Is Bank of America Safe?

Laura Martisiute

Reading time: 5 minutes

Table of Contents

If you are a Bank of America customer (or plan to become one), you need to know: Is Bank of America safe?

Below, we explain whether Bank of America is:

- Safe.

- Good for privacy.

We also look at some steps you can take to improve both your safety and privacy when using this financial institution.

What Is Bank of America?

Bank of America (BofA) is one of the largest financial institutions in the United States and globally. They provide various financial products and services to individual consumers, small and middle-market businesses, and large corporations.

BofA offers various consumer banking products, including savings and checking accounts, credit and debit cards, mortgages, and home equity loans.

They also provide corporate lending and treasury services and investment banking services to companies worldwide.

In terms of assets and market capitalization, BofA regularly ranks among the top banks globally.

Like many large financial institutions, BofA has faced regulatory fines and legal challenges, particularly related to the 2008 financial crisis and subsequent mortgage practices.

Is Bank of America Safe?

Yes, Bank of America is generally considered safe.

As a financial institution, Bank of America is subject to stringent regulations by financial authorities such as the Federal Reserve, the Office of the Comptroller of the Currency (OCC), and the Federal Deposit Insurance Corporation (FDIC) in the United States.

Deposits at Bank of America are insured by the FDIC up to $250,000 per depositor, per ownership category.

BofA employs advanced cybersecurity measures to protect its customers’ data. These measures include encryption, multi-factor authentication, and real-time fraud monitoring. The bank has online and mobile banking security protocols to safeguard against unauthorized access and cyber threats.

Bank of America experienced a data breach in February 2024, exposing 57,000 accounts. The bank responded by notifying customers and stating that it was looking to resolve security gaps.

Bank of America receives a security rating of 859 out of 950 from the security company UpGuard.

The top concerns are a lack of enforcement for HTTP Strict Transport Security (leaving vulnerability to man-in-the-middle attacks), using weak cipher suites in TLS 1.2, a lack of secure cookies, insecure Content Security Policy implementation, and a lack of HTTPOnly cookies.

Is Bank of America Private?

Depends on your definition of “private.”

Bank of America provides a clear and detailed privacy policy outlining how it collects, uses, and shares customer information.

The privacy policy specifies the circumstances under which customer information may be shared with third parties, such as for legal compliance, marketing purposes (with customer consent), and servicing customer accounts.

Customers can opt out of certain data-sharing practices, particularly for marketing purposes, which gives them some control over their personal information.

Major privacy sites have not yet reviewed BofA’s overall privacy policy.

However, the privacy policy for its mobile banking app receives a score of 34% from the Common Sense Privacy Program.

Among the concerns highlighted are that it’s unclear whether personal information is sold or rented to third parties and whether third parties collect data for their own purposes.

The Common Sense Privacy Program also notes that BofA customers’ personal information is shared for third-party marketing, personalized advertising is displayed, and users’ information is used to track and target ads on third-party sites.

How to Improve Your Safety and Privacy on Bank of America

Follow the steps below for a more private and secure experience at Bank of America.

- Understand and utilize privacy settings. Familiarize yourself with BofA’s privacy policy to understand how your data is collected, used, and shared. Take advantage of opt-out options for marketing communications and data sharing with third parties. You can do this through your online banking account settings or by contacting BofA’s customer service.

- Secure your online banking account. Use strong, unique passwords for your online banking account. Avoid using easily guessable information. Enable multi-factor authentication to add an extra layer of security to your account.

- Keep your account updated. Ensure your contact information is up to date so you receive notifications about any changes or suspicious activities on your account.

- Monitor your accounts. Frequently monitor your account statements and transaction history for any unauthorized activities.

- Enable alerts and notifications. Set up account alerts to receive real-time notifications about transactions, changes to your account, and suspicious activities.

- Limit data sharing. Only provide the minimum required information when setting up your account or conducting transactions.

- Restrict third-party apps. Be cautious about linking your BofA account to third-party apps and services. Review the privacy policies of these apps to understand how they handle your data.

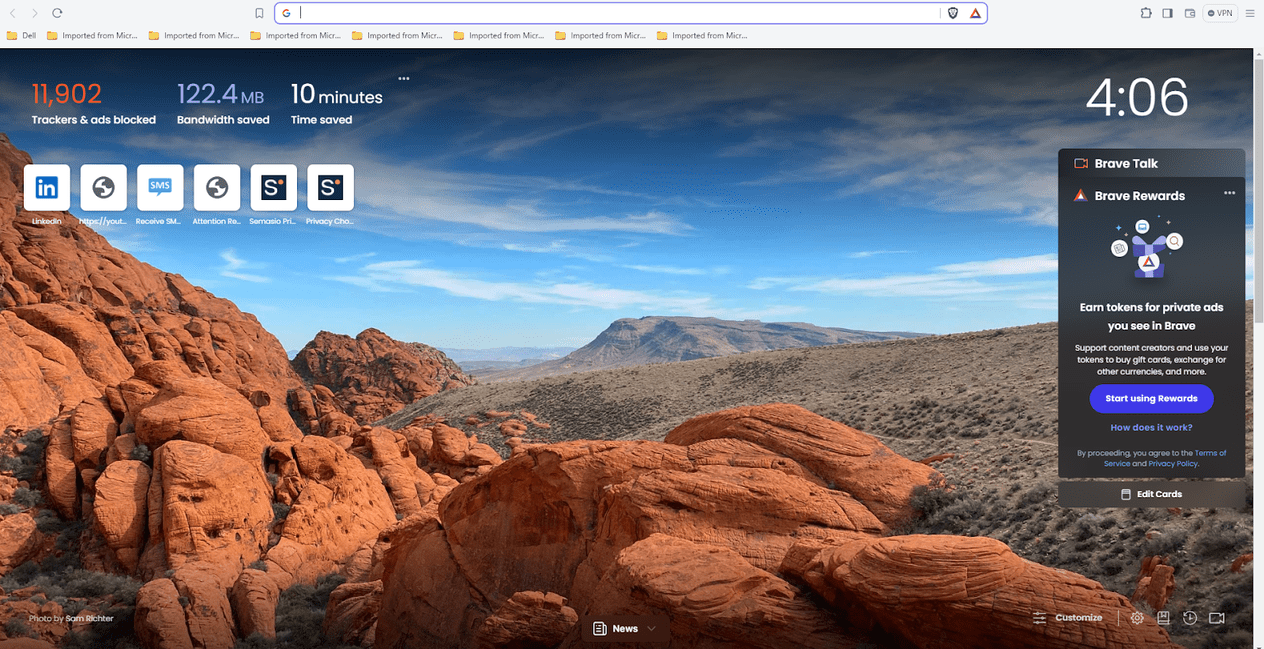

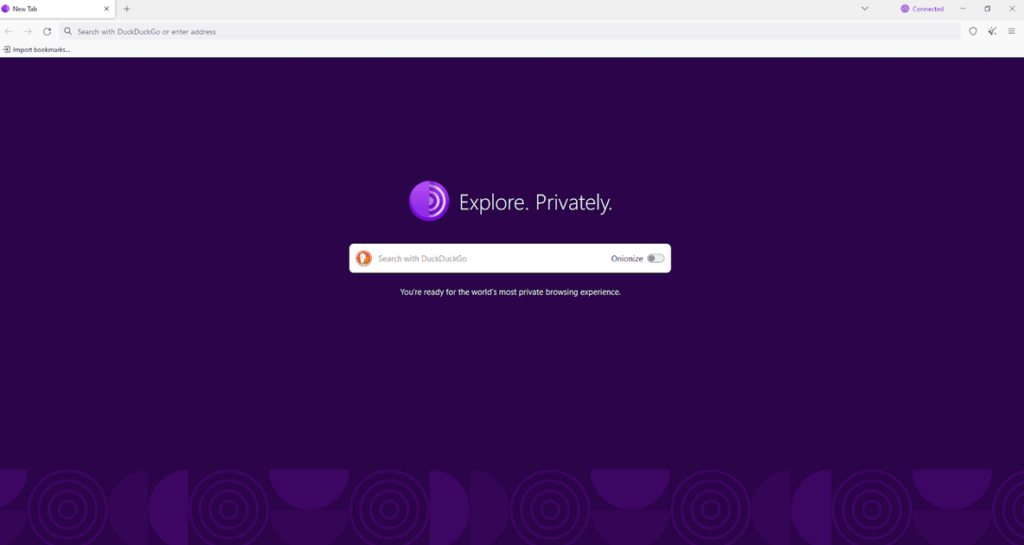

- Use secure connections. Avoid accessing your bank account over public Wi-Fi. Use a secure, private internet connection whenever possible. Consider using a Virtual Private Network (VPN) for an added layer of encryption and privacy when accessing your accounts online.

- Be aware of phishing scams. Be cautious of phishing emails and text messages that appear to be from BofA but are attempting to steal your information. Verify any suspicious communication by contacting BofA directly.

- Verify the website. Always ensure you are on the official Bank of America website before entering your login details. Look for “https://” and a padlock icon in the browser address bar.

- Go paperless. Opt for electronic statements to reduce the risk of sensitive information being intercepted through your physical mail.

Our privacy advisors:

- Continuously find and remove your sensitive data online

- Stop companies from selling your data – all year long

- Have removed 35M+ records

of personal data from the web

Save 10% on any individual and

family privacy plan

with code: BLOG10

news?

Don’t have the time?

DeleteMe is our premium privacy service that removes you from more than 750 data brokers like Whitepages, Spokeo, BeenVerified, plus many more.

Save 10% on DeleteMe when you use the code BLOG10.