How to Complete a TransUnion Opt Out Guide [+ Examples]

Julianne Subia

Reading time: 7 minutes

Follow the guide below to learn how to complete a TransUnion opt out.

TransUnion is a credit reporting agency and data broker that reportedly has insights on around 98% of US adults.

You can remove your personal data from TransUnion by opting out. Keep on reading for step-by-step instructions on how to opt out of TransUnion.

Here’s what we cover:

Table of Contents

For a quicker and easier alternative to manual opt-outs, subscribe to DeleteMe.

What Is TransUnion?

TransUnion is a credit reporting agency.

It provides credit report data to clients in accordance with credit reporting and data privacy regulations.

TransUnion might share your data with companies for various purposes, including (but not limited to):

- Employment.

- Rental screening.

- Insurance underwriting.

TransUnion collects personal consumer data from various sources, including government entities, banks/credit unions, financial technology companies, marketing companies, insurance carriers, data brokers, etc.

You can opt out of TransUnion by completing an online form on its website.

If you think your information is on TransUnion, Innovis also probably has it. Want to opt out of Innovis? Read our Innovis opt-out guide.

How to Opt Out of TransUnion

Opt out of TransUnion in 4 steps.

1. Go to the TransUnion website and click “Your Privacy Choices”

Go to https://www.transunion.com/.

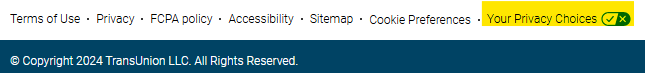

Scroll to the bottom of the page and click “Your Privacy Choices” in the footer.

2. Click “Begin Request”

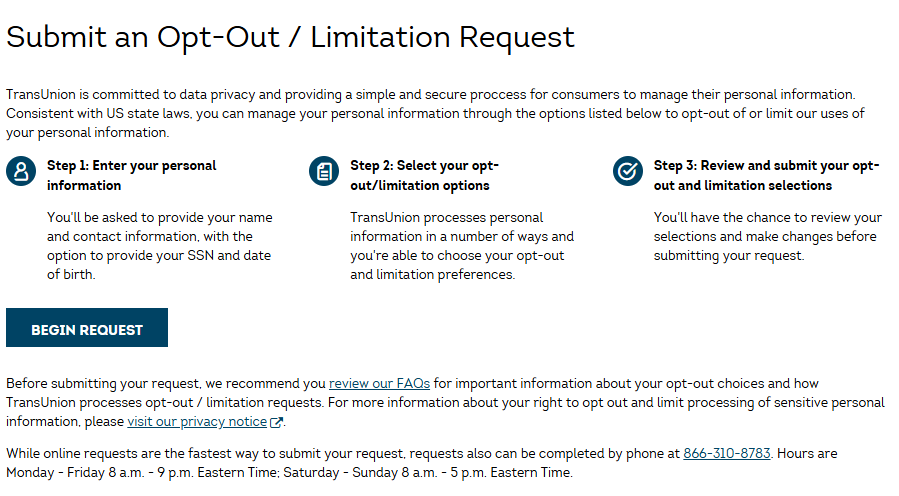

You will be redirected to a page with information on how to perform an opt-out/limitation request.

Click the “Begin Request” button.

3. Fill out the online form

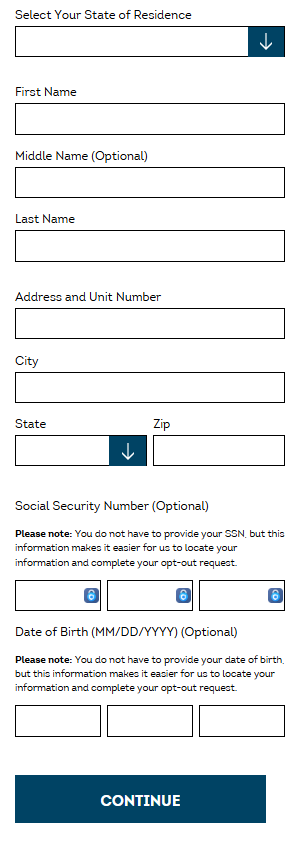

You will be redirected to an online form. Fill out all the mandatory fields.

Select your state of residence.

Enter your first name, last name, address, city, state, and zip.

The middle name field is optional.

The social security number and date of birth fields are also optional.

Click the “Continue” button.

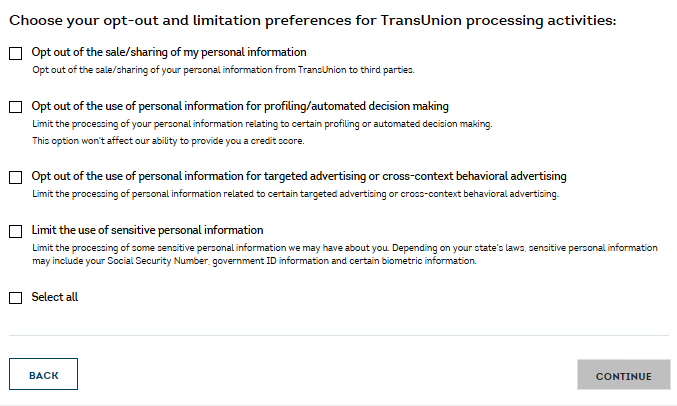

Choose your opt-out preference. You can select all options by clicking “Select all.”

Click the “Continue” button.

4. Review and submit your request

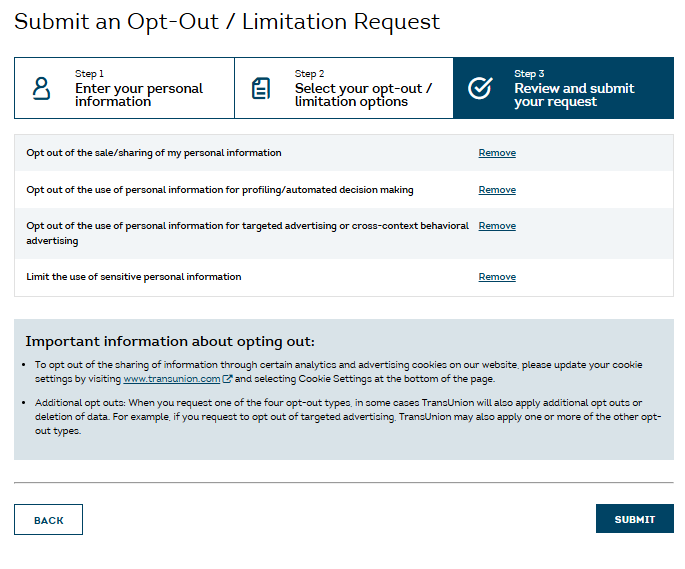

You will be redirected to a page where you can review your opt-out request.

If you are happy with the request, click the “Submit” button.

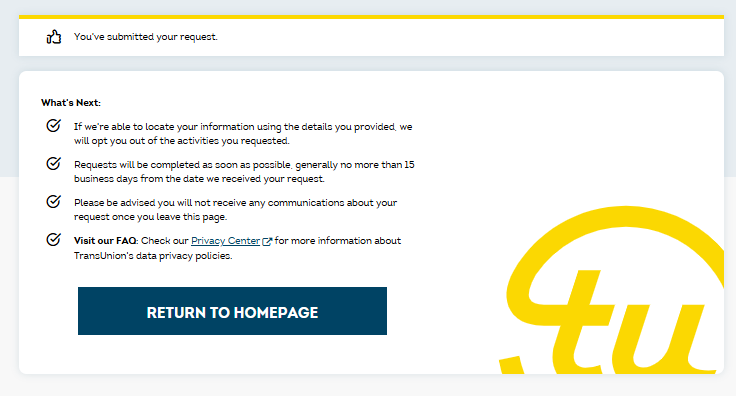

Your TransUnion opt-out request was submitted.

Other Methods to Opt Out of TransUnion

You can also opt out of TransUnion by phone. Call 866-310-8783 Monday – Friday 8 am – 9 pm Eastern Time or Saturday – Sunday 8 am – 5 pm Eastern Time.

What Happens After You Opt Out of TransUnion?

Once you opt out of TransUnion, they will attempt to locate your information using the details you provided when filling out the online opt-out form.

If TransUnion locates your information, they will complete your request as soon as possible, usually within no more than 15 business days from when they receive your request.

You will not receive any communications about your TransUnion opt-out request from TransUnion (unless you create an account with them).

TransUnion Opt Out FAQs

Here are some common questions people have about opting out of TransUnion.

Is TransUnion legit?

Yes, TransUnion is a legitimate credit reporting agency and one of the three major agencies in the US (alongside Equifax and Experian).

The agency collects and maintains consumer credit information, which it uses to create credit reports and scores that are used by lenders, landlords, employers, and other entities to assess an individual’s creditworthiness and financial reliability.

What is TransUnion credit score?

A TransUnion credit score is a numerical representation of an individual’s creditworthiness calculated by TransUnion.

TransUnion has a blog post on what factors go into its credit score. These factors include age and credit mix, payment history, utilization, balances, new credit, and available credit.

What’s the difference between TransUnion and Equifax?

The main difference between TransUnion and Equifax is that although they’re both major credit reporting agencies, they use different scoring models. This means that your credit score at TransUnion will likely differ from your credit score at Equifax.

Is TransUnion free for credit report?

Yes, like the other two major reporting agencies, TransUnion offers free credit reports.

By federal law, you’re entitled to one free credit report each year from each of the three major credit bureaus.

Currently, you can also actually get free weekly reports through https://www.annualcreditreport.com/, which the agencies created as a one-stop-shop for consumers to review their reports regularly.

What Is TransUnion credit score used for?

A TransUnion credit score is a numerical representation of an individual’s creditworthiness based on their credit history and financial behavior.

It is used to determine your creditworthiness by landlords, credit card companies, mortgage lenders, and others deciding whether they should extend your credit.

How often does TransUnion update?

According to TransUnion, credit reports are updated whenever lenders provide new information to the agency. Typically, this happens every 30-45 days.

Your credit scores can change several times a month based on updates from your active credit accounts. When lenders send new information to credit bureaus, it’s added to your credit reports right away, which can affect your scores.

Is TransUnion accurate?

Not always. There are plenty of posts online from people who have experienced TransUnion reporting incorrect information.

This doesn’t just apply to TransUnion – reports from other credit reporting agencies may also contain inaccurate or incorrect data.

While TransUnion collects information from various sources and uses algorithms and data verification processes to ensure the information is as accurate as possible, reporting mistakes by lenders and identity mix-ups can still occur. In other cases, resolved disputes or closed accounts may not be updated fast enough, affecting your credit score.

As a result, it’s a good idea to check your TransUnion (and other agencies’) report. If you notice any mistakes, you can dispute a credit report. TransUnion has a page on how to do so.

Is Equifax or TransUnion more accurate?

That probably differs between individuals. The reason why is that accuracy can vary based on individual circumstances and the specific information each credit reporting agency collects.

How to contact TransUnion?

You can contact the TransUnion Consumer Relations Department at 800-916-8800.

If you want to opt out of TransUnion, you don’t need to contact the agency – you can opt out online. See our TransUnion opt-out guide for step-by-step instructions.

What banks pull from TransUnion?

According to consumer experiences, banks that pull from TransUnion include Barclays, Chase, Bank of America, and US Bank, among others. See a more detailed list here.

Is TransUnion safe?

Yes, TransUnion is as safe as any of the other two major credit reporting agencies.

Its privacy policy says it has a “comprehensive information security program […] designed to protect the confidentiality, integrity, and accessibility of personal information.”

That said, TransUnion has experienced security breaches in the past. For example, in 2022, hackers breached a server in TransUnion’s South African division, accessing individuals’ personal information.

Who uses TransUnion?

TransUnion is used by a range of individuals and organizations, including but not limited to banks, credit card companies, landlords, property managers, insurance companies, and employers.

Our privacy advisors:

- Continuously find and remove your sensitive data online

- Stop companies from selling your data – all year long

- Have removed 35M+ records

of personal data from the web

Save 10% on any individual and

family privacy plan

with code: BLOG10

news?

Don’t have the time?

DeleteMe is our premium privacy service that removes you from more than 750 data brokers like Whitepages, Spokeo, BeenVerified, plus many more.

Save 10% on DeleteMe when you use the code BLOG10.