How to Complete an Experian Opt Out Guide [+ Examples]

Julianne Subia

Reading time: 8 minutes

To opt out of Experian, follow our Experian opt-out guide below.

Experian offers “data-driven solutions for every industry” and is one of the three major credit reporting agencies in the US.

It collects, aggregates, and sells personal information about consumers to third parties, including credit histories, payment behaviors, and other financial data.

Businesses like lenders, landlords, and employers can use this data to assess creditworthiness, verify identities, and make informed decisions.

Here’s what we cover:

Table of Contents

For a quicker and easier alternative to manual opt outs, subscribe to DeleteMe.

What Is Experian?

Experian is a data broker.

Data brokers like Experian gather and consolidate personal information to produce credit scores, which are used to verify identities and evaluate risk for various services, including jobs, insurance policies, and loan approvals.

Having your personal information in data brokers’ databases increases your risk of data beaches, identity theft, and other threats.

If you think Experian has your personal Information, chances are, so does Instant Checkmate. Want to opt out of Instant Checkmate? Read our Instant Checkmate opt-out guide.

How to Opt Out of Experian

Opt out of Experian in 5 steps.

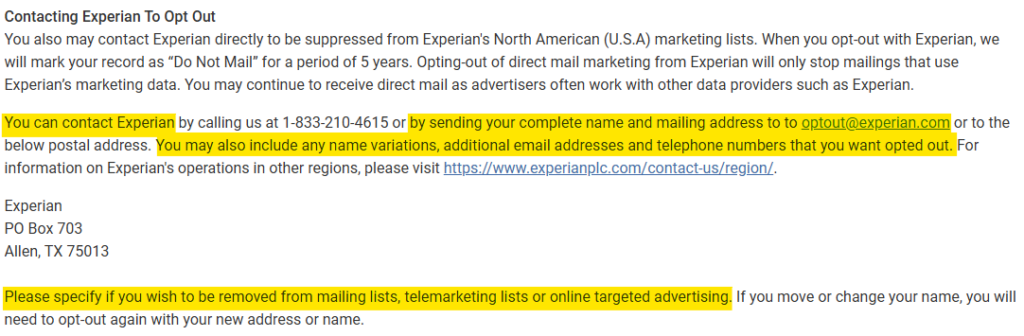

1. Opt out of direct mail, telemarketing, and online targeted advertising by sending an email to optout@experian.com

To opt out of direct mail, telemarketing, and/or online targeted advertising, email optout@experian.com.

Include the following information in your email:

- Direct mail opt-out & online targeted advertising. Include your full name and mailing address. You can also include any name variations and additional email addresses and phone numbers you want Experian to opt out.

- Telemarketing opt out. Include your full name, name variations, mailing address, phone number (including area code), and email address.

In your email, specify whether you want to be opted out from Experian mailing lists, telemarketing lists, or online targeted advertising.

You can ask to be opted out of all three in one email; just make sure to include all relevant information.

If you move or change your name, you will need to opt out again.

Experian opt-outs last five years. After five years, you will need to opt out again.

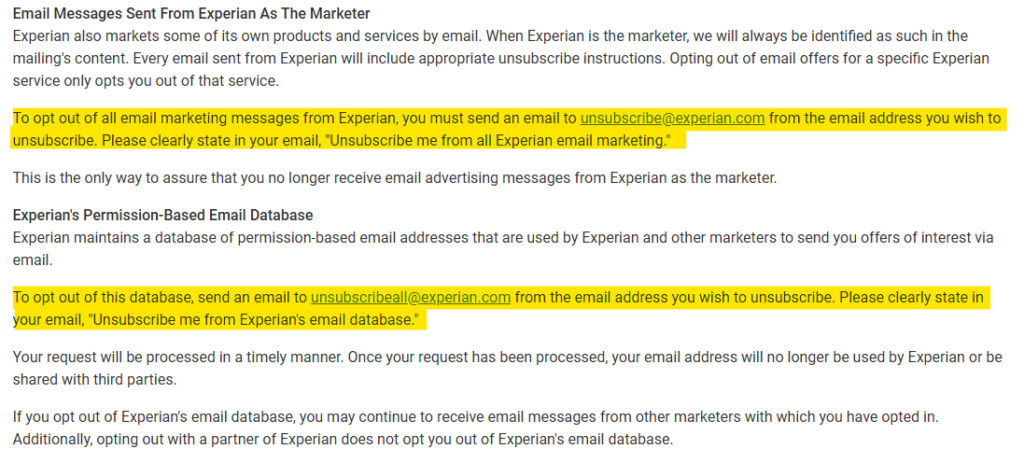

2. Opt out of email marketing by sending an email to unsubscribe@experian.com

To opt out of email marketing, you need to email unsubscribe@experian.com from the email address you want to unsubscribe.

Make sure to unsubscribe from both Experian email marketing and Experian’s permission-based email database, which Experian and other marketers use.

In your email, state both of the following:

- Unsubscribe me from all Experian email marketing.

- Unsubscribe me from Experian’s email database.

Note: If you want to opt out more than one email address, you’ll need to send a separate request from each email address.

3. Opt out of Experian’s Partner Programs

Go to Experian’s Partner Opt Out page: https://www.experian.com/privacy/partner-opt-out.

Click the “Click here” link under ‘Make An Informed Choice.’

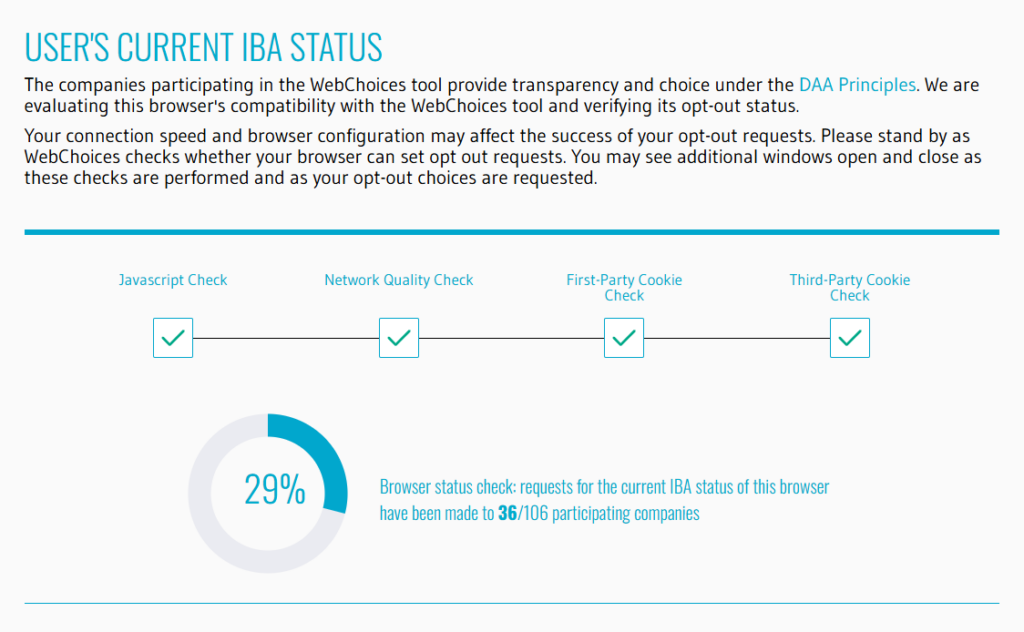

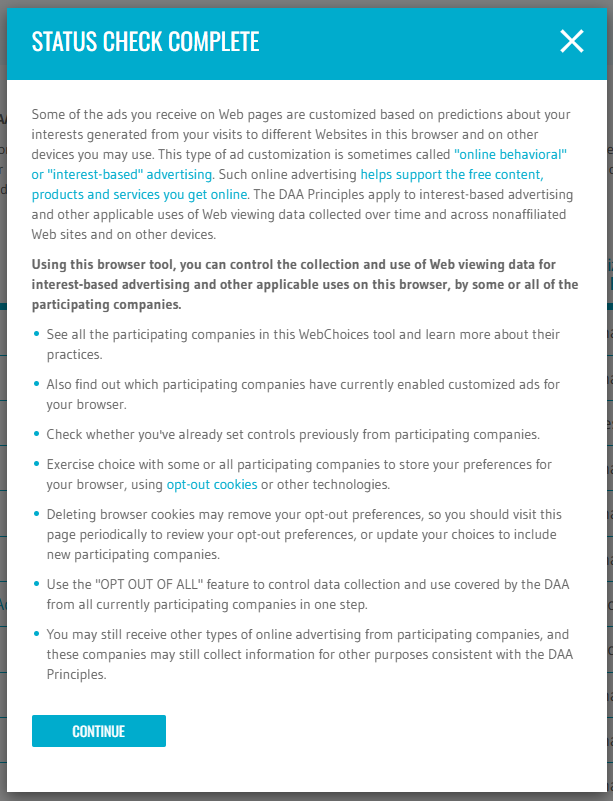

You will be redirected to a page that will check your browser’s compatibility with the WebChoices tool (which lets you mass opt out of cookies) and verify your opt-out status.

Once the status check is complete, click the “Continue” button.

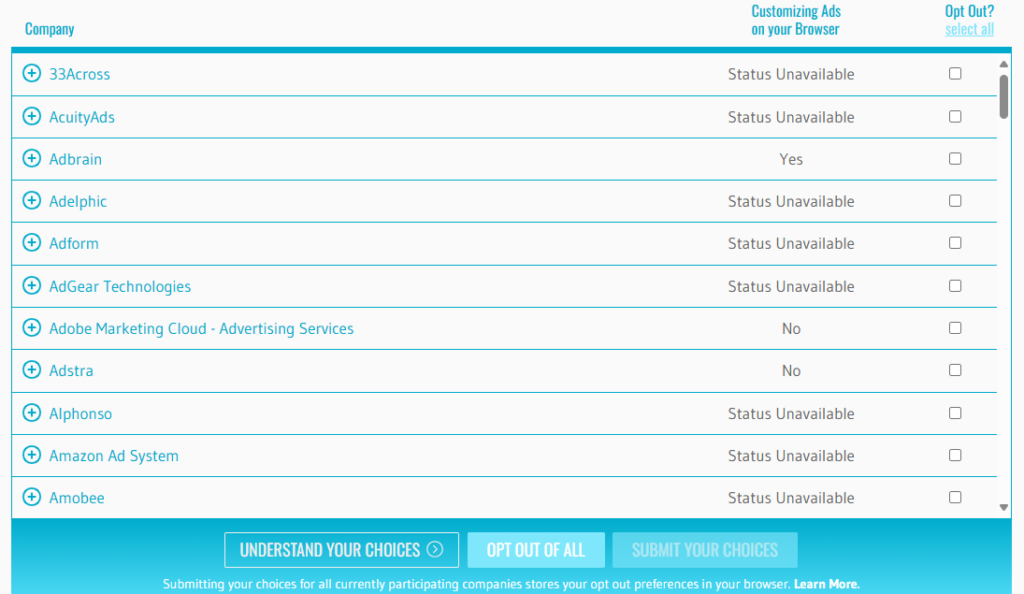

Click the checkbox beside the company you want to opt out of. Or, click “select all” at the top to opt out from all participating companies.

Click the “Submit Your Choices” button.

Next, you will see a page saying that your opt-out choices are being requested. This may take a few minutes.

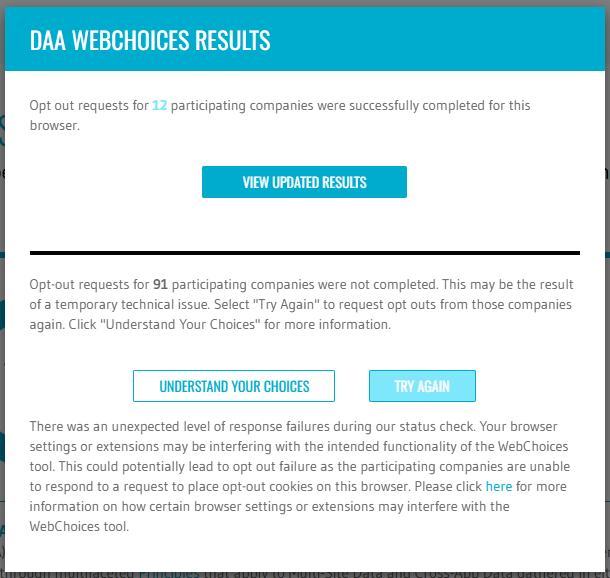

You’ll see a screen saying how many opt-out requests were successfully completed.

If you see that some opt-out requests were not completed, click the “Try Again” button.

Click “View Updates Results” to see which companies you opted out of.

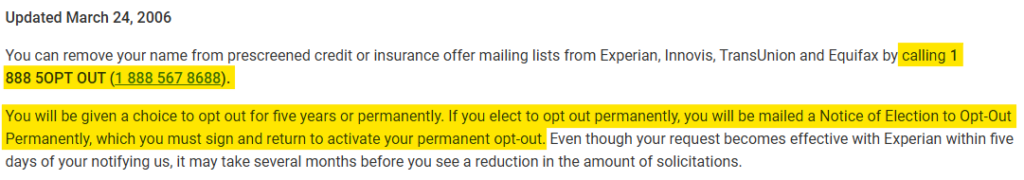

4. Opt out of Preapproved offers by calling 1 888 5OPT OUT (1 888 567 8688) OR completing a form through OptOutPrescreen.com

Call 1 888 5OPT OUT (1 888 567 8688) to opt out of preapproved offers.

You can opt out for five years or permanently.

If you choose to opt out permanently, Experian will mail you a Notice of Election to Opt-Out Permanently, which you’ll need to sign and return to Experian.

Note: Your opt-out request will become effective five days after you notify Experian, BUT it might take a few months before you see a reduction in how many solicitations you get.

As an alternative to calling Experian, you can also opt out of preapproved offers by filling out an online form on OptOutPrescreen.com.

To do that, go to https://www.optoutprescreen.com/.

Scroll to the bottom of the page and click “Click Here to Opt-In or Opt-Out.”

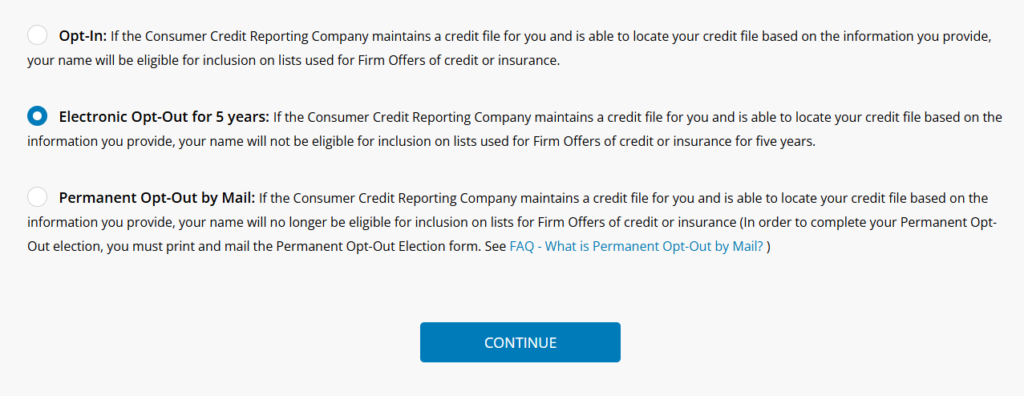

Scroll down and click “Electronic Opt-Out for 5 years.”

Click the “Continue” button.

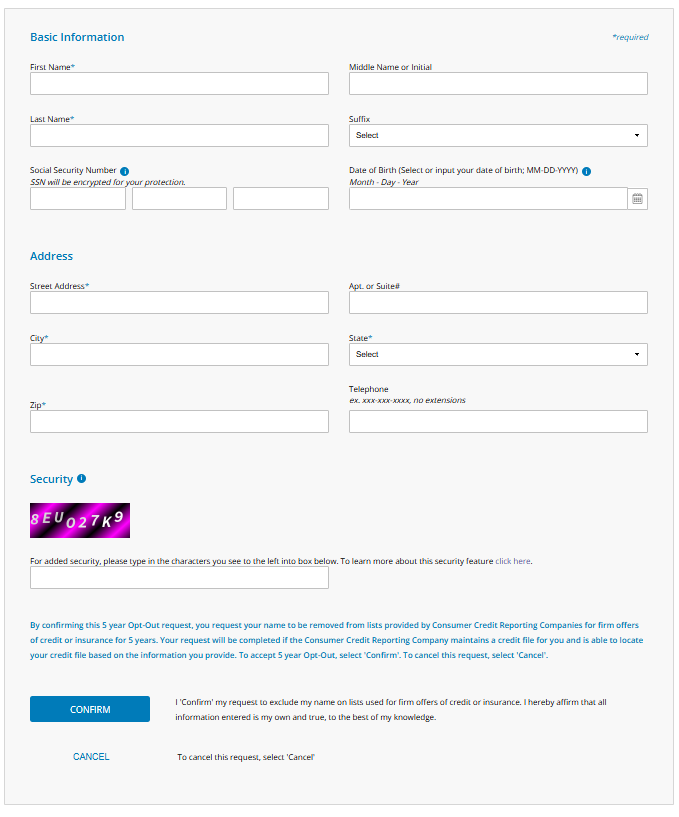

Fill out the form.

Enter your first name, last name, and address.

The other fields are optional.

Complete the security question.

Click the “Confirm” button.

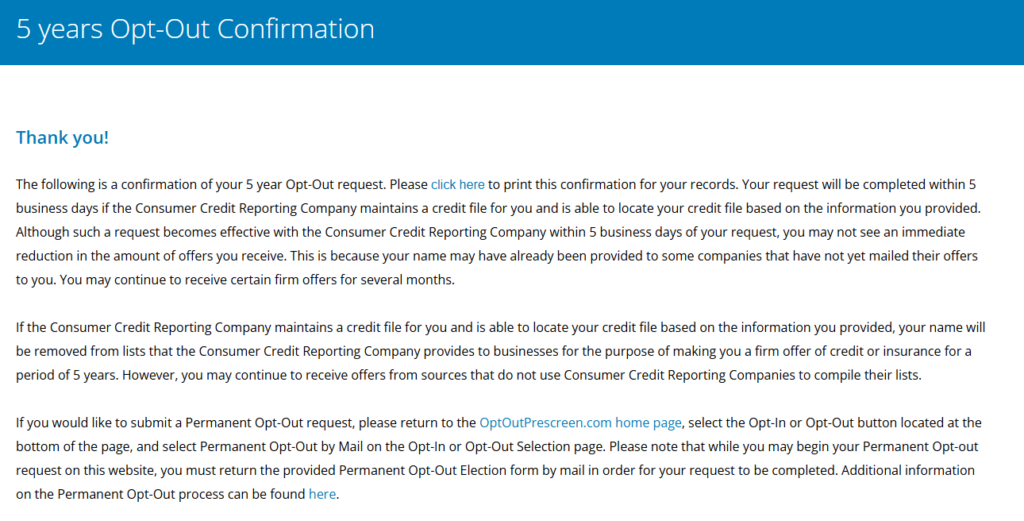

Your 5-year opt-out request was submitted.

If Experian maintains a credit file for you and can locate your credit file based on the information you provided in the form above, they will remove you from their list for five years.

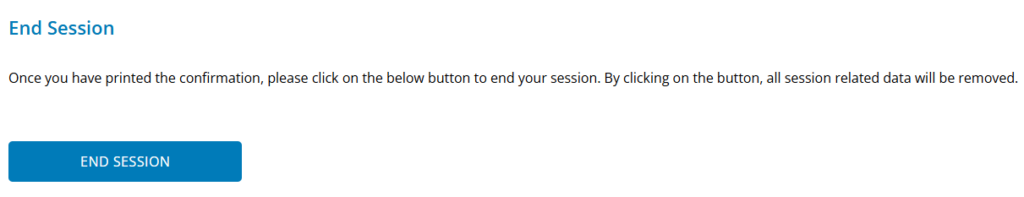

Make sure to scroll down to the bottom of the confirmation page and click the “End Session” button.

5. Opt out of Experian’s affiliate Tapad

To opt out of Experian affiliate Tapad, go to https://crportal.tapad.com/#/.

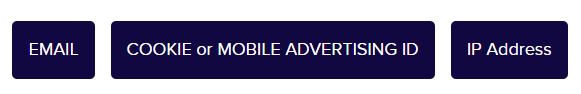

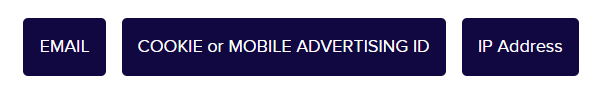

Scroll to the bottom of the page and click your preferred opt-out method.

To opt out of Tapad using your email, click the “Email” button.

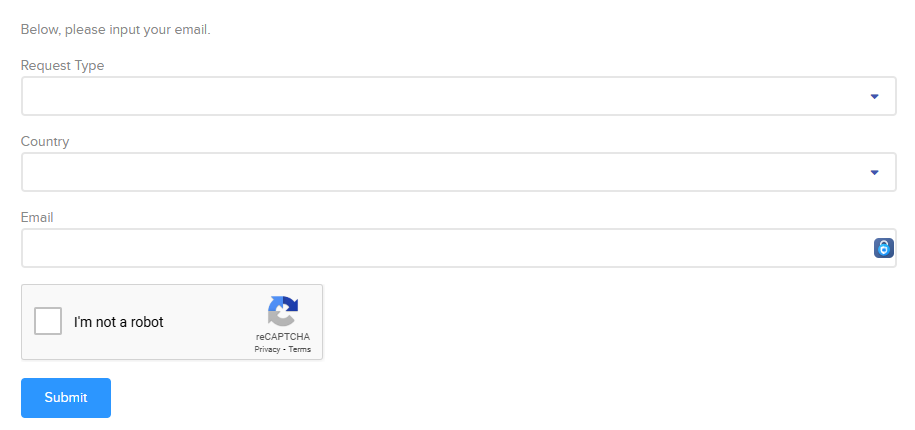

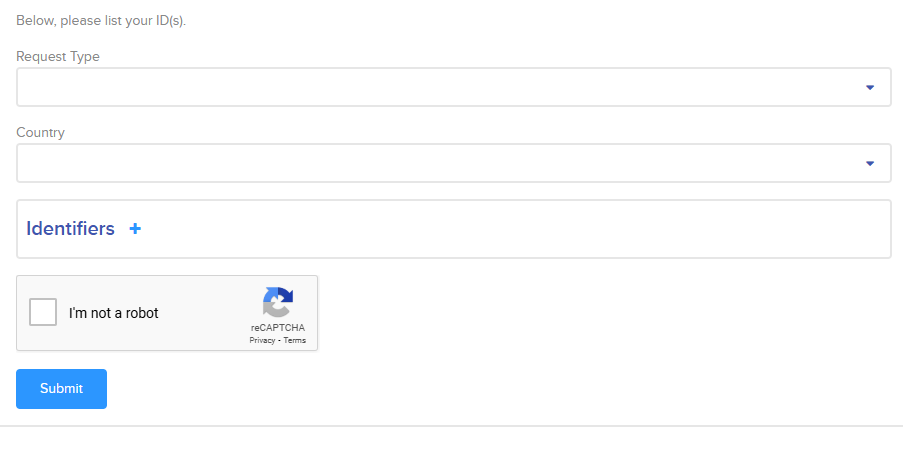

You will be redirected to an online form. Fill it out.

Select your request type.

Select your country.

Enter your email.

Click the “I’m not a robot” checkbox.

Click the “Submit” button.

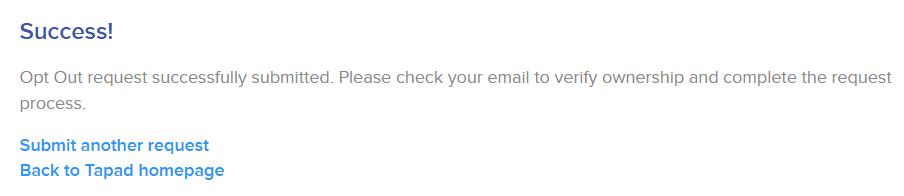

Your Tapad opt-out request was submitted, but you still need to click an email confirmation link.

Go to your email inbox and find the email from Tapad.

Note: If you don’t see the email from Tapad, check your spam folder.

Click the “Verify Email Address” button.

Your email was verified.

Cookie or mobile advertising ID

To opt out of Tapad using a cookie or mobile advertising ID, click “Cookie or Mobile Advertising ID.”

You will be redirected to an online form. Fill it out.

Select your request type.

Select your country.

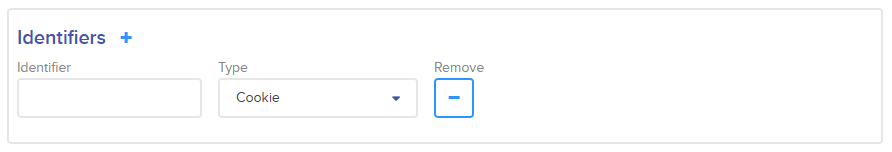

Click “+” beside ‘Identifiers’

Select your identifier type (cookie or MAID) and enter it.

Click the “I’m not a robot” checkbox.

Click the “Submit” button.

Your Tapad opt-out request was submitted.

Note: Opt outs are dependent on recognition of your IDs. To stay opted out, you must not clear or delete your cookies or reset your mobile advertising ID.

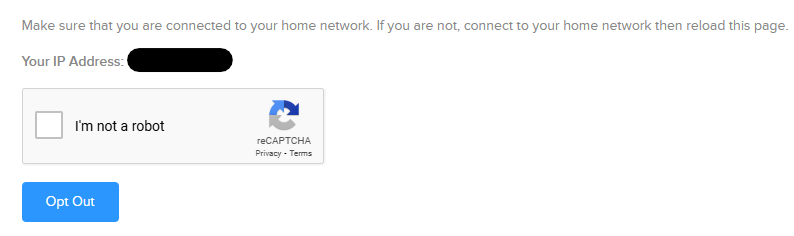

IP address

To opt out of Tapad using a cookie or mobile advertising ID, click “IP Address.”

Click the “I’m not a robot” checkbox.

Click the “Opt Out” button.

Your Tapad opt-out request was submitted.

Note: Tapad says that public IPv4 addresses infrequently rotate between households, so Tapad will opt out the IP address registered for the 12 months from when your request was submitted.

What Happens After You Opt Out of Experian?

What happens after you opt out of Experian depends on what you opt out of (email marketing, preapproved offers, etc.)

However, in most cases, Experian will not delete your information. According to Experian, doing so would mean that they would have no way of knowing your opt-out preferences.

For example, after you opt out of receiving direct mail, telemarketing, and targeted advertising, Experian will mark your record as “Do Not Target” for five years. After five years, you can renew your opt-out request by completing the opt-out process again.

Experian Opt Out FAQs

Here are some common questions people have about opting out of Experian.

Is Experian accurate?

As with any other data broker, the accuracy of Experian’s data can vary. Some data points may be 100% accurate, while other data points may not be accurate or may be out-of-date.

According to one research paper, non-white individuals are less likely to have accurate data: “Experian’s coverage and accuracy may have significant discrepancies across different races, with non-white individuals generally being less likely to be covered and having less accurate data.”

Is Experian safe?

Experian is safe in that visiting its official site is unlikely to infect you with malware.

However, the data Experian provides may not be 100% accurate. Depending on what it’s used for, it may not be safe.

Similarly, having your personal data in Experian’s databases can potentially put you at increased risk of identity theft and other threats.

Is Experian legit?

Yes, Experian is a legit data broker that collates information for reporting credit scores.

How can you talk to someone at Experian?

To contact Experian about privacy, you can write to:

Chief Privacy Officer

Compliance Department

Experian

475 Anton Blvd.

Costa Mesa, CA 92626.

To order your credit report, call 1 888 EXPERIAN (1 888 397 3742).

Our privacy advisors:

- Continuously find and remove your sensitive data online

- Stop companies from selling your data – all year long

- Have removed 35M+ records

of personal data from the web

Save 10% on any individual and

family privacy plan

with code: BLOG10

news?

Don’t have the time?

DeleteMe is our premium privacy service that removes you from more than 750 data brokers like Whitepages, Spokeo, BeenVerified, plus many more.

Save 10% on DeleteMe when you use the code BLOG10.