Is Credit One a Scam?

Laura Martisiute

Reading time: 7 minutes

Table of Contents

If you’re thinking of using Credit One, you need to know: Is Credit One a scam?

Below, we explain whether Credit One is a scam and discuss some steps you can take to improve your safety when using this credit card issuer.

What Is Credit One?

Credit One is a U.S.-based consumer credit card issuer.

It specializes in offering unsecured and secured Visa®, Mastercard®, and American Express® cards aimed at individuals who may not qualify for mainstream credit cards due to credit history constraints.

In addition to cards, it also offers deposit products, such as high-yield CDs and jumbo certificates of deposit.

Though their names sound similar, Credit One is not affiliated with Capital One.

Is Credit One a Scam?

No, Credit One is not a scam. It’s a legitimate financial services company that offers credit cards and primarily caters to individuals with low credit scores.

However, according to several third-party publications, though Credit One can be useful for specific customers, it’s not the best choice for most people.

CNET said the following about Credit One:

“Opening a certificate of deposit at Credit One Bank isn’t for everyone: You’ll need to meet jumbo deposit requirements of at least $100,000 to cash in on those high-yielding CD rates. And while Credit One can be a great place to grow your savings, it’s worth noting that some of the best CD rates are available with a much smaller sum of money.”

While NerdWallet’s conclusion was this:

“Credit One provides a wide variety of cards for credit rebuilders and those with average credit. But if you have good or excellent credit (FICO scores of 690 or higher), you potentially have many more cards to choose from. It’s likely you’ll find cards that are either just as rewarding with no annual fee, or cards with annual fees that offer significantly better perks.”

User reviews of Credit One are mixed:

- 3.3 out of 5.0 stars (from 17,634 reviews) on WalletHub.

- 1.1 out of 5.0 stars (from 3,627 reviews) on Consumer Affairs.

- 4.7 out of 5.0 stars (from 600,392 reviews) on Google Play.

- 1.09 out of 5.0 stars (from 1,657 reviews) on Better Business Bureau.

- 1.2 out of 5.0 stars (from 630 reviews) on Trustpilot.

People complain about payments and billing issues (for example, unexpected or hidden fees applied even before a customer uses the card) and customer service problems (hard-to-reach representatives and inconsistent or unhelpful answers).

They also complain about accounts being closed suddenly without explanation or the difficulty of cancelling their Credit One accounts.

Some reviews are for specific Credit One cards:

- 3.8 out of 5.0 stars (from 602 reviews) on Credit Karma for Credit One Bank® Platinum Visa®.

- 3.9 out of 5.0 stars (from 58 reviews) on Experian for Credit One Bank® Secured Card.

- 3.6 out of 5.0 stars (from 1602 reviews) on Credit Karma for Credit One Bank® Platinum Visa® for Rebuilding Credit.

- 3.2 out of 5.0 stars by Bankrate for Credit One Bank® Wander® American Express® Card.

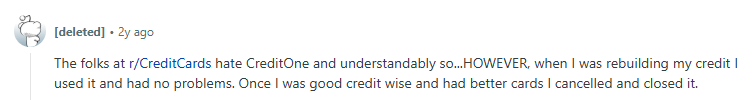

People’s experiences with Credit One on online forums like Reddit are also varied, though most users only recommend using the bank when you’re rebuilding credit.

One person said: “When I was rebuilding my credit I used it and had no problems. Once I was good credit wise and had better cards I cancelled and closed it.”

That said, most reviewers describe Credit One as frustrating, unfair, and borderline scammy.

One user reported: “I had constant problems with them.”

Another said: “Worst credit card company ever. They are not honest and interest rate are ridiculous. They will charge you a fee every 6 months not yearly. They will wreck your credit. Stay clear.”

Credit One is Better Business Bureau (BBB) accredited and has an “A+” rating. It has received 2,239 complaints on the BBB website over the past three years, with 742 resolved in the last 12 months. (Read our review “Is BBB a Scam?”)

Security

Credit One Bank is a member of the FDIC (i.e., the funds you deposit with it are protected up to the legal insurance limits).

In most cases, the FDIC provides coverage of up to $250,000 per depositor, per insured bank, based on the type of account ownership. That includes a total of $250,000 for all accounts owned by one individual, $250,000 for each co-owner on joint accounts, and up to $250,000 per named beneficiary on revocable trust or Payable-on-Death (POD) accounts.

The specific coverage limits depend on the ownership category of the deposits.

On its security page, Credit One states that it offers protection against unauthorized card charges, mobile app security features (e.g., Face ID), and account notifications.

It also states that it limits employee access to your data and has “lock-tight advanced security standards”, although it does not specify what these standards are.

In its privacy policy, Credit One says it uses “commercially reasonable administrative, technical, and physical security measures” to protect your information, which include “computer safeguards and secured files and buildings.”

If it shares personal information with third-party service providers or joint marketers, it says it restricts these parties’ ability to use or disclose the information they share.

Credit One also requires these parties to have appropriate security measures in place.

Privacy

Credit One outlines the type of data it collects, the reasons for collecting it, and with whom it shares it in its privacy policies.

It collects the following information:

- Personal information, such as name, address, email, phone, Social Security number, etc.

- Online activity data, such as IP address, browser type, device ID, cookies, web beacons, and usage patterns.

It uses this information to process credit card applications and transactions, manage accounts, and communicate with customers, as well as for marketing, personalized ads, and promotions.

It also uses it to analyze ad effectiveness and improve services, verify identity, manage fraud/security risks, and comply with laws. Additionally, for research, development, and internal auditing, as well as for personalization, to enforce terms, protect operations, and fulfill legal obligations.

Credit One may share data with affiliates, business partners, service providers, government agencies, Yodlee, credit reporting agencies, and in the context of corporate transactions (e.g., mergers).

It retains information for as long as needed.

The company may collect fingerprints, facial recognition data, and other similar information with the individual’s consent. This data is deleted within one year after account closure and is never sold.

In 2015, Credit One was found liable for violating the Telephone Consumer Protection Act (TCPA) with excessive robocalls.

So, Should You Use Credit One?

Potentially, but only if you have poor or limited credit and want to rebuild your credit history and fully understand the fees.

It’s generally recommended to avoid Credit One if you already have good or excellent credit, as you can likely get better cards with no annual fee, lower APRs, and better rewards.

How to Use Credit One Safely and Privately

- Understand all the fees before you apply. Read the cardholder agreement carefully (look for annual fees, monthly fees, cash advance fees, and payment processing fees).

- Use autopay to avoid late fees. Set up automatic payments from your checking account for at least the minimum due.

- Check your Credit One account regularly. Log in often (via app or website) to monitor charges.

- Limit cookies and tracking. Adjust settings to block third-party cookies or use an ad blocker to reduce tracking.

- Turn off location and ad tracking on mobile. In your phone’s privacy settings, turn off ad tracking and location tracking for the Credit One app. Reset your advertising ID regularly (in iOS or Android settings).

- Use strong security on your Credit One account. Use a strong, unique password stored in a password manager. Don’t access your account from public Wi-Fi without a VPN.

- Be careful with biometrics. If you choose to use Face ID or fingerprint login, note that Credit One will store this data (although they claim to delete it within one year of account closure). If privacy is a concern, stick to a password/PIN login.

- Treat it as a stepping stone. Once your credit improves, consider applying for a better card with no annual fee and more perks, and then close your Credit One account.

Our privacy advisors:

- Continuously find and remove your sensitive data online

- Stop companies from selling your data – all year long

- Have removed 35M+ records

of personal data from the web

Save 10% on any individual and

family privacy plan

with code: BLOG10

news?

Don’t have the time?

DeleteMe is our premium privacy service that removes you from more than 750 data brokers like Whitepages, Spokeo, BeenVerified, plus many more.

Save 10% on DeleteMe when you use the code BLOG10.