The Fake Check Scam

Will Simonds

Reading time: 2 minutes

It starts with an unsolicited job offer and ends with you owing your bank thousands of dollars. The notorious fake check scam is one of the financial stings at the heart of phony employment fraud.

Weaponizing bank processing times to steal your money, scammers send you a check for “supplies” and instruct you to immediately wire back the excess funds—but when the check inevitably bounces days later, you are held responsible for every dollar you wired. Here is the mechanism behind this trap.

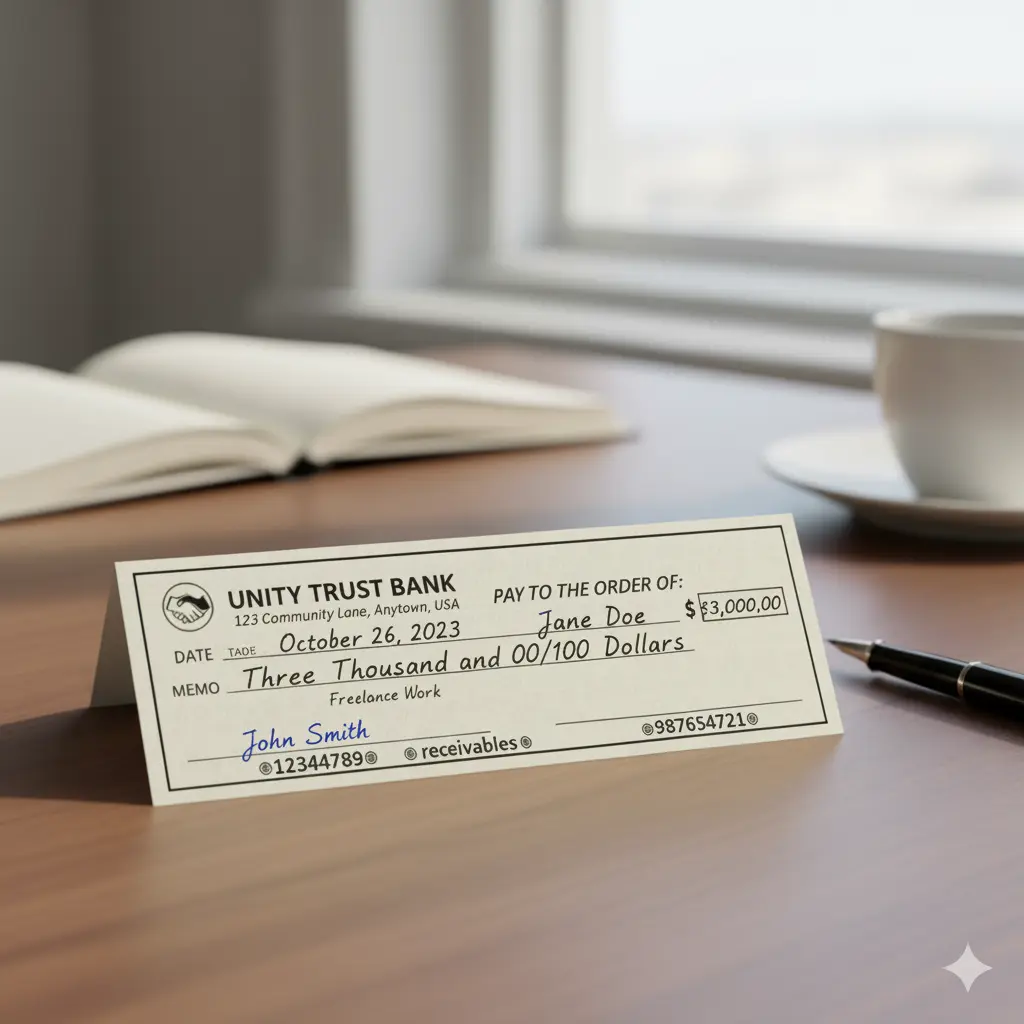

- The Premise: The scammer tells you they need to send you money to purchase supplies or software for the new job. They send you a check (or money order) for, say, $3,000.

- The Catch: The cost of the supplies is only $500. They instruct you to deposit the full $3,000, keep your $500 for the equipment, and immediately wire the remaining $2,500 to their “preferred vendor” (who is really the scammer).

- The Bank Hold Delay: When you deposit a check, banks are required by federal law (in the U.S.) to make the first $200–$500, or sometimes the full amount, available to you quickly, often within 24 hours. Crucially, “available” does not mean the check has officially cleared. It only means the bank is lending you the money based on the good faith that the check is valid.

- The Wire Transfer: Because the money is “available,” you are able to complete the wire transfer of $2,500 to the “vendor.” Wire transfers are immediate and often impossible to reverse.

- The Bounce: A few days to a week later, the bank discovers the check is fraudulent (fake, stolen, or drawn on a closed account). They reverse the deposit.

- Your Loss: The bank removes the full $3,000 from your account. Since you already wired away $2,500, you are left responsible for the $2,500 deficit. Your bank holds you accountable because you authorized the wire transfer.

So, the scammer capitalizes on the time delay between the bank making the funds available to the customer and the bank receiving official notification that the check is bad.

Written with assistance from AI.

Our privacy advisors:

- Continuously find and remove your sensitive data online

- Stop companies from selling your data – all year long

- Have removed 35M+ records

of personal data from the web

Save 10% on any individual and

family privacy plan

with code: BLOG10

news?

Don’t have the time?

DeleteMe is our premium privacy service that removes you from more than 750 data brokers like Whitepages, Spokeo, BeenVerified, plus many more.

Save 10% on DeleteMe when you use the code BLOG10.