How to Stop Credit Card Offers in the Mail

Will Simonds

Reading time: 6 minutes

Table of Contents

Tired of having your mailbox crammed with credit card junk mail?

Well, you’re not alone! Getting endless amounts of pre-approved credit card offers by mail can be extremely frustrating as well as feel like an invasion of privacy.

Fortunately, there are several options you can use to stop receiving credit card offers in the mail.

1. Use Optoutprescreen.com

Optoutprescreen is a centralized service run by major credit bureaus Equifax, Experian, Innovis, and TransUnion. It’s these credit bureaus that sell your personal data to credit card issuers in the first place, who in turn send you the pre-approved credit card offers. Therefore, utilizing Optoutprescreen can help cut off the process at the source.

The site offers two options for credit card mail opt-out: 5 years or permanent.

Option 1: 5-Year Opt-Out

To proceed with the 5-Year Opt-Out, you can either call 1-888-5-OPT-OUT (1-888-567-8688) or fill out a form online.

This is how the process works online:

1. Go to optoutprescreen.com. Scroll down the page and click the “Click Here To Opt-In Or Opt-Out” button.

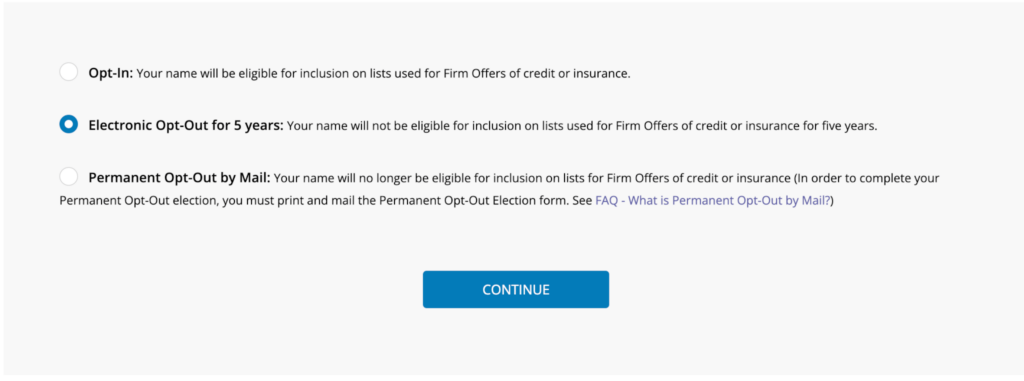

2. Choose “Electronic Opt-Out for 5 years” and click “Continue.”

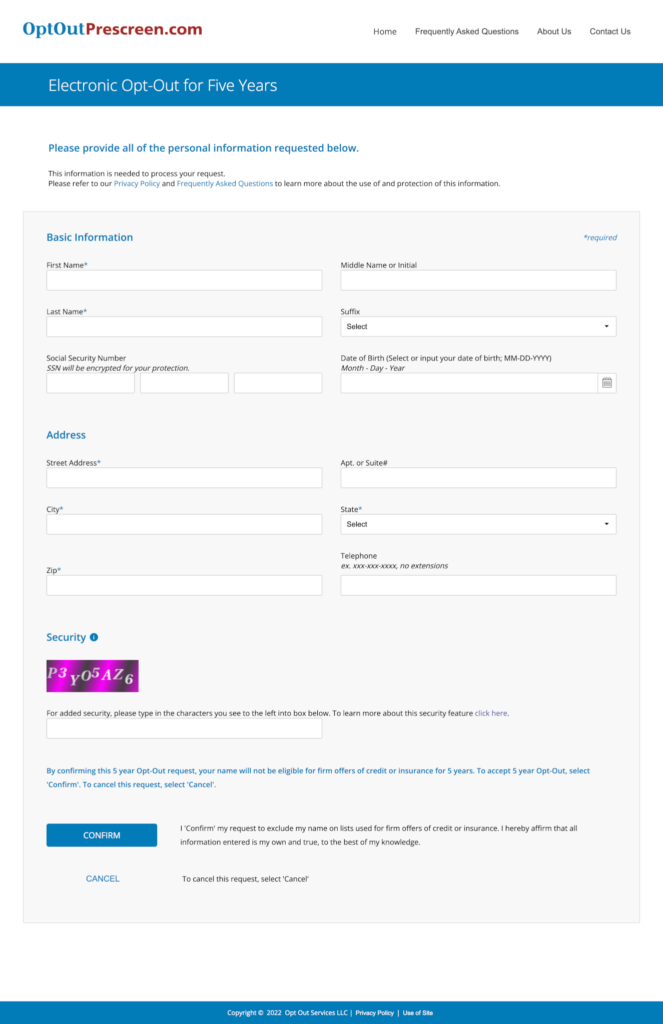

3. Fill in your personal information, perform the CAPTCHA, and click “Confirm.” Note that providing your SSN, date of birth, and telephone number are voluntary fields and not required to process your request.

Option 2: Permanent Opt-Out

To proceed with the permanent opt-out, you can either call 1-888-5-OPT-OUT (1-888-567-8688) or fill out a form online, detailed below.

1. Go to optoutprescreen.com. Scroll down the page to click “Click Here To Opt-In Or Opt-Out.”

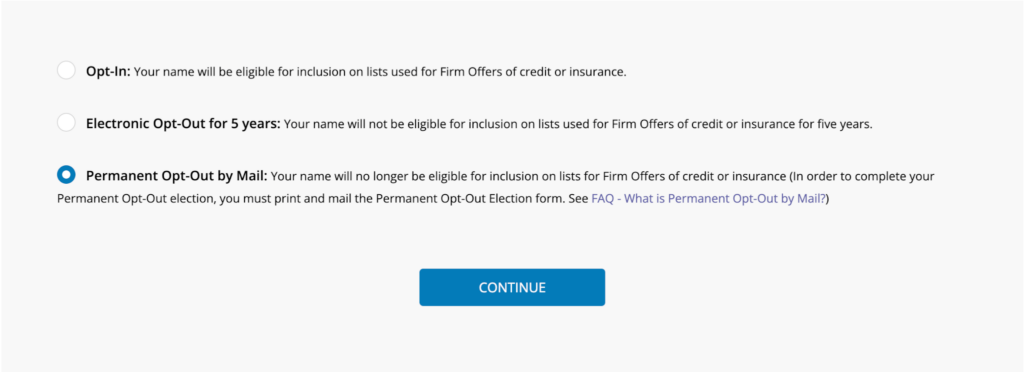

2. Choose “Permanent Opt-Out by Mail” and click “Continue.”

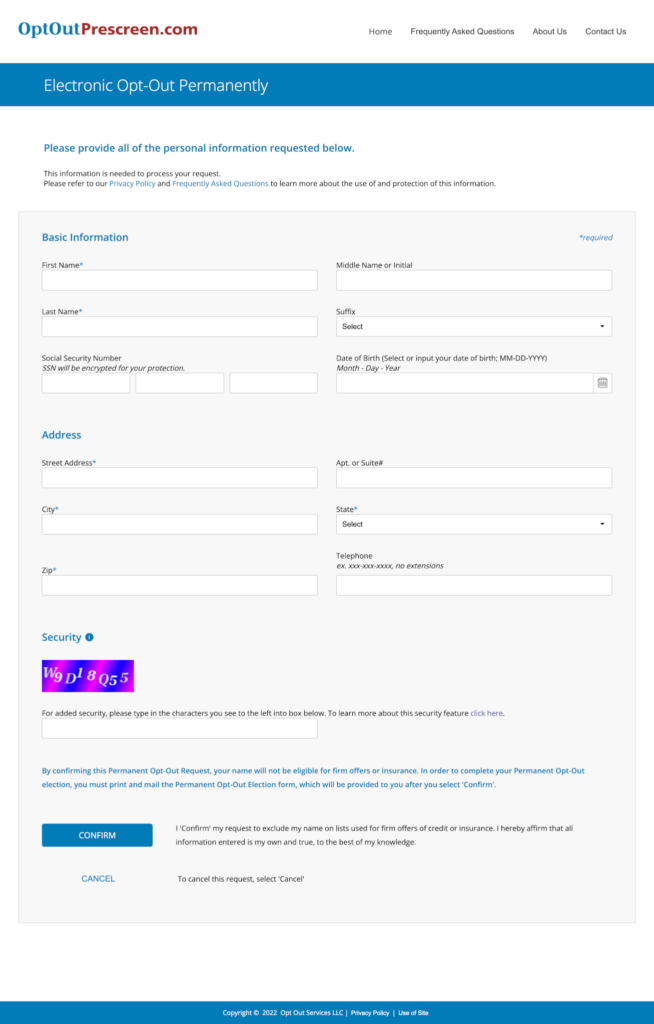

3. Fill out your personal information, perform the CAPTCHA, and click “Confirm.” Again, note that certain fields pertaining to personal information are voluntary.

4. Print out and sign the document.

5. Mail the document to this address:

Opt-Out Department

P.O. Box 530200

Atlanta, GA 30353

2. Notify the major credit bureaus

While Optoutprescreen should opt you out of all the bureaus’ marketing lists, you can gain some extra peace of mind by contacting bureaus individually. Here’s how:

Experian

To completely remove your profile from Experian you must go through several processes, all of which you can find on their opt-out page.

Specifically, to opt out of pre-approved offers contact Experian by phone at 1-402-458-5247, or by mail. To complete the opt-out request via mail you must provide the following information:

- Full legal name (including variations)

- Mailing address

- Telephone number (including area code)

- Email address

- Written statement expressing your wish to be removed from mailing lists, telemarketing lists, or targeted online advertising.

You can send this information via email to optout@experian.com or to this mailing address:

Experian Marketing Services

Attn: Opt-out Services

PO Box 80128

Lincoln, NE 68521

Equifax

Removing yourself from Equifax is a bit more challenging than other bureaus, as the company doesn’t provide specific instructions to opt out (aside from using optoutpresreen.com).

However, you can contact a customer service line at 1-888-378-4329 to confirm your request to stop receiving mail from them.

TransUnion

To confirm your opt-out from TransUnion, it’s fairly simple. All you need to do is mail a request that includes the following information:

- First, middle, and last names (including suffixes)

- Current mailing address

- Previous addresses (if you’ve moved within the last six months)

- Home telephone number with area code (for telephone preference service)

- Social security number

- Date of birth

- Signature

The request can be sent to this address:

TransUnion Opt-Out Request

P.O. Box 505

Woodlyn, PA 19094

Innovis

Not unlike Equifax, Innovis also doesn’t offer an explicit opt-out service. To make sure you’ve been opted-out from Innovis, you need to contact their consumer assistance center.

Phone: 1-800-540-2505

Mail: PO Box 530088, Atlanta, GA 30353-0088

Email: info@innovis.com

3. Register with DMA Choice

DMAchoice is a registry run by the Direct Marketing Association, which gives you an opportunity to choose the type of mail you want to receive. You can opt out from credit card offers, but also other types of mail as well, such as catalogs or magazine offers.

The registration costs $2 online or $3 via mail. Your registration with DMA will last for 10 years.

Registering via mail

1. Fill out the DMAchoice Mail-In Form with all required information.

2. Click “Submit.”

3. Print the document.

4. Send it via mail to the address below (but not by certified or registered mail).

DMAchoice

Consumer Preferences

P.O. Box 900

Cos Cob, CT 06807

If you don’t have access to the Internet, you can register by sending your name and address (with signature) and a $3 fee (check or money order payable to ANA) to the same address.

However, keep in mind that the process via mail will take longer than online registration. Also, any categorical or specific opt-out requests or preferences are not offered via mail.

Registering online

1. Go to dmachoice.org and click “Register” or “Get Started.”

2. Fill out the form, perform the CAPTCHA, and click “Payment.”

3. Pay the fee and follow the steps as prompted.

After completing the registration, the amount of unwanted mail you receive should reduce significantly. Additionally, you have the opportunity to opt out of emails and phone calls.

- eMail Preference Service (reduce unwanted commercial email)

- Telephone Preference Service (reduce national commercial calls)

4. Remove your data from data-broker sites

Using any of the above options will reduce the amount of credit card junk mail you receive, at least for some time. However, if you want to eliminate it permanently, you will need to remove yourself from data-broker sites.

Data brokers are platforms that search and collect your personally identifiable information from public sources and sell it to advertisers that want it—including credit providers. In other words, to make sure credit card junk mail stops permanently, you need to remove yourself from these sites as well.

Currently, there are hundreds of data broker sites in the U.S. alone, and many are notorious for relisting information even after a removal request. Deleting data manually from these platforms and monitoring its potential reappearance just isn’t possible for most people.

That’s why we launched DeleteMe, a service dedicated to removing your personal information from data-broker platforms. Our service removes customer data from over 580 data brokers (review our full list) and ensures it stays off these sites.

Our comprehensive plans start at just $10.75 per month.

What to do if the above isn’t effective

Now that you have a better idea about how to stop credit card junk mail, don’t lose your temper if you try all these methods and continue to receive it. It can take up to 3 months for information to be removed from these lists effectively and the credit card offers to stop.

If the mail still continues after several months, file a complaint with The Federal Trade Commission (FTC). Collect any evidence these companies have not respected your wish to not be contacted, add any verifiable proof (e.g. screenshots), and fill out this online form.

Our privacy advisors:

- Continuously find and remove your sensitive data online

- Stop companies from selling your data – all year long

- Have removed 35M+ records

of personal data from the web

Save 10% on any individual and

family privacy plan

with code: BLOG10

news?

Don’t have the time?

DeleteMe is our premium privacy service that removes you from more than 750 data brokers like Whitepages, Spokeo, BeenVerified, plus many more.

Save 10% on DeleteMe when you use the code BLOG10.