sensitive data and limit the use of your sensitive info (like SSN or bank account details) to only what’s needed for service.

- Turn off targeted advertising cookies. Through Turbo Debt’s cookie preferences center.

- Request a copy of all data Turbo Debt has on you. That way, you can see exactly what’s being stored.

- Opt out of the arbitration clause. If you don’t want to give up your right to sue, opt out of the arbitration clause in writing within 30 days of signing up. Save proof of your opt-out request (certified mail or emailed PDF with timestamp).

- Monitor your credit and accounts. Expect a credit score drop and track changes via free reports at AnnualCreditReport.com. Watch for new collection activity or lawsuits from creditors once payments stop.

- Document every creditor communication. Doing so can be helpful in case of disputes.

- Have a backup plan. Decide in advance how long you’re willing to stay in the program before switching to another option.

Our privacy advisors:

- Continuously find and remove your sensitive data online

- Stop companies from selling your data – all year long

- Have removed 35M+ records

of personal data from the web

Save 10% on any individual and

family privacy plan

with code: BLOG10

news?

Don’t have the time?

DeleteMe is our premium privacy service that removes you from more than 750 data brokers like Whitepages, Spokeo, BeenVerified, plus many more.

Save 10% on DeleteMe when you use the code BLOG10.