Is True Accord a Scam?

Laura Martisiute

Reading time: 6 minutes

Table of Contents

If you have been contacted by True Accord, you need to know: Is True Accord a scam?

Below, we explain whether True Accord is a scam and discuss the things you need to know if this company has contacted you.

What Is True Accord?

TrueAccord is a licensed third-party debt collection agency.

It recovers debts on behalf of various creditors, such as banks, credit card companies, e-commerce providers, and direct lenders.

When lenders or creditors decide they can’t collect a debt, they may turn it over to TrueAccord, which may reach out to you by mail, phone, or other methods to arrange payment.

True Accord uses fintech, behavioral analytics, and machine learning to modernize debt recovery for creditors and consumers.

Is True Accord a Scam?

No, True Accord is not a scam. It’s a legitimate third-party debt collection agency.

However, online users commonly report receiving emails or texts claiming debts for accounts they never had.

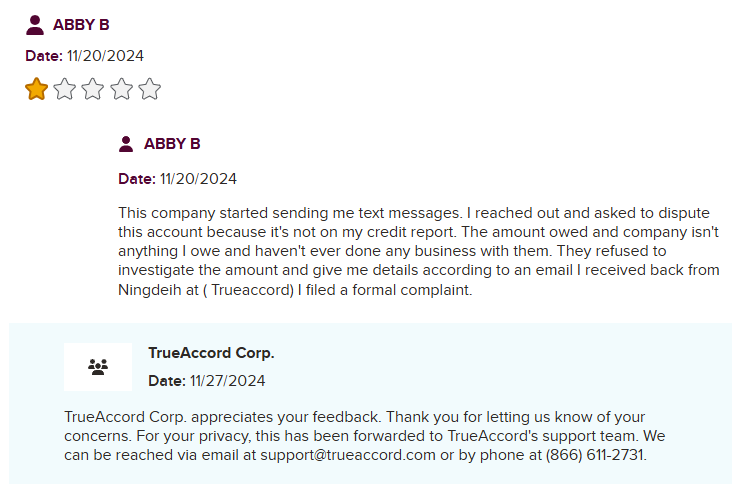

One complaint on the Better Business Bureau (BBB) website said the following:

“This company started sending me text messages. I reached out and asked to dispute this account because it’s not on my credit report. The amount owed and company isn’t anything I owe and haven’t ever done any business with them. They refused to investigate the amount and give me details according to an email I received back from Ningdeih at ( Trueaccord) I filed a formal complaint.”

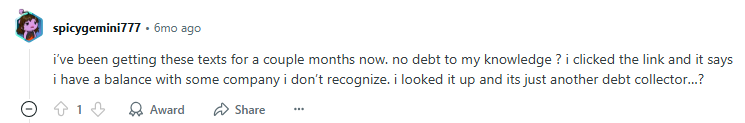

Numerous Reddit users report a similar experience.

“i’ve been getting these texts for a couple months now. no debt to my knowledge ? i clicked the link and it says i have a balance with some company i don’t recognize. i looked it up and its just another debt collector…?”

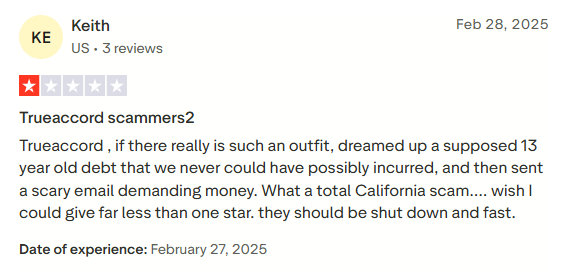

“Trueaccord , if there really is such an outfit, dreamed up a supposed 13 year old debt that we never could have possibly incurred, and then sent a scary email demanding money. What a total California scam…. wish I could give far less than one star. they should be shut down and fast.”

Some users also report being contacted by True Accord about old debts.

Most people’s advice is to know the statute of limitations on your debt. This is the time limit a collector has to sue you for payment, and it depends on both your state and the type of debt you owe (like credit cards, medical bills, or personal loans).

After that period, the debt is considered “time-barred”. Collectors may still contact you and ask for payment, but they can’t take you to court to enforce it.

As many users warn, making even a small payment or admitting in writing that you owe the debt can restart the clock, making the debt collectible again.

Overall, True Accord gets mixed reviews from users:

- 2.2 out of 5.0 stars (from 8 reviews) on Trustpilot.

- 1.9 out of 5.0 stars (from 27 reviews) on Sitejabber.

- 4.13 out of 5.0 stars (from 126 reviews) on Better Business Bureau.

Several people who had a debt that was handled by True Accord reported a positive experience overall.

For example, one Reddit user said:

“A year or two ago I had a debt move to TrueAccord. In my experience, it was the easiest debt collector I ever worked with. They never reported to the credit bureau and I setup and managed the payment plan all within their website. Pretty sure they are some kind of silicon valley type CA. never called me either. IIRC they do not own the debts they are just collecting for the OC. Just my two cents.”

True According is not Better Business Bureau (BBB) accredited. It received 369 total complaints on the BBB website in the last three years, 144 of which have been resolved in the past 12 months. (Read our review “Is BBB a Scam?”)

What to Do If You’ve Been Contacted by True Accord

If True Accord has contacted you and you’re not sure why, proceed cautiously.

- Confirm that the communication is legitimate. Scammers sometimes impersonate real companies like TrueAccord. Verify that communications originate from official TrueAccord domains. Instead of clicking links in emails or texts, log into the official consumer portal or call the number listed on TrueAccord’s website, not the one provided in the message.

- Verify your debt. Request a debt validation letter in writing. Under the U.S. Fair Debt Collection Practices Act (FDCPA), collectors must provide this upon request.

- Dispute the debt if it doesn’t belong to you. If you have no record of the debt, dispute it formally through certified mail or the collector’s online portal. Keep an eye out for disparate account details, such as incorrect creditor names or vague descriptions.

- Don’t ignore True Accord. Avoiding them could lead to the account being escalated to another agency or even legal action. Instead, answer and review the details of the account with them so you understand your options.

- Understand the statute of limitations on debt. The statute of limitations varies by state and by type of debt (credit card, medical, personal loan, etc.). It’s usually between 3 and 6 years, but in some states it can be up to 10 years. Once the statute of limitations has expired, the debt becomes “time-barred”. Collectors can still contact you to request payment, but they cannot sue you to force payment. If you make a payment (even a small one) or acknowledge the debt in writing, you may restart the clock, making the debt legally collectible again.

- Know your rights. Under federal law, collectors are prohibited from harassment, deception, or unauthorized threats, and must provide verification of the debt while respecting limits on communication and honoring written requests to stop contact.

- Pay or negotiate. If the debt is valid and you recognize it, you can either pay it in full or work out a settlement with TrueAccord.

- Understand the impact on credit reports. Even if the debt is paid, the collection may remain for up to 7 years, though some collectors may agree to a “pay-for-delete” in negotiations.

Our privacy advisors:

- Continuously find and remove your sensitive data online

- Stop companies from selling your data – all year long

- Have removed 35M+ records

of personal data from the web

Save 10% on any individual and

family privacy plan

with code: BLOG10

news?

Don’t have the time?

DeleteMe is our premium privacy service that removes you from more than 750 data brokers like Whitepages, Spokeo, BeenVerified, plus many more.

Save 10% on DeleteMe when you use the code BLOG10.