Is Advance America a Scam?

Laura Martisiute

Reading time: 8 minutes

Table of Contents

If you’re thinking of using Advance America, you need to know whether it’s safe. Is Advance America a scam?

Below, we explain whether Advance America is a scam and discuss some steps you can take to improve your safety when using this payday-loan provider.

What is Advance America?

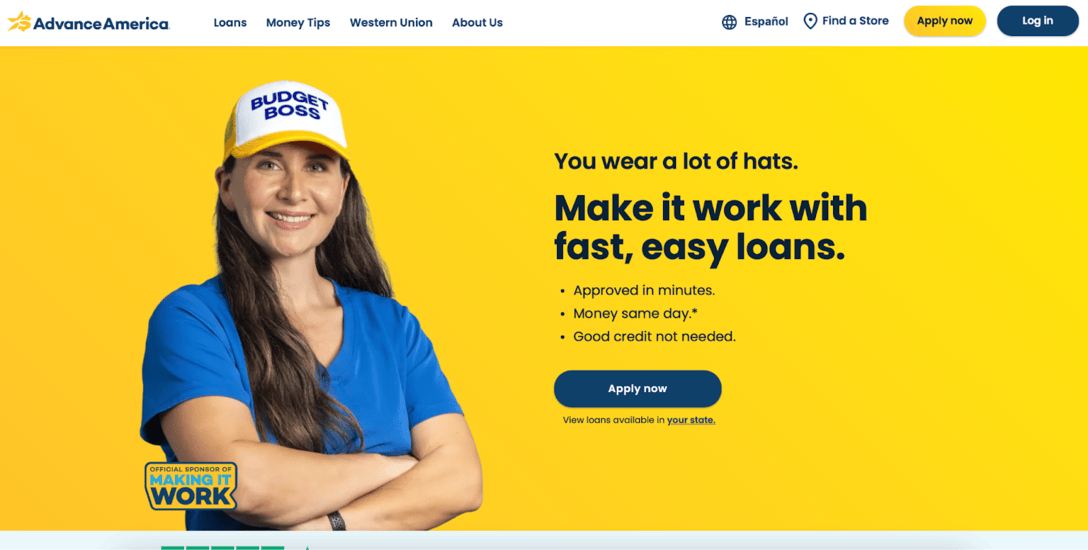

Advance America is a licensed payday‑loan and installment‑loan provider that offers short‑term loans to borrowers who often have limited credit options.

Launched in 1997, the lender offers loans both online and through physical stores. It is one of the largest payday‑loan providers in the United States.

It markets fast funding and easy approval, but the loans carry high fees and interest rates.

Is Advance America a Scam?

No, Advance America is not a scam. It’s a legitimate, state‑licensed lender that has been operating for more than two decades.

Several third-party publications and review sites have reviewed Advance America.

For example, a Credit Karma review warns that Advance America’s payday loans can carry triple‑digit APRs and notes that loans are typically due within two to four weeks, and that extending them can be costly.

Although the lender provides small loans to people with poor credit and funds quickly, Credit Karma cautions that these products should only be used as a last resort.

User reviews of Advance America are mixed at the time of writing:

- 4.9 out of 5.0 stars (from over 100,000 reviews) on Trustpilot.

- 1.5 out of 5.0 stars (from over 200 reviews) on ConsumerAffairs.

- 1.71 out of 5.0 stars (from over 100 reviews) on Better Business Bureau.

Customers praise the fast and easy process for obtaining a loan and excellent customer service.

Common complaints include high fees and interest, and balances not going down despite making multiple or large payments.

On online forums like Reddit, users note that Advance America is a legitimate company but caution that payday loans, in general, are expensive short-term solutions.

Advance America is accredited by the Better Business Bureau (BBB) and holds an A+ BBB rating. BBB ratings represent how the BBB thinks the business is likely to engage with consumers.

The company has received 316 total complaints on the BBB website in the last three years, 82 of which have been closed in the past 12 months.

Complaints center on billing errors, customer service, and disputes about loan balances.

Advance America impersonation scams

Fraudsters have been known to impersonate Advance America representatives, contacting consumers by phone, text, or email and claiming to offer pre‑approved loans, then demanding upfront fees or gift cards.

Victims who refuse are sometimes threatened with legal action or debt collection.

These scams are so common that several states have issued consumer alerts about them.

On its website, Advance America warns customers that it will never ask for upfront fees, prepaid cards, wire transfers, threats, or unsolicited personal information, and anyone doing so is likely a scammer.

Advance America regulatory actions and lawsuits

Advance America has faced several legal actions alleging violations related to its lending practices.

In North Carolina, a 2004 class action alleged that the company charged illegal fees and APRs exceeding 450%, far above the state’s 36% cap. The case was settled in 2006 for $18.75 million.

In Pennsylvania, the Attorney General sued the lender for disguising interest rates as “monthly participation fees.” In 2015, Advance America agreed to pay $10 million, including $8 million in restitution and $2 million in penalties, and to forgive $12 million in outstanding loans. The lawsuit alleged that the company charged rates above those allowed under state law.

In 2018, California regulators fined Advance America $160,000 for evading interest rate caps by adding fees to loans, pushing rates over 100% on auto-title loans.

In 2023, following a security incident in which criminals accessed sensitive customer data, Advance America was accused of delaying notification to affected customers by approximately six months.

This led to a class action alleging inadequate cybersecurity, and a $7.75 million settlement was preliminarily approved in October 2025, offering up to $5,000 for losses or about $50 pro rata payments.

Advance America security

In its privacy policy, Advance America briefly mentions its security measures.

It says it uses “security measures that comply with federal law.” These include “computer safeguards and secured files and buildings.”

On its FAQs page, Advance America states that any information you submit for a loan to the company is sent through a secure server and is stored in a secure database.

In February 2023, criminals accessed sensitive customer data, including names and Social Security numbers.

As a result, advance America became the target of a class action lawsuit claiming it had failed to put in place adequate data protection measures. A preliminary settlement of $7.75 million received court approval in October 2025.

Advance America privacy

Advance America explains the kind of data it collects, why, and with whom it shares it in its privacy policy.

The precise information that Advance America collects depends on the products or services you have with it, but may include:

- Social Security number.

- Income.

- Transaction history.

- Credit history.

- Employment information.

- Checking account information.

- Contact information.

Advance America may collect this information directly from you (e.g., when you apply for a loan or provide details) and from third parties (e.g., credit bureaus, affiliates, and other companies).

The company may use your personal data to process transactions, manage accounts, verify identity and creditworthiness, respond to legal requests (such as court orders and investigations), report to credit bureaus, and offer and market financial products and services.

Even after you are no longer a customer, information may continue to be shared as described in the policy.

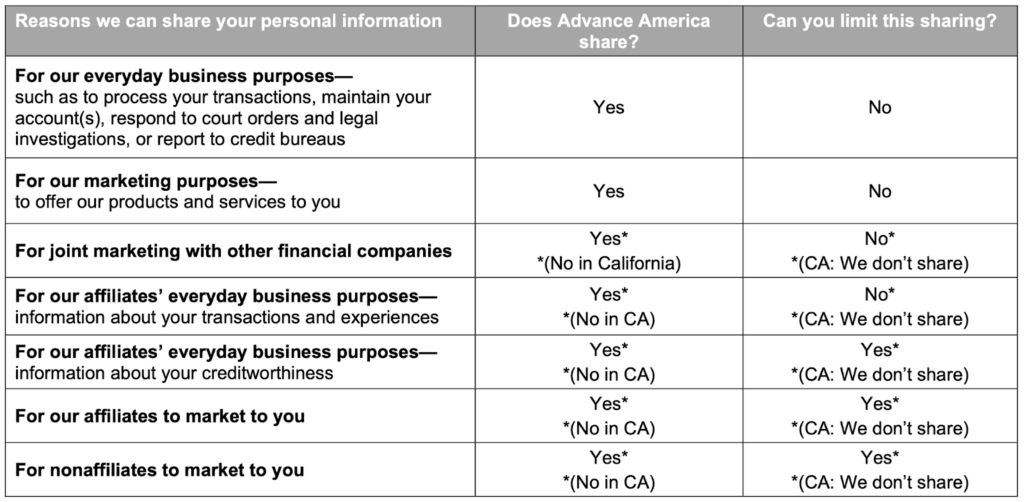

You can limit some data sharing, including for affiliates’ everyday business purposes, affiliate marketing, and non-affiliate marketing.

You cannot limit the sharing of your information for everyday business operations (transactions, account maintenance, and legal compliance), the company’s own marketing, joint marketing with other financial companies, and affiliates’ everyday business purposes.

California residents generally have more restrictions (many forms of affiliate and non-affiliate sharing do not occur in California).

Depending on where you reside (e.g., California), you may have privacy rights, such as the right to request disclosure of and deletion of personal information.

You may receive account-related texts (e.g., payment reminders) if you opt in, and you may separately opt in to marketing texts. You can manage messages and withdraw consent at any time (effective within one day). Texts may be sent using autodialers or prerecorded messages.

The company uses necessary, functional, tracking, social media, and advertising cookies (including third-party cookies) to operate its website, analyze usage, and deliver targeted ads across sites, which may track users over time and devices.

You can manage or turn off cookies through browser settings and advertising opt-out tools. California residents may opt out of targeted advertising using Global Privacy Control (GPC).

So, Should You Use Advance America?

Depends.

Advance America may suit borrowers who have urgent, short‑term cash needs, lack access to cheaper credit, and are able to repay the loan quickly.

It may not be a good fit for people who have other financing options, need a long‑term solution, or cannot repay quickly, as the high interest rates and fees can deepen financial problems and lead to cycles of debt.

How to Use Advance America Safely and Privately

- Double-check you’re actually dealing with Advance America and not scammers. Use only the official website (look for the padlock icon in your browser to confirm the site is encrypted) or verified phone numbers listed on their site. If contacted by an “Advance America representative” unexpectedly, do not engage. Instead, contact Advance America directly using official contact information.

- Never pay upfront. Advance America notes on its website that it does not ask for upfront fees, prepaid cards, wire transfers, or “good faith deposits.”

- Treat the loan as a short-term tool. Advance America loans can carry very high fees and triple-digit APRs. Only use the company if you have no cheaper credit options and can repay quickly (usually within 2–4 weeks).

- Keep detailed records. Save loan agreements, payment confirmations, account statements, and customer service communications. Doing so may come in useful in case there are any billing errors and balance disputes.

- Monitor your credit. Because sensitive data (including Social Security numbers) has been involved in past security incidents, it may be a good idea to regularly review credit reports and watch for unfamiliar accounts or inquiries. Consider placing a fraud alert on your credit file if you are concerned.

- Understand how Advance America collects and uses your personal information. You can find this information in the Advance America privacy policy or read the section above (‘Advance America privacy’).

- Limit marketing and sharing where possible. Certain types of sharing (affiliate and non-affiliate marketing) may be limited depending on state law. California residents generally have stronger limits on sharing and marketing. Any opt-out choices apply to all joint account holders.

- Manage cookies and online tracking. The Advance America website uses cookies, including third-party cookies. To increase privacy, you can adjust browser cookie settings, delete cookies regularly, and/or use advertising opt-out tools. California residents can also turn on Global Privacy Control (GPC) to opt out of targeted advertising.

Our privacy advisors:

- Continuously find and remove your sensitive data online

- Stop companies from selling your data – all year long

- Have removed 35M+ records

of personal data from the web

Save 10% on any individual and

family privacy plan

with code: BLOG10

news?

Don’t have the time?

DeleteMe is our premium privacy service that removes you from more than 750 data brokers like Whitepages, Spokeo, BeenVerified, plus many more.

Save 10% on DeleteMe when you use the code BLOG10.