Is KYC Safe?

Laura Martisiute

Reading time: 4 minutes

Table of Contents

If you use or plan to use KYC, you need to know: Is KYC safe?

Below, we explain whether KYC is:

- Safe to use.

- Good for privacy.

We also look at some steps you can take to improve both your safety and privacy when using this process.

What Is KYC?

KYC, or “Know Your Customer,” is a process that businesses, especially financial institutions, use to verify their customers’ identities to prevent illegal activities like fraud.

Regulatory authorities in many countries mandate KYC as part of broader anti-money laundering laws.

The KYC process typically begins with customer identification, where the institution collects personal information such as the customer’s name, address, date of birth, and identification documents like a passport or driver’s license.

This step ensures that the institution knows exactly who it is dealing with.

Customer due diligence, where the institution evaluates the potential risk associated with the customer, is also part of the KYC process and usually involves collecting more in-depth information about a customer.

KYC is not a one-time procedure; it requires continuous monitoring of customer transactions to identify and report any suspicious activities.

Is KYC Safe?

Depends on your definition of “safe.”

Financial institutions have to follow strict regulations on how the personal information collected during KYC is handled, including how data is stored, used, and shared.

However, even when there are strong security measures in place, it’s not impossible for the personal information that was collected during the KYC process to be exposed in a data breach.

In 2024, it was reported that cybercriminals stole the records of around 5 million individuals from the KYC service World-Check.

Also, while financial institutions are generally required to use KYC data strictly for verification and compliance purposes, there is always the risk that this data could be misused.

Is KYC Private?

Again, it depends on your definition of “private,” but generally, no.

Financial institutions collect a lot of personal information about customers as part of the KYC process, which can include biometrics.

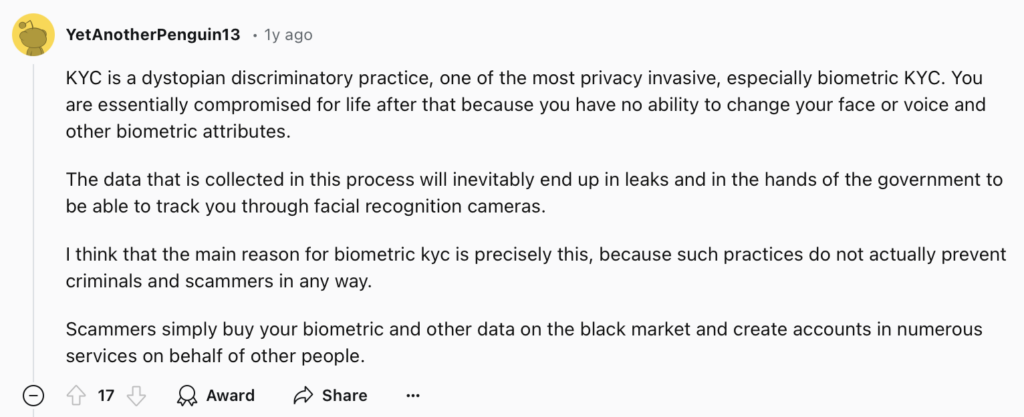

Individuals who are particularly privacy-focused might even see this level of data collection as dystopian.

KYC data may be shared with third parties such as regulatory bodies, government agencies, and other financial institutions.

On the plus side, many jurisdictions have data protection laws that govern how KYC information is handled.

Individual financial institutions may be able to provide privacy policies related to their KYC practices.

How to Improve Your Safety and Privacy From KYC Processes

Follow the steps below for a more private and secure experience while using KYC processes.

- Choose reputable institutions. Research the institution’s reputation and read its privacy policy (paying attention to sections on its security measures and data handling practices) before you share your personal information with it.

- Understand data usage and sharing. Review the institution’s privacy policy to understand how your information will be handled. Ask questions if you’re unclear about anything, especially sections of the policy related to third-party data sharing.

- Limit the information you provide. Provide only the necessary information for the KYC process.

- Use a separate email address. Use a separate email address (i.e., not your personal or work email) for financial institutions to compartmentalize your information.

- Opt for minimal accounts where possible. Some financial institutions offer accounts that require less extensive KYC processes, which can mean less data collection. If available and possible for your needs, choose these account types.

- Monitor your credit and identity. Regular monitoring can alert you to misuse of your personal information.

- Be cautious with biometric data. Biometric data (like fingerprints or facial recognition) is sensitive and difficult to change if compromised. If you’re asked to provide biometric data, inquire how it will be stored, secured, and used. Only provide such data if you feel comfortable doing so.

Our privacy advisors:

- Continuously find and remove your sensitive data online

- Stop companies from selling your data – all year long

- Have removed 35M+ records

of personal data from the web

Save 10% on any individual and

family privacy plan

with code: BLOG10

news?

Don’t have the time?

DeleteMe is our premium privacy service that removes you from more than 750 data brokers like Whitepages, Spokeo, BeenVerified, plus many more.

Save 10% on DeleteMe when you use the code BLOG10.