Table of Contents

Have you moved into a new home and suddenly seen the amount of mail you receive skyrocket? It’s mortgage junk mail and it can be overwhelming.

While it should be an exciting occasion for you, companies will take it as an opportunity to try to sell you everything from homeowners insurance to interior renovations. Unfortunately, it’s also not uncommon for fraudsters to try to benefit from this situation as well.

Luckily, this guide will teach you how to stop mortgage junk mail for good, and how to protect your home address information from ending up in the wrong hands.

Why are you receiving so much mortgage junk mail?

The main reason you start receiving more mail after closing on a new home is because the information on your mortgage goes public, including name, address, and loan amount.

Once that information is available, companies called data brokers collect it, bundle it with the rest of your personal data they’ve acquired, and then sell it forward to the highest bidding companies or individuals.

There are a number of different solicitors interested in your information, all who will jump at the chance to send you junk mail when you’ve moved into your new home.

1. Businesses targeting new homeowners

Businesses whose target consumers are new homeowners spend a lot of money to reach people like you and they usually do so by buying your information from data brokers.

These might be agencies offering mortgage protection insurance (MPI), credit offers, renovation services, or other products and services that are relevant for new homeowners.

2. Local companies seeking new customers

Local businesses often purchase consumer information in order to target neighborhoods where they provide services.

These could include anything from local restaurants to home maintenance companies operating close to your new home.

3. Fraudsters trying to scam you

Sadly, many scammers also end up with your information. They might send you official-looking mail, posing as your mortgage provider or other legitimate institutions.

They will use tactics and language to try to convey a sense of urgency, to get you to contact them so they can gain access to more of your sensitive personal information.

If you receive any suspicious-looking mail, report it immediately and never call any listed phone number that might be provided in these mailings.

What are tools to stop receiving mortgage junk mail?

The deluge of mortgage junk mail can become a nuisance very quickly, certainly, but it can also be a privacy threat.

Here are some simple steps you can take to stop mortgage junk mail effectively and protect your personal information.

1. Contact the companies directly

Contacting companies that are already sending you unwanted mail directly is a great initial step to take action to make them stop.

These are few different ways you can do this:

- Go to the company website for information about a mailing list removal process

- Call the organization who is sending the mail and request an opt out directly

- Request an opt out via email

- Request an opt out via traditional mail

2. Opt out from all direct mail through DMAchoice

Register at DMAchoice to stop your information from ending up on new mailing lists. This non-profit organization is run by the Data & Marketing Association (DMA) and allows you to customize your direct mail preferences and opt-out from entire direct-mail categories.

The process is simple:

1. Visit DMAchoice website and fill out the initial intake form.

2. Pay the $2 processing fee.

3. Tailor your mail preferences to opt out from mail you no longer wish to receive.

After your registration is confirmed, your name and address will not be added to any new mailing lists for 10 years.

But keep in mind, this service only helps prevent your information ending up on any new mailing lists.

3. Opt out from credit offers

One type of mail that fills up your mailbox after applying for a mortgage are credit offers. But, thankfully, there’s a simple solution to stop all credit card junk mail.

OptOutPrescreen is a centralized service run by major credit bureaus Equifax, Experian, Innovis, and TransUnion.

It’s actually these credit bureaus that sell your data to the credit card issuers sending you tons of pre-approved offers in the first place. So, utilizing OptOutPrescreen can help stop the credit card issuers from getting their hands on your address.

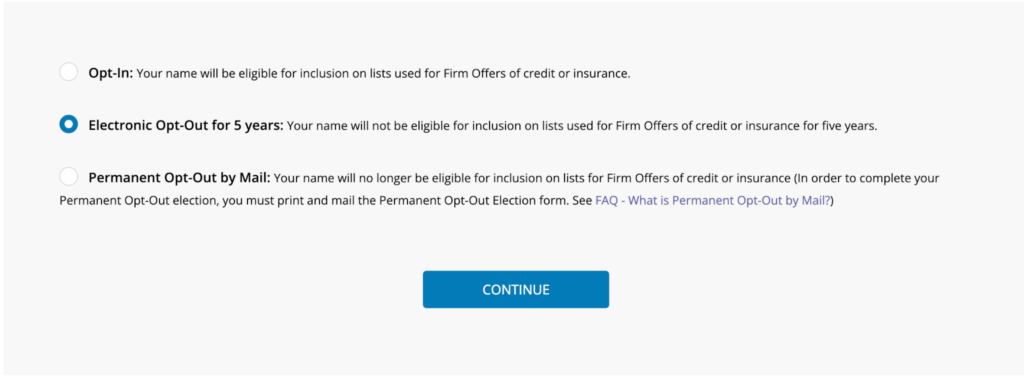

The site offers two options for credit card mail opt out: “5-Year Opt Out” or “Permanent Opt Out.”

Option 1: 5-Year Opt Out

To proceed with a 5-Year Opt Out, either call 1-888-5-OPT-OUT (1-888-567-8688) or fill out a form online.

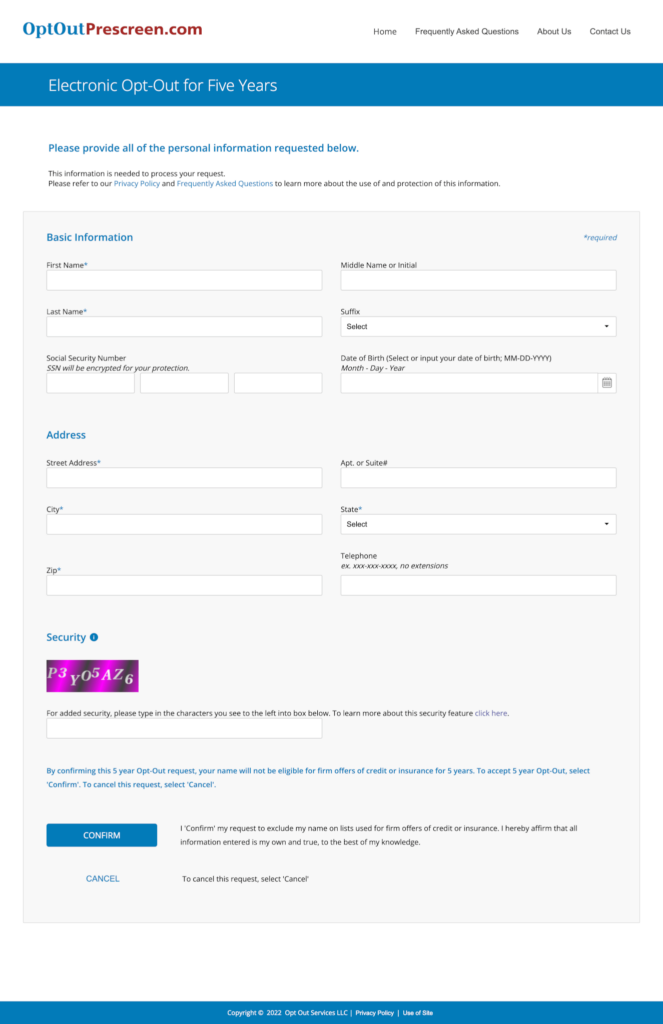

This is how the online process works:

1. Go to optoutprescreen.com and scroll down the page to click the “Click Here To Opt-In Or Opt-Out” button.

2. Choose “Electronic Opt-Out for 5 years” and click “Continue.”

3. Fill in your personal information, perform the CAPTCHA, then click “Confirm.” (Note: providing SSN, DOB, and phone number are all voluntary fields and not required to process your request.)

Option 2: Permanent Opt-Out

Either call 1-888-5-OPT-OUT (1-888-567-8688) or fill out the form online to select the option for the Permanent Opt Out.

- Go to optoutprescreen.com and scroll down the page to click “Click Here To Opt-In Or Opt-Out.”

- Choose “Permanent Opt-Out by Mail” and click “Continue.”

- Fill out your information, perform the CAPTCHA, and click “Confirm.” (Again note that certain fields pertaining to personal information are voluntary.)

- Print out and sign the document.

- Mail the document to this address: Opt-Out Department, P.O. Box 530200, Atlanta, GA 30353

3. Opt out from Data Brokers

Any and all of these options are effective in their own way, but at the end of the day the reason you’re receiving so much mortgage junk mail is because of data brokers.

The only effective method to make it stop is to opt out from all data broker databases. This way you can prevent your information from being sold in the first place.

So how do you do that? Well, you’d need to opt out from every single data broker individually. We can provide you with our free opt-out guide to show you how.

The problem is, with over 500 data brokers, that can be a very time-consuming process. Even worse, these companies are notorious for relisting your information every few months.

The good news is that hard work is worth the trouble. Opting out from data brokers won’t only stop mortgage junk mail, it also protects your online privacy from other telemarketers, spammers, and scammers, prevents identity theft, and reduces other junk mail.

How can DeleteMe help you stop mortgage junk mail?

If manually removing yourself from each and every data-broker site is simply not an option for you due to lack of time, the best option is to sign up for our service at DeleteMe.

Here at DeleteMe, we’re experts at removing your personal data from the Internet. When you sign up, our privacy experts use sophisticated AI to identify and scrub your personal data from all data-broker platforms and other online sources of personally identifiable information (PII). Every few months, we’ll conduct a formal review to make sure your data remains safe.

Our plans start at just $10.75 a month.

Stop mortgage junk mail and protect your home

If you follow all of these steps to opt out of mailing lists, and remove yourself from data-broker sites using DeleteMe, mortgage junk mail will stop within the next few months, guaranteed.

By taking these precautions, you keep your data safe, and, therefore, your home safe. Then you can sit back and relax, and enjoy your new home.

DeleteMe is our premium privacy service that removes you from more than 30 data brokers like Whitepages, Spokeo, BeenVerified, plus many more.

Save 10% on DeleteMe when you use the code BLOG10.

Our privacy advisors:

- Continuously find and remove your sensitive data online

- Stop companies from selling your data – all year long

- Have removed 35M+ records of personal data from the web

Save 10% on any individual and family privacy plan with code: BLOG10