Tax-Day 2020: Does Online Filing Share Your Data with Brokers?

Will Simonds

Reading time: 3 minutes

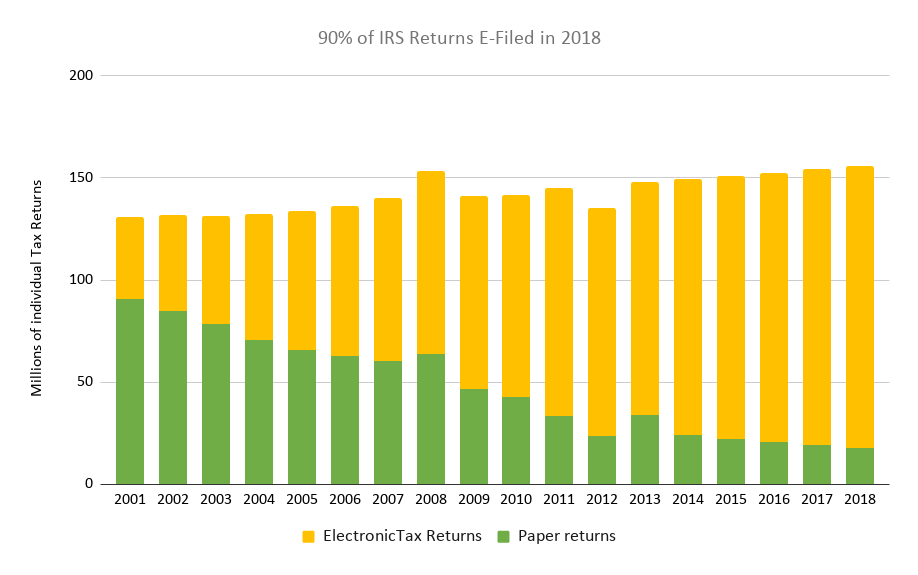

Are you planning on filing your taxes online? Complaints about the tax-prep industry have existed for decades. For years they’ve lobbied successfully against development of direct electronic tax-return filing, or ‘return-free filing’-processes, either of which could potentially decimate their industry.

The average person’s IRS returns are simply not that complicated, yet millions of people still end up having to pay tax-prep-middlemen for the privilege of filing electronically.

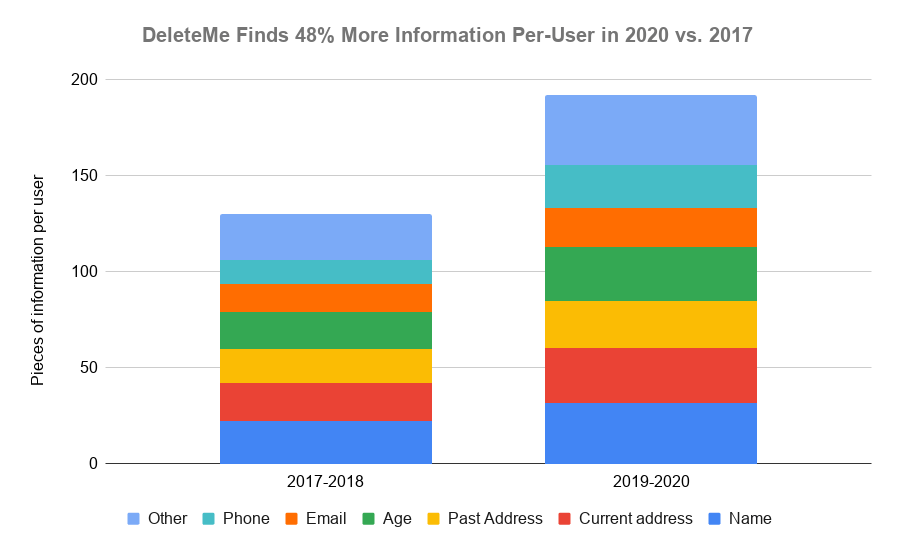

What adds insult to injury, however, is a far-less discussed aspect of the boom in online tax-prep: the explosion in commercialization of people’s tax-return personal information (not the actual financial tax return but all the other data around each customer).Federal law strictly forbids the government from sharing data from any individual’s tax return. However, this restriction doesn’t necessarily apply to private-industry 3rd parties we provide that information to voluntarily.

The tax-prep industry insists: “We don’t *sell* people’s data!”. But this is mostly misleading legal-semantics: they share it, and they make significant money sharing it. And they extract user permission to share it by burying the details in lengthy (in H&R Block’s case, 9,000-word-long) user-agreements.

NBC News sounded an initial warning bell about this topic in 2006, but in years since, the issue has only gotten more complex. Increasingly, online tax-prep providers who are filing taxes online offer ‘free’ versions of services – in exchange for more-explicit permissions on consumer data-use.

Companies like Credit Karma have emerged with a business-model based directly on leveraging consumer personal-data. Consumers see the product as ‘free,’ but the vendor sells targeted access to the user to their primary customers: Financial Services marketers and Data Brokers.

While the bulk of consumer financial information gets utilized in technically-legal ways – mainly improving the targeting of credit-card, insurance and loan-offers – by tax-prep firms themselves, there is no getting around the fact that the explosion in online-data-sharing has also coincided with exponential growth in data breaches, data-abuse, and fraud.

Eventually, all consumer records leak into the public domain, and this lax attitude toward consumer data privacy has fueled markets for predatory lending, dubious legal services, insurance scams, as well as the massive growth in identity theft. A 2019 report by internet-security firm Carbon Black found widespread instances of W-2 and 1040 forms being offered in-bulk by dark web resellers.

While fraud and identity theft continue to be an intractable problem, we believe a more-solvable problem is improved transparency to the end user.

Consumers currently don’t have any clear options if they want to both file taxes electronically, but also don’t want financial records being exposed to 3rd parties for marketing purposes. While there may potentially be some data-security benefits to buying tax-prep software directly and avoiding online services, there is nothing requiring providers to make these tradeoffs clear to the user.

New regulatory legislation in this area has been avoided for decades. The last attempt at doing so was thrown out of court when it was ruled that IRS currently has no statutory authority to regulate tax-preparers at all.

The only option currently left for consumers is to make extra efforts to actively protect their own information, and be aware of the risks and tradeoffs associated with ‘discounted’ tax-prep services. Until congress is compelled to enforce stricter requirements on this industry, the best we can do is try and clean up the data they leak to 3rd parties like data brokers.

Our privacy advisors:

- Continuously find and remove your sensitive data online

- Stop companies from selling your data – all year long

- Have removed 35M+ records

of personal data from the web

Save 10% on any individual and

family privacy plan

with code: BLOG10

news?

Don’t have the time?

DeleteMe is our premium privacy service that removes you from more than 750 data brokers like Whitepages, Spokeo, BeenVerified, plus many more.

Save 10% on DeleteMe when you use the code BLOG10.