The Equifax Data Breach and Identity Protection

Will Simonds

Reading time: 4 minutes

It’s not just Equifax. The entire industry is full of itself, corrupt, and hawking services with close to zero value. It’s hard to find the perfect words, but the best descriptor for current identity protection is probably simple: “insurance fraud”.

The problem of managing our identity online is real – we live increasingly digital lives with the inevitable result that our information is more and more exposed. At the same time, hackers and the tools they use for finding data online are always improving.

The Equifax data breach is literally the last demonstration the public should need to see clearly that big company solutions today claiming to protect our identities are a joke. They need to be destroyed and recreated from the ground up.

Equifax is telling consumers it will protect them, now, really? Really.

Our credit bureaus, Equifax, Experian, TransUnion, allowed a natural monopoly by our government, are scoring us, selling our data, and then re-selling us on paying them more money to protect our data files. In the Equifax data breach, this hypocrisy has now reached beyond absurd levels:

“Equifax to Offer Free Identity Theft Protection and Credit File Monitoring to All U.S. Consumers”.

What? After Equifax gets hacked and loses people’s social security, driver’s licenses, and other personal info, they will remedy consumers how? With it’s very own trusted Equifax protection? This is the crisis response from a $15-billion business that made the 2017 Forbes list of World’s Most Innovative Companies.

If this is identity protection, then Congress under the FCRA should have Equifax and rest of the industry refund all US customers’ money right now.

Consumers are buying bad product with good marketing

It’s not just the industry. It’s us consumers who are buying a bad product. We are what we are – busy, attention-challenged, brand-trusting people trying – and rightly so – to think ahead and to protect ourselves from harms. We talk to each other: “Did you hear about Jenny and Jim – someone took out 3 credit cards and a $10,000 auto-loan on them?” “Rick’s friend never got that tax return money in the mail – now he’s been back and forth to the state capitol five times.” Such horror stories spread quickly at places like the Michigan International Speedway NASCAR races, which Lifelock sponsored. The CEO, so confident in his own service, he wore his own social security number in public ads for all to see.

When the problems seem personal and the marketing sounds great – $1M dollars of protection, lost wallet reimbursement, etc, people naturally buy in. But it’s (almost) all totally worthless. If the industry was forced to publish in dollars how much it had spent to remediate identity theft claims it would – I guarantee – amount to less than one-tenth of 1% of revenue.

If current identity protection industry–with it’s ineffective credit monitoring, database deletion, lost wallet and stolen funds reimbursement and other nice-sounding services needs to be destroyed, what should be rebuilt in its place?

What would a rebuilt, effective, identity protection industry look like?

It starts with accepting the reality that your data is never safe on any online database. We need to create new solutions that allow consumers to stop giving out their data to so many different businesses. At the same time, we need to allow these businesses to verify customers in order to prevent fraud. Many companies are working on solutions in this area, leveraging the latest mobile phone capabilities, new Blockchain technologies, and more.

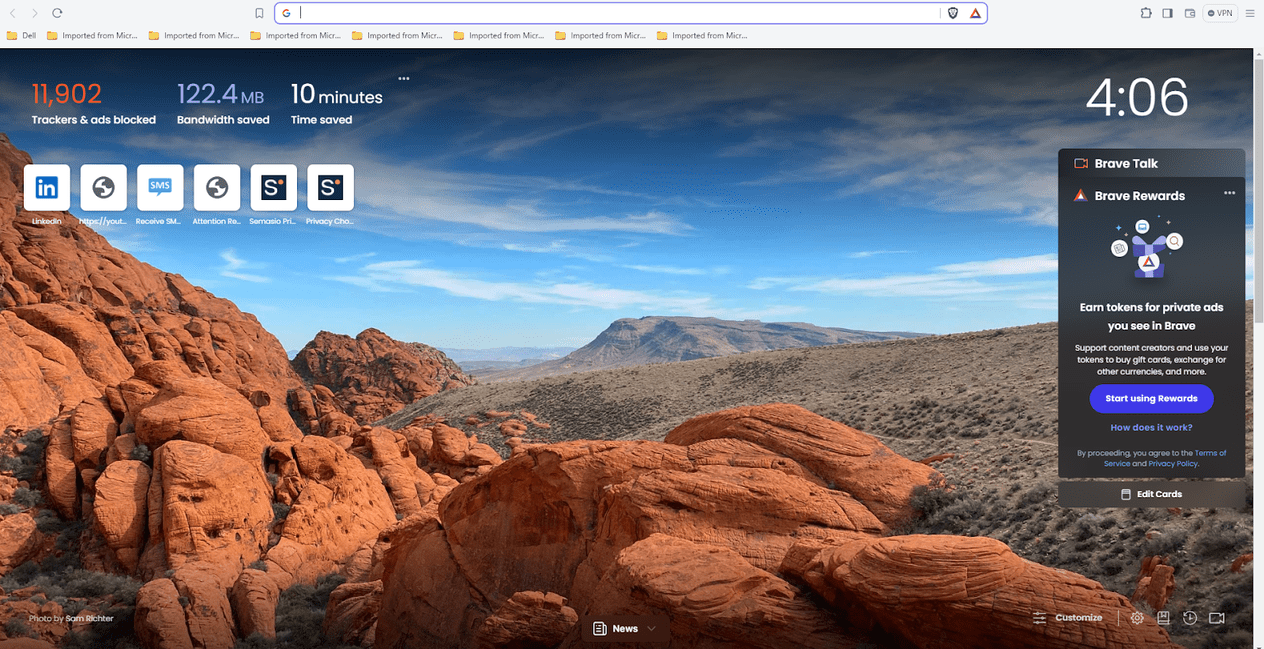

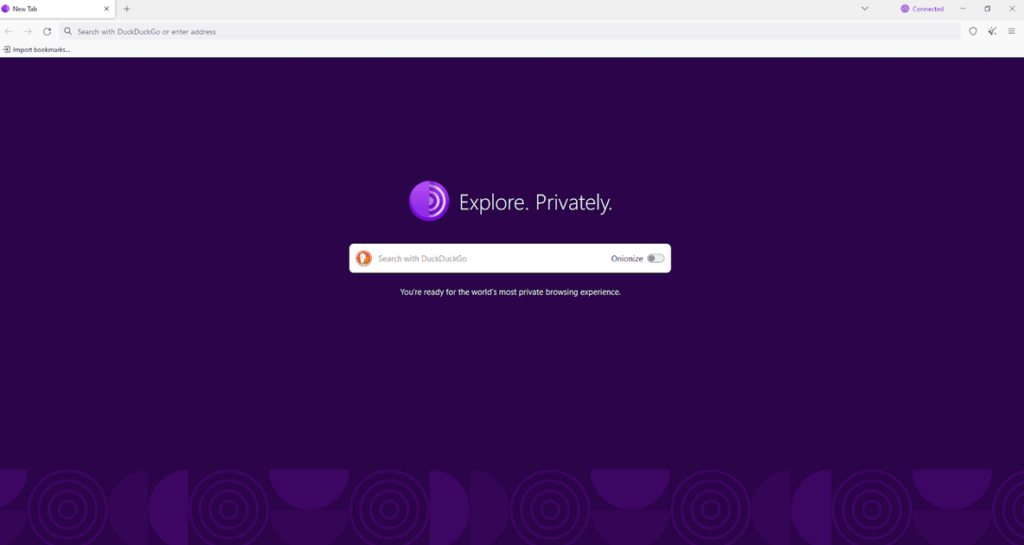

Better technologies than today’s identity protection are part of the solution. Greater personal awareness and responsibility for managing our identity is required as well. In the meantime, stop using identity protection that doesn’t work 99.9% of the time.

About the author

Rob Shavell is the co-founder and CEO of Abine.com, The Online Privacy Company. Abine offers DeleteMe for removing information made public about you online and of Blur, the only password manager and digital wallet that protects passwords, payments and privacy. Abine’s solutions have been trusted by over 25 million people worldwide.

Our privacy advisors:

- Continuously find and remove your sensitive data online

- Stop companies from selling your data – all year long

- Have removed 35M+ records

of personal data from the web

Save 10% on any individual and

family privacy plan

with code: BLOG10

news?

Don’t have the time?

DeleteMe is our premium privacy service that removes you from more than 750 data brokers like Whitepages, Spokeo, BeenVerified, plus many more.

Save 10% on DeleteMe when you use the code BLOG10.