Is Zelle a Scam?

Laura Martisiute

Reading time: 6 minutes

Table of Contents

If you’re thinking of using Zelle, you need to know: Is Zelle a scam?

Below, we explain whether Zelle is a scam and discuss some steps you can take to improve your safety when using this platform.

What Is Zelle?

Zelle provides bank-based peer-to-peer (P2P) transfers.

It is operated by Early Warning Services (a private financial services company), owned by seven major US banks.

With Zelle, you can send and receive money using your bank account, usually just with an email address or mobile phone number.

No separate app is needed. Zelle works via most bank apps (you can see a complete list of participating banks here). Transfers typically go through in minutes, provided both you and the recipient are enrolled in Zelle.

There are usually no fees with Zelle (i.e., Zelle doesn’t charge any fees, and neither do most banks for letting you use this service).

It’s often used for sending money to other individuals for scenarios like splitting dinner, paying rent, or paying back a friend. Once sent, transfers are typically irreversible.

Zelle is available in the US only.

Until early 2025, Zelle had a standalone app. It has now been discontinued. To use Zelle, you need to enroll at a bank/credit union offering it.

Is Zelle a Scam?

No, Zelle is not a scam. It’s a legitimate digital payment network popular in the US.

It gets fairly positive reviews from third-party sites.

For example, a PCMag review of Zelle from 2020 gives the service a rating of 4.0 out of 5.0 (“Excellent”). A TechRadar review from the same year gives Zelle a rating of 3.5 out of 5.0.

Zelle gets mixed reviews from users:

- 1.1 out of 5.0 stars (from 1,044 reviews) on Trustpilot.

- 4.1 out of 5.0 stars (from 161,817 reviews) on Google Play.

- 4.8 out of 5.0 stars (from 599,136 reviews) on the App Store.

- 1.5 out of 5.0 stars (from 557 reviews) on Pissed Consumer.

On online forums like Reddit, most people report having had a positive experience with Zelle.

One person said: “I have been using zelle through my banking app for years to send money to my wife for bills every payday. It’s never taken more than a couple of minutes to transfer to her account.”

However, there are some posts from people saying their money “vanished” and that they were locked out of their accounts when using Zelle.

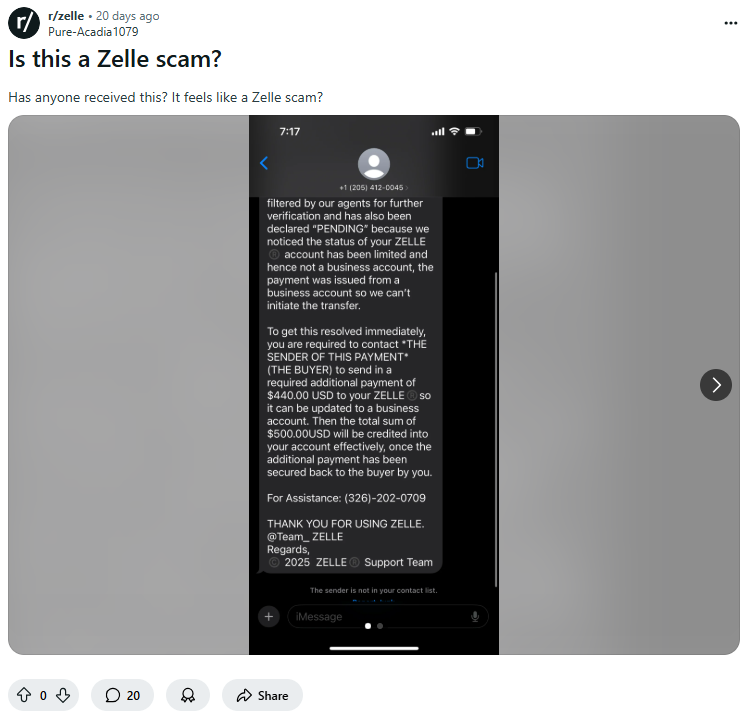

Zelle has its own subreddit where users can post questions, answers, and experiences.

Security

Zelle has several security measures in place.

For instance, it uses bank-level encryption and sends money directly between linked bank accounts, reducing the risk of account hacks.

Participating banks typically use tools to flag suspicious activity and may offer fingerprint or facial recognition security.

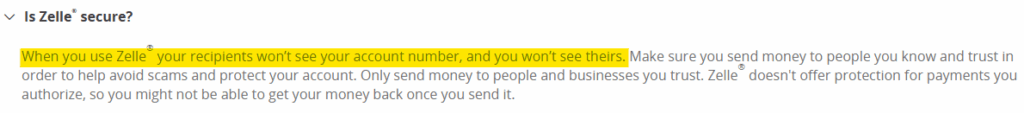

Also, no account numbers are shared. As per JPMorgan Chase’s (one of the banks that participate in Zelle) website, when you use Zelle, the recipient won’t see your account number (you won’t see theirs, either).

You can’t cancel a Zelle transfer. This means it’s on you to make sure that the details (e.g., recipient, sum of money, etc.) you’ve entered are correct and that the person you’re sending the money to is legitimate and will not try to scam you.

If you’re buying something from someone online, and you’re not 100% sure about the person, you may want to use another payment method, like a credit card, so you have recourse in case things go wrong and you don’t get your product/service.

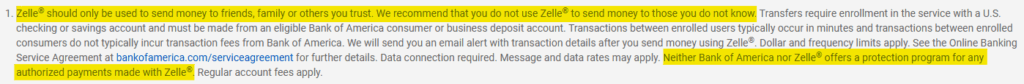

As Bank of America (one of the banks participating in Zelle) says, “Neither Bank of America nor Zelle® offers a protection program for any authorized payments made with Zelle.”

This is one of the reasons why the money expert Clark Howard does not like Zelle.

If a criminal gains access to your account, the bank typically restores your funds. Howard says, “But the banks are tying people’s accounts into Zelle, because their interpretation of the law is they don’t have to do that and for any fraud that occurs, it’s just too bad, so sad.”

A 2024 Consumer Financial Protection Bureau (CFPB) lawsuit alleged that Zelle skipped important safety features when developing the app. The lawsuit also said hundreds of thousands of people who filed fraud complaints were told to contact fraudsters themselves. Over seven years, customers reportedly lost more than $870 million due to these failures.

The CFPB has since dropped the suit.

As you can imagine, scammers love Zelle. There are countless reports from people online about their encounters with Zelle scams.

Things are so bad that JPMorgan Chase has a new policy that says it can block Zelle transactions, which it thinks come from social media, to protect customers from scammers.

Privacy

Zelle’s privacy policy only applies to its app, which has been discontinued as of 2025.

You should refer to your financial institution’s privacy policy if you use Zelle through online banking or mobile banking apps.

So, Should You Use Zelle?

Probably, but only to send money to people you know and trust.

The money expert Clark Howard also recommends using Zelle with a separate checking account that has a small amount of money in it. That way, you won’t lose all your money if you’re compromised.

How to Use Zelle Safely and Privately

- Only send money to people you trust. Zelle is meant for transacting with family, friends, and other people you know well. Once you make a transaction, you can’t cancel it.

- Double-check transaction details. Verify recipient details and the amount of money you’re sending. You can’t typically reverse Zelle transactions.

- Don’t click on any suspicious links. Only use Zelle through your bank’s app and avoid clicking on links in texts and emails claiming to be from Zelle.

- Secure your phone. Use a strong passcode and keep your phone’s OS and apps up-to-date.

- Don’t respond to “urgent” requests. Scammers often pretend to be from your bank or Zelle, and often use urgency to get you to do something, like “send money to verify your identity.” Your bank will never make these kinds of requests.

- Turn on two-factor authentication (2FA). Most banks offer 2FA, and it’s always a good idea to turn it on for an added layer of protection in case your password is ever leaked.

- Use secure networks. Never check financial data or make financial transactions over unsecured networks like public WiFi.

- Check transaction history. Review your financial transactions periodically to spot suspicious activity early.

- Delete the Zelle app. Now that the Zelle app has been discontinued, make sure to delete it from your phone.

Our privacy advisors:

- Continuously find and remove your sensitive data online

- Stop companies from selling your data – all year long

- Have removed 35M+ records

of personal data from the web

Save 10% on any individual and

family privacy plan

with code: BLOG10

news?

Don’t have the time?

DeleteMe is our premium privacy service that removes you from more than 750 data brokers like Whitepages, Spokeo, BeenVerified, plus many more.

Save 10% on DeleteMe when you use the code BLOG10.